According to analysts, over the same three months of last year, the volume of such transactions was $ 2.6 billion, and in the fourth quarter of 2024 $ 3 billion. In total, 405 transactions were made in the first quarter of this year, which is 39.5% less than in January-March 2024 (670), but more than in October-December (372).

“The macroeconomic shocks of the first quarter did not prevent the capital from looking for useful scenarios for using leading cryptocurrencies,” Pitchbook experts explained.

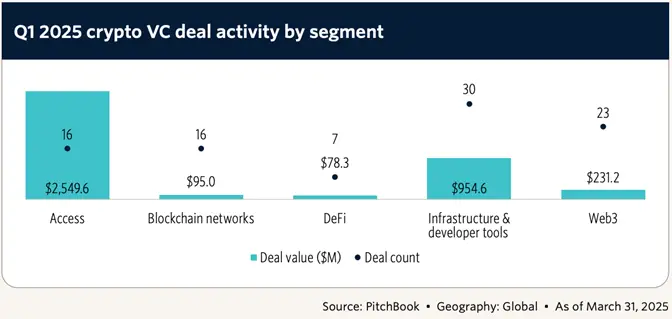

The main recipient of the funds was the management of digital assets, exchanges and suppliers of financial services – $ 2.55 billion in the framework of 16 transactions. The following are named companies developing the market for the market – $ 955 million in the framework of 30 transactions.

Pitchbook predicts the further growth of the interest of large investment funds in startups in the field of digital payments, money transfers and improved solutions for the management of protocol security.

Earlier, Chinese crypto journalist Colin Wu (Colin Wu) published a report according to which 66 investment rounds were held in April – this is 63% less compared to the same period last year.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.