Courtyard no equal

The market of non -replaceable tokens (NFT) in 2025 was far from its peak of 2021. For Polygon, the best month fell on February 2022, when NFT was sold in an amount of over $ 350 million. August 2025 was much more modest: the sales volume this month amounted to only $ 67.3 million, which did not reach July (4.8%) and June (10.6%).

But Polygon has a reason for pride – their collection NFT Courtyard became the best in August 2025. In total, sales were made over $ 62.5 million. Courtyard showed even more impressive results in the last week of August. In terms of sales, it surpassed the Cryptopunks, Dmarket and Pudgy Penguins collection, taking places from the second to the fourth.

Source: Cryptoslam.io

Mass deployment of stablecoins

A lot of players in August decided to integrate stablecoins in the Polygon blockchain. The first in the middle of the month, such a step was taken by the Miomi Game e -sports platform. Its users have become Available Creating matches, joining them and victory when using the US dollar in a proportion of 1: 1 AUSD.

A few days later, the Japanese fintech company JPYC launched a coin of the same name on Polygon with a binding to Japanese yen. It is provided directly by the currency of Japan on deposits, as well as short -term government bonds. JPYC I chose Polygon due to high throughput and low network commissions.

At the same time, the American state of Wyoming – Frontier Stable Token (FRNT) was deployed on Polygon. It is 102% provided with American dollars and short -term tenderris. It is worth noting that the state representatives decided to launch FRNT immediately on seven blockchains: Polygon, Avalanche, Ethereum, Solana, Arbitrum, Optimism and Base. Despite the full technical readiness, FRNTR so far Inaccessible citizens. The main reason was regulatory barriers.

Politics put on Polygon

The US Department of Trade has made a decision according to which data on the country’s gross domestic product (GDP) will be recorded on seven different blockchains, one of which will be Polygon. The implementation of the initiative will be held with the support of the Kraken large cryptocurrency exchange.

It is worth noting that this case was the first when a country from a large seven will use a blockchain to reflect state statistics. The choice in favor of the Polygon network shows that the American leadership seriously perceives the prospects for the development of this cryptocurrency. It is natural that choice The US authorities attracted attention from the new investors.

An increase in the number of users

Analytical platform Nansen I presented it The information according to which the number of active users on the Polygon network in the last week of August increased by 10%, reaching 2.4 million. This shows that users believe in the project. Polygon’s positive dynamics in this metric is especially valuable, given the fact that competitors of SOLANA and BASE have lost their share of their active users.

Dynamics Defi

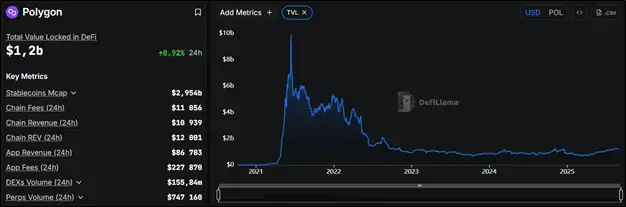

The main indicator characterizing the progress in the decentralized finance sector (Defi) is the total blocked cost (TVL). In March 2025, the indicator reached its many -month minimum – $ 685.29 million. However, over the next six months, it showed serious growth. On September 1, TVL Polygon is $ 1.2 billion, which exceeds the March indicator by 1.75 times, and July is 0.67%. But to the historical maximum $ 9.89 billion, recorded in June 2021, is still very far away.

Source: Defillama.com

All of these factors contributed to the rise in the cost of Polygon in the last days of August. But the eighth month of 2025 has already sunk into oblivion, and on the threshold the ninth. Can Polygon continue his procession upstairs or is he waiting for a “hard landing”?

Technical analysis

Now everything looks like the growth should continue. In any case, from the point of view of technical analysis. The Polygon trend remains ascending, since the price is located above a 50-day sliding average (indicated in blue). The RSI indicator also gives signals to continue growth due to the fact that it is higher than 50, but the overwhelming area has not yet reached.

Now it is important for Polygon to gain a foothold above the resistance level of about $ 0.278. If this can be done, it is likely to rise to $ 0.31. But in case of failure, most likely, a rollback will take place to the level of support near $ 0.227.

Source: TradingView.com

Conclusion

Polygon growth by 40% in August is primarily associated with the fact that the US Department of Trade has chosen this blockchain for recording data on GDP, as well as for deploying a number of stablecoins in its network. In addition, cryptocurrency was noted by the growth of active users and the most sold by the NFT collection.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.