- PDD Holdings (PDD) sinks 4.04% daily, reaching minimal not seen since August 28, 2024.

- PDD extends its losses after the tariff imposition of 84% to American products by China.

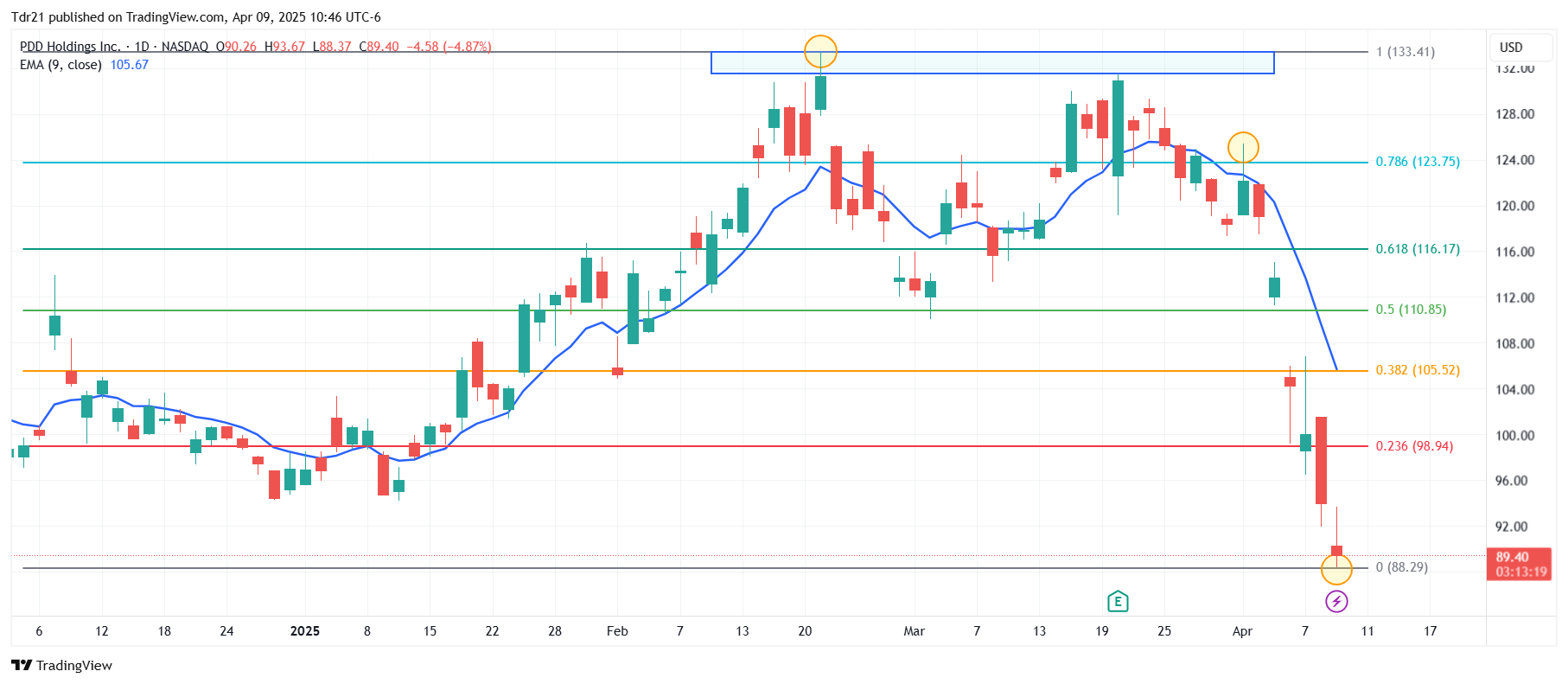

The PDD Holdings (PDD) values established a daily maximum at $ 93.67, finding aggressive vendors that carried the price of the action to minimal not seen since August 28, 2024 in 88.37 $. Currently, PDD operates at $ 89.56, losing 4.76% today.

The commercial war between the United States and China drags PDD holdings to minimums of more than seven months

The Business Group of Chinese origin, PDD Holdings (PDD), focused on managing low -cost electronic commerce companies such as Temu, presents a fall of 4.04% today, reaching minimums of more than seven months not seen since August 28, 2024 in 88.37 $.

The fall of PDD Holdings (PDD) is presented in the middle of an intense commercial war in the United States and China. The administration led by Donald Trump imposed 104% tariffs on products from the Asian country, effective as of today. In retaliation, China’s Ministry of Finance established 84% rates to American goods.

In this context, PDD holdings titles (PDD) sign six consecutive days down, pointing to the key support of August 28 at 88.01 $.

Technical levels of PDD holdings

PDD shares reacted on the decline from a short -term resistance given by the maximum of April 1 at $ 125.40, in convergence with the 78.6% fibonacci setback. The next key resistance is observed at $ 133.33 of February 21. To the south, the important support is found at $ 75.44, pivot point of August 21, 2023.

PDD daily graphics

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.