Bitcoin (BTC) was again in the spotlight, reaching a new all-time high of $73,760 on March 14, 2024.

The new all-time high marks a major milestone for BTC, especially ahead of the highly anticipated halving. PlanB, a popular analyst in the crypto community, shared his thoughts on this phenomenon and gave a forecast regarding the future prospects of Bitcoin.

$200,000 is a conservative target for BTC

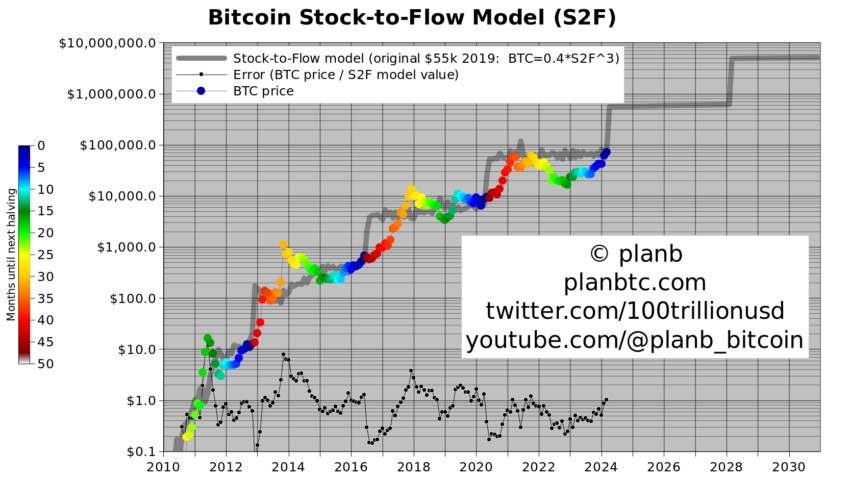

PlanB's forecast is based on the Stock-to-Flow (S2F) model. It predicts significant price fluctuations around Bitcoin halvings by comparing the current supply of the coin to the flow of new BTC entering the market. According to PlanB, BTC's compliance with the S2F model's predictions, especially before the halving, is the most important indicator of its future performance. The transition from blue to red dots in the PlanB model indicates a transition to new phases of the market cycle, with red indicating a bullish market.

This transition is forecast to continue based on historical patterns, rising signals and sustained bullish momentum.

PlanB believesthat while the market will be subject to volatility with potential drops of 20-30%, the overall trajectory remains upward.

As for the next market top, some expect Bitcoin to reach $200,000. However, according to PlanB, this figure may be lower than expected. From an S2F perspective, he is looking at a target well above the average – perhaps above $500,000 – which would be in line with the model's predictions.

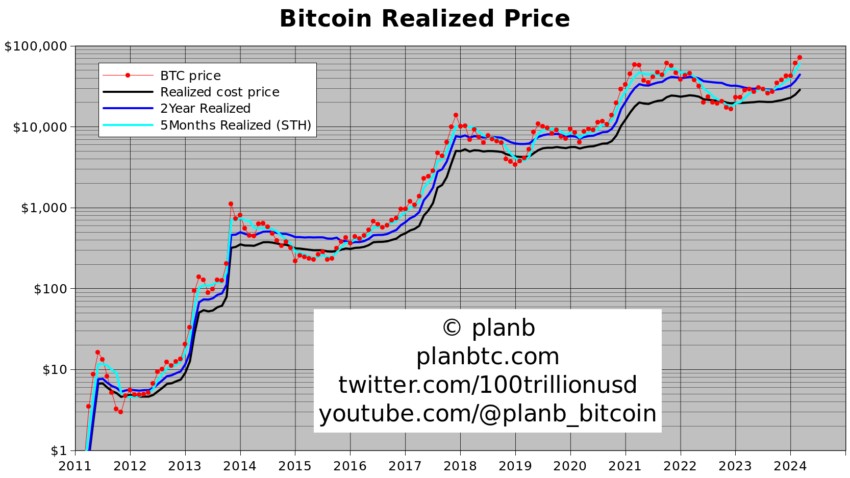

A key factor supporting this optimistic outlook is the behavior of on-chain indicators such as realized price and two-year realized price, which show notable growth during bull markets. Specifically, the five-month realized price forms a new strong support level at $60,000.

In addition, the relative strength indicator (RSI) reflects an interesting picture. It is currently at its highest pre-halving level, suggesting that BTC is entering this phase with unprecedented strength. This shift from the pattern of declining returns in previous cycles may indicate a transition to exponential growth.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.