Pan American Silver Corp. (PAAS) is a Canadian mining company headquartered in Vancouver, British Columbia. It focuses on the exploration, development, extraction, processing, refining and recovery of silver, gold, zinc, lead and copper mines in the Americas. Below is the long-term Elliott Wave technical update for the stock.

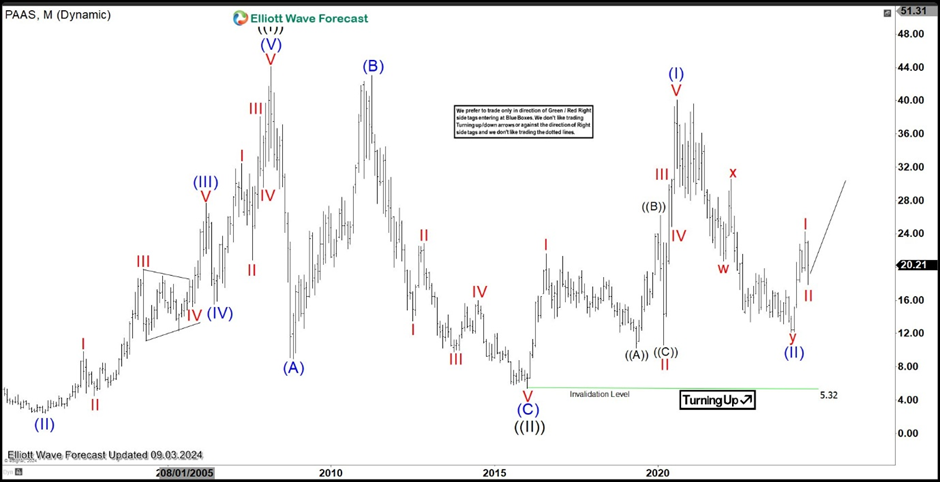

PAAS Monthly Elliott Wave Chart

The monthly Elliott Wave chart of Pan American Silver (PAAS) above shows that the stock has finished the correction of the Great Super Cycle wave ((II)) at 5.32. Since then, it has moved higher in wave ((III)) as an impulse. From wave ((II)), wave (I) ended at 40.11 and the pullback in wave (II) ended at 12.16. As long as the pivot at the low of 5.32 remains intact, the stock is expected to continue to rise.

The daily Elliott Wave chart of PAAS above shows that the stock completed wave (II) at 12.18. From there, wave (III) is in progress as a 5-wave impulse. From wave (II), wave I completed at 24.27 and the retracement in wave II is proposed to be complete at 17.86. The stock still needs to break above the peak of wave I at 24.27 to rule out a double correction. As long as the pivot at the low of 12.18 remains intact, the retracement is expected to find buyers in 3, 7 or 11 swings for further upside.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.