The price of PEPE is growing again, increasing by almost 57% over the last month. The cryptocurrency market as a whole has slowed over the past 24 hours, but the PEPE remains one of the few tokens trading close to the important level of the breakthrough.

Memboin is still 51% lower than its historical maximum. This retains the potential for further growth if the market impulse is preserved.

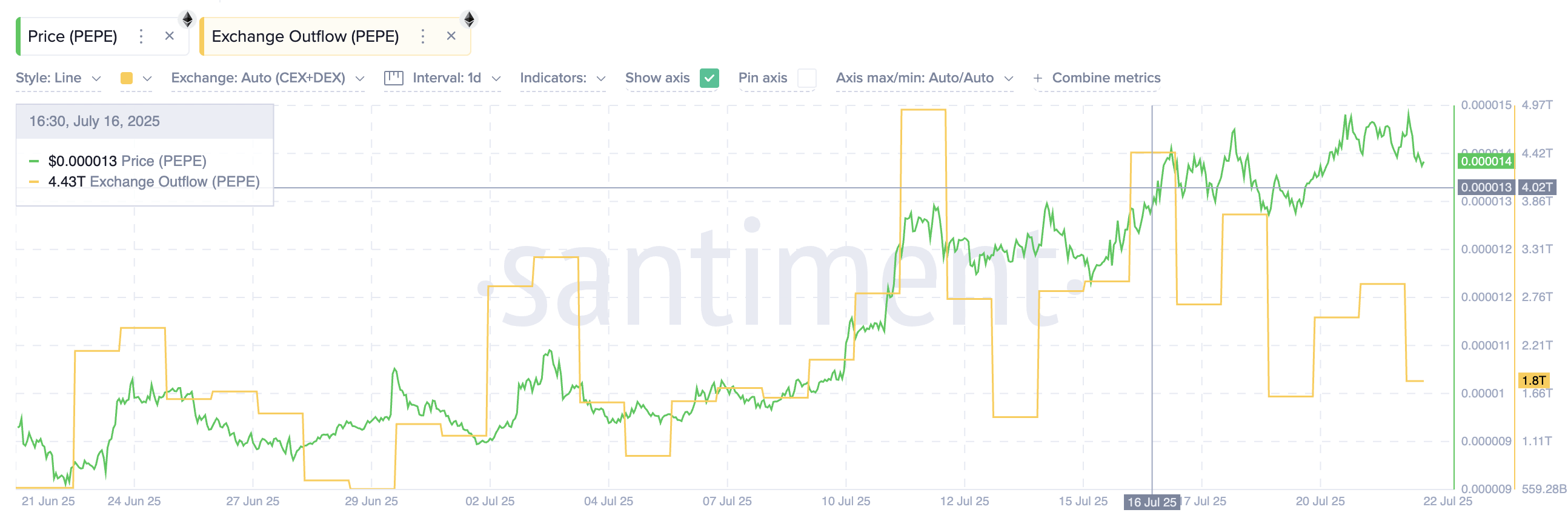

Large edges from exchanges are talking about high trust

Since July 16, almost 17.9 trillion PEPE tokens left the exchange, which reflects a stable weekly trend. This usually indicates that holders transfer their assets into private wallets. When more tokens leave the trading platforms than it comes, this usually suggests that less traders are preparing for sale. Such a signal by bull, as it reduces the pressure on the price in the short term.

It is interesting that the outflow of tokens continues, despite the increase in prices by more than 12% for the same period. This may mean that the sale is not a priority for Kozhlov at the moment.

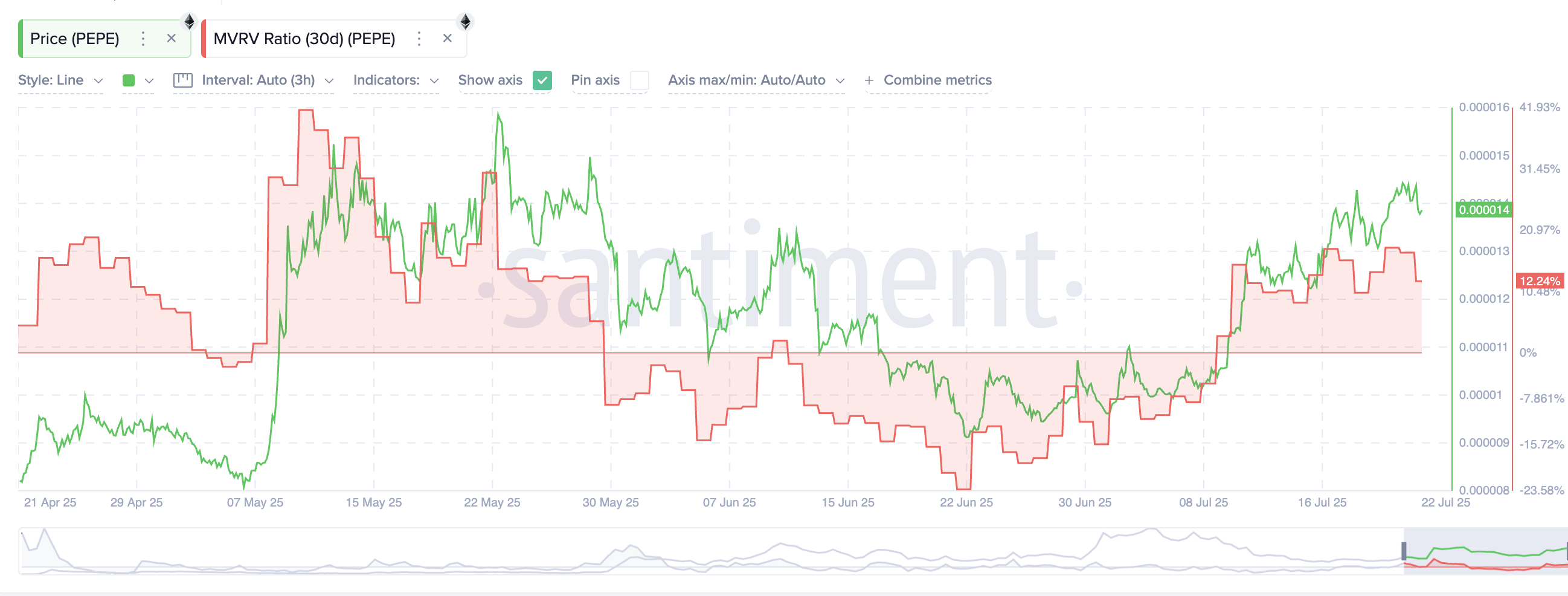

MVRV data indicate a low risk of sale

The 30-day ratio of market to the realized value (MVRV) has become positive, but remains at the level of +12.24%. The low but positive value of MVRV shows that Kholer have a small profit, but insufficient for mass sales. Typically, short -term holders begin to sell when the indicator exceeds 20-30%.

Thus, the current level of MVRV leaves the space for price growth. In combination with an active outflow of coins from exchanges, this confirms that the recent pricing force of PEPE can be stable.

PEPE is on the verge of exit from the wedge, but …

Now the PEPE is traded at the upper boundary of the wedge -shaped pattern, which often portends growth. However, the token should gain a foothold above $ 0.00001497 (the level of expansion of Fibonacci 0.382). A confident breakthrough of this key resistance will give additional confirmation. In this case, the price can reach $ 0.000017 or move higher.

If the PEPE does not hold the impulse and drops below $ 0.00001200, this can signal the beginning of a wider correction and the abolition of the current bull trend.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.