- Donald Trump pauses his “reciprocal” tariffs for 90 days.

- The pharmaceutical actions of Dow Jones recover after the pause of tariffs.

- Trump raises their tariffs on Chinese products to 125%.

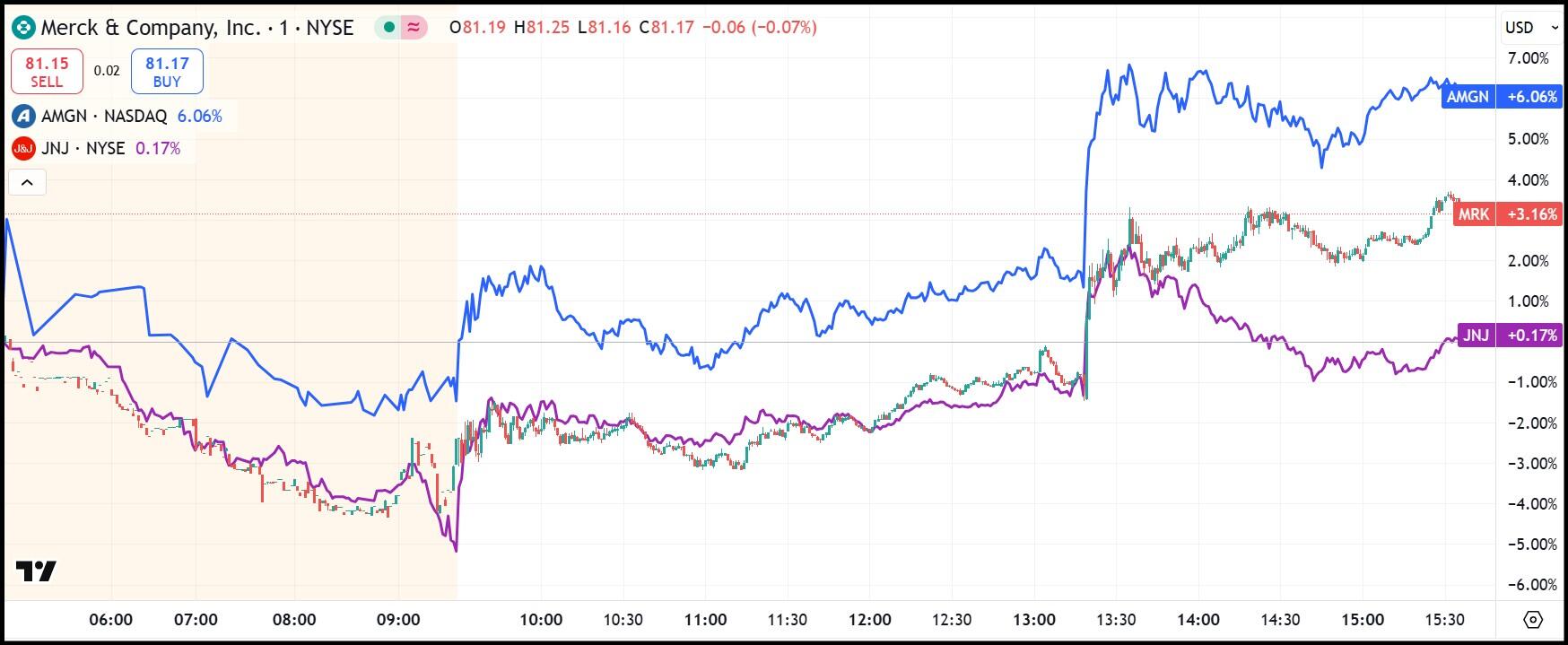

- MRK, AMGN and JNJ recover from intra -intradia minimums.

The sudden and surprising 90 -day pause of US President Donald Trump in his so -called “reciprocal” tariffs (which were not reciprocal) has helped pharmaceutical actions to recover on Wednesday.

After quoting significantly down on Wednesday morning, given the expectation that Trump would eliminate the pharmaceutical exemption for tariffs, pharmaceutical actions exploited upwards since the exemption is no longer necessary now that the highest bilateral tariffs have been delayed.

Trump, on the other hand, has indicated that it will remain with the base tariff of 10% in general at the moment. This caused the Nasdaq Composite to shoot 10% and the Dow Jones industrial average (DJIA) rose 7%.

Pharmaceutical actions recover: Amgen, Johnson & Johnson, Merck

The US President Donald Trump told a private group of Republican members of the Chamber on Tuesday night that he was considering eliminating the tariff exemption for the pharmaceutical industry. According to The Wall Street Journal, Trump said: “We are going to impose tariffs on our pharmaceutical products, and once we do that, they will quickly return to our country because we are the big market.”

This report abruptly harmed pharmaceutical actions at the beginning, including the components of the Dow Jones industrial average (DJIA) Johnson & Johnson (Jnj), Merck (MRK) and AMGEN (AMGN).

However, Trump’s publication on its Truth Social platform on Wednesday afternoon changed all that. Suddenly, investors have 90 days to plan about future tariffs and some might expect that much higher tariffs will never see daylight.

After falling between 2% and 3% early on Wednesday, the three actions invested their course after the delay in tariffs. Only JNJ’s action continues to quote red at the time of writing this, although well above the minimums of the session. JNJ fell to $ 141.50 before reversing more than $ 148.00.

When Trump announced 25% tariffs on South Korea, 24% over Japan, 17% over Israel, 20% over the European Union and 26% on India last week, pharmaceutical actions breathed relieved to know that they were exempt along with semiconductors and some other industries. But Trump’s interest in eliminating his exemption could mean that when the 90 -day break ends in July, companies will be affected by tariffs when trying to carry their products produced abroad to the US market.

Trump also increased its 104%tariffs on Chinese products to 125%, with immediate effect, in response to China to increase its own tariffs on US products to 84%.

Trump would prefer that the pharmaceutical industry relocate its production in the US. Relocating production due to tariffs would be less attractive, since they would have to pay these US tax rates on their benefits in the US.

Bernstein analyst, Courtney Breen estimates that Trump’s paused tariff rates would add around 46,000 million dollars in import costs only for the industry.

MRK (Candlesticks), AMGN (Blue), Jnj (Purple) Stock Performance for April 9, 2025 (1-minute candles)

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.