Cryptocurrency exchange Poloniex continued trading in the Banana Gun project token (BANANA) at a price inflated by thousands of percent after an error was discovered in the code of this asset and its value collapsed. Writes about this RBC Crypto.

On September 11, the Telegram bot Banana Gun team released its own BANANA token. Initially, the price of the cryptocurrency was $0.65, according to information portal CryptoRank.

After the start of trading, the price of the token increased to $8.4, but after a couple of hours in the source code of the token discovered bug, and the developers withdrew liquidity, promising to restart the project and compensate losses to token holders.

Within a few minutes after this, the asset price on decentralized exchanges fell from $8.4 to $0.025, according to data DexScreener. The developers asked users to stop trading because they plan to restart the project contract after verification.

After the problems with BANANA became known, the Poloniex exchange, which announced the listing of the token even before its release, disabled the input and output of the asset, but did not stop trading in it.

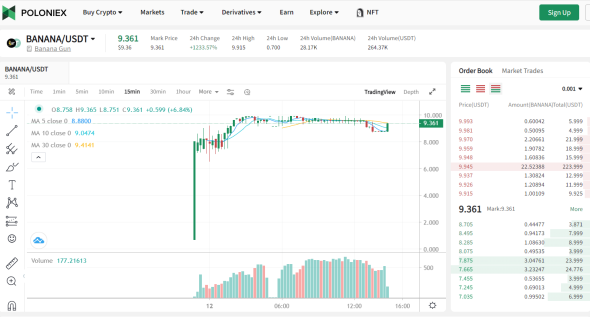

Thus, after the BANANA rate on DEX platforms dropped to $0.02, Poloniex still gave its users the opportunity to buy it at $6-8.

More than 14 hours have passed since the problem was discovered. At the same time, trading on Poloniex is not only not closed, but the price of the asset has increased from $6-$8 to almost $10. At the same time, the trading volume increased from 8 thousand USDT to 267 thousand USDT. During this time, exchange users traded this token for approximately $260 thousand at a price of $6-9, which is thousands of percent higher than the market ($0.025).

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.