Most millennial millionaires hold a significant portion of their fortune in cryptocurrency and plan to increase their investment in 2022 despite high market volatility.

A Millennial Millionaire study by American broadcaster CNBC found high cryptocurrency ownership among the millennial generation (born in the 1980s and 1990s) as a hedge of risk, investment and store of value.

A CNBC poll found that roughly 83% of millennial millionaires own cryptoassets. At the same time, 48% of respondents plan to increase investment in digital currencies in 2022, and only 6% intend to reduce the number of cryptoassets in their portfolios.

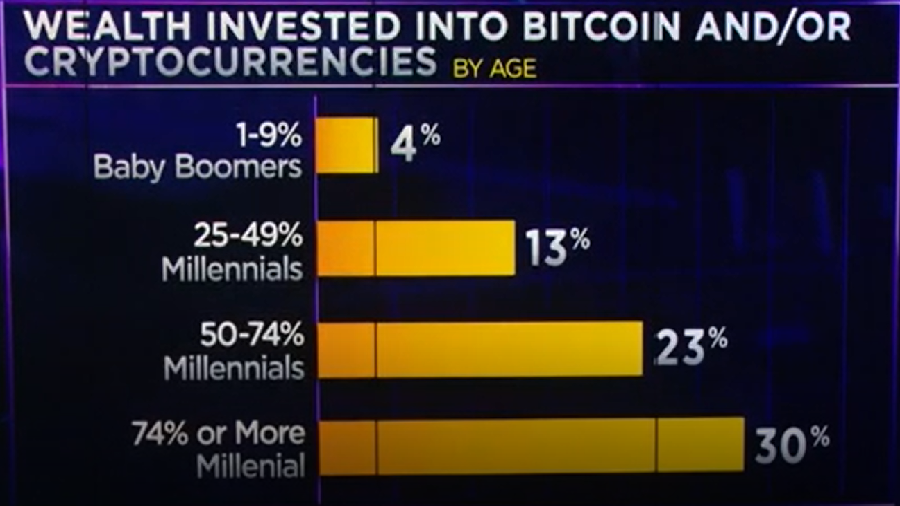

53% of millennial millionaires have more than 50% of their investment portfolio in cryptocurrencies. At the same time, a third of those surveyed said that their investments in crypto assets exceed 75% of the total investment.

The CNBC study assesses the sentiment of market participants in various sectors of the economy. Most of the millennial millionaires who have invested in cryptocurrencies expect their return on investment to increase in the future. At the same time, they define inflation as the main problem and threat to economic growth. Unlike the majority of the population, who fear inflation-driven price increases, millennials tend to worry about higher interest rates and how this will affect their investments.

While older millionaires are skeptical about cryptocurrencies and their future, millennials are at the forefront of decentralized technology. For example, most of the baby boomer investors surveyed (born after World War II to 1964) said they did not know what NFT was, and 33% said NFT was “an overblown fiction.” At the same time, over 66% of millennial millionaires say NFTs are “the next big thing.”

Perhaps it is the generation gap that forms basic investment preferences that has become one of the reasons for the rejection of cryptocurrencies by existing businesses, private banks and regulators. However, they will have to admit that their future depends on the next generation of cryptocurrency-interested clients.

So, according to a SimpleMoneyLife study conducted earlier this year, millennials in 67% of cases will prefer Bitcoin to investing in gold. Additionally, back in 2019, London-based law firm Michelmores LLP conducted a survey of wealthy millennials in the UK and found that 20% of respondents had invested in BTC and other cryptocurrencies.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.