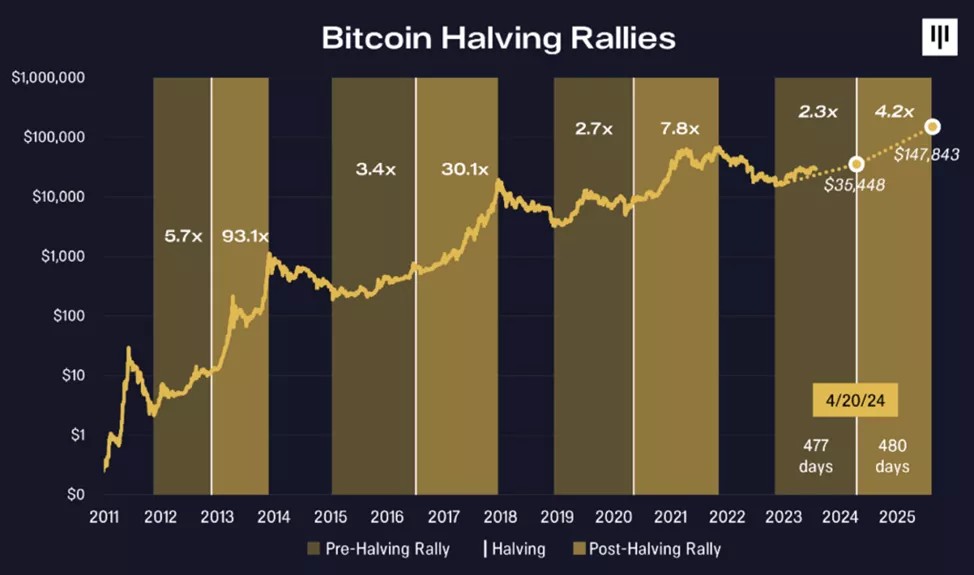

On the eve of the expected halving in April 2024, digital gold may rise in price to $35,448 and then go into rally mode to $147,843. Such forecasts submitted Pantera Capital analysts.

The experts obtained the mentioned values based on the Stock-to-Flow metric. The model predicts the value of bitcoin based on the stock-to-production (SF) ratio.

Halving is historically associated with higher prices for the first cryptocurrency due to its impact on the ratio of reserves to production.

According to the cycles, the price of bitcoin was supposed to bottom on December 30, 2022. In fact, it happened almost two months earlier amid the collapse of FTX.

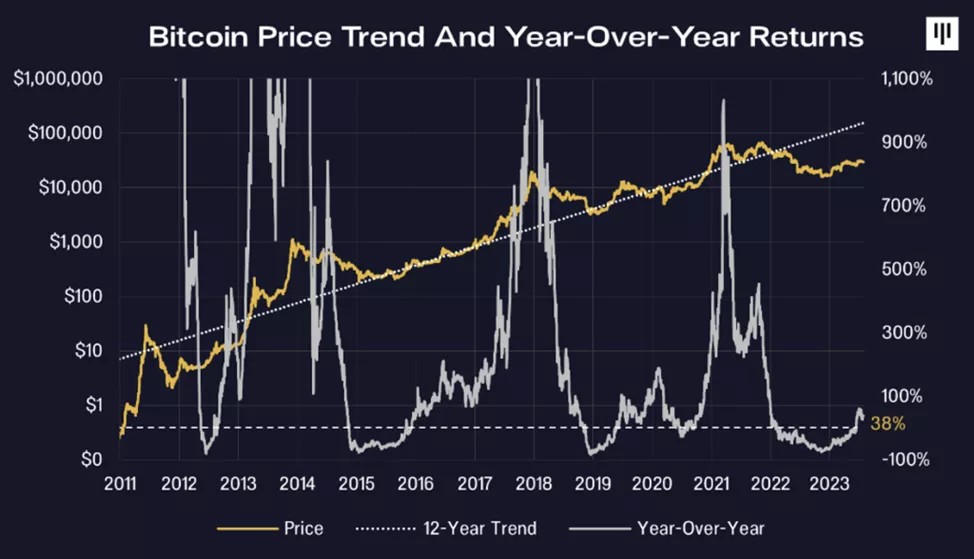

The current price is 7% higher than the model price, they added.

Pantera Capital noted that bitcoin went through the longest period of negative annual returns in its history, at 15 months (February 2022 to June 2023).

According to analysts, the recent XRP court ruling and BlackRock’s bid to launch a Bitcoin ETF will also provide “a strong foundation for the next digital asset bull market.”

Recall that trader and analyst Michael van de Poppe predicted the growth of digital gold quotes to $50,000 ahead of the halving.

On December 12, 2022, BitMEX founder Hayes announced that the first cryptocurrency had reached the bottom, and five months later he predicted its new rally by 2024.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.