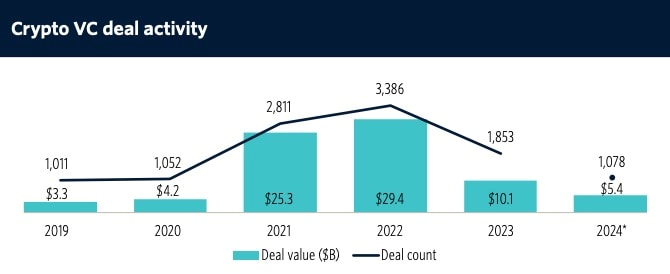

The total number of deals fell by 12.4% in the second quarter of 2024, which is evidence of an increase in the volume of invested funds. PitchBook experts believe that by the end of the year, the total investment volume will be higher compared to 2023 and will amount to approximately $10.8 billion, compared to last year’s $10.1 billion.

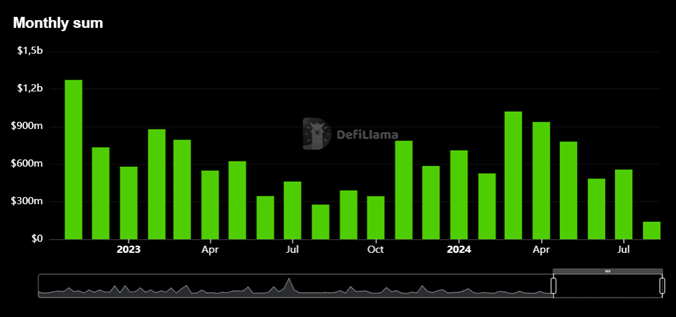

The best month in terms of inflows in 2024 so far is March with $1.019 billion.

“Given the return of positive investor sentiment and the absence of any major market downturns, we expect investment volume and momentum to continue to grow through the end of the year,” the authors of the PitchBook report emphasized.

In the second quarter, investors focused on projects and startups in the field of blockchain technologies, including such as: Monald Labs, Babylon, BerachainPitchBook noted that competition among cryptocurrency projects increases at the early stage of launch, and decreases at the later stage.

Earlier, experts from the financial company Cantor Fitzgerald, which manages assets worth $13.2 billion, recommended that investors increase their share of bitcoins to obtain high profits next year, 2025.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.