- The Chilean Peso has rebounded after hitting a five-month low of 884.96.

- The Dollar has strengthened against emerging currencies after reaching five-week lows at 103.67.

The USD/CLP registered a high of the day at 914.91, it is currently trading at 912.92, gaining 0.09% daily, in a day with very little activity. The Chilean peso has returned to operating at May 15 levels, depreciating in line with most currencies of emerging countries.

The dollar has strengthened after the economic data from the United States

The Dollar Index (DXY) has started an uptrend after hitting the April 10 low at 103.67. Today it was announced that unemployment benefit applications increased by 215,000 compared to the previous week, which represents a figure lower than the estimates of 220,000 and the previous week's estimates of 223,000. At the time of writing, the Dollar Index is trading at 104.482, losing 0.04% daily.

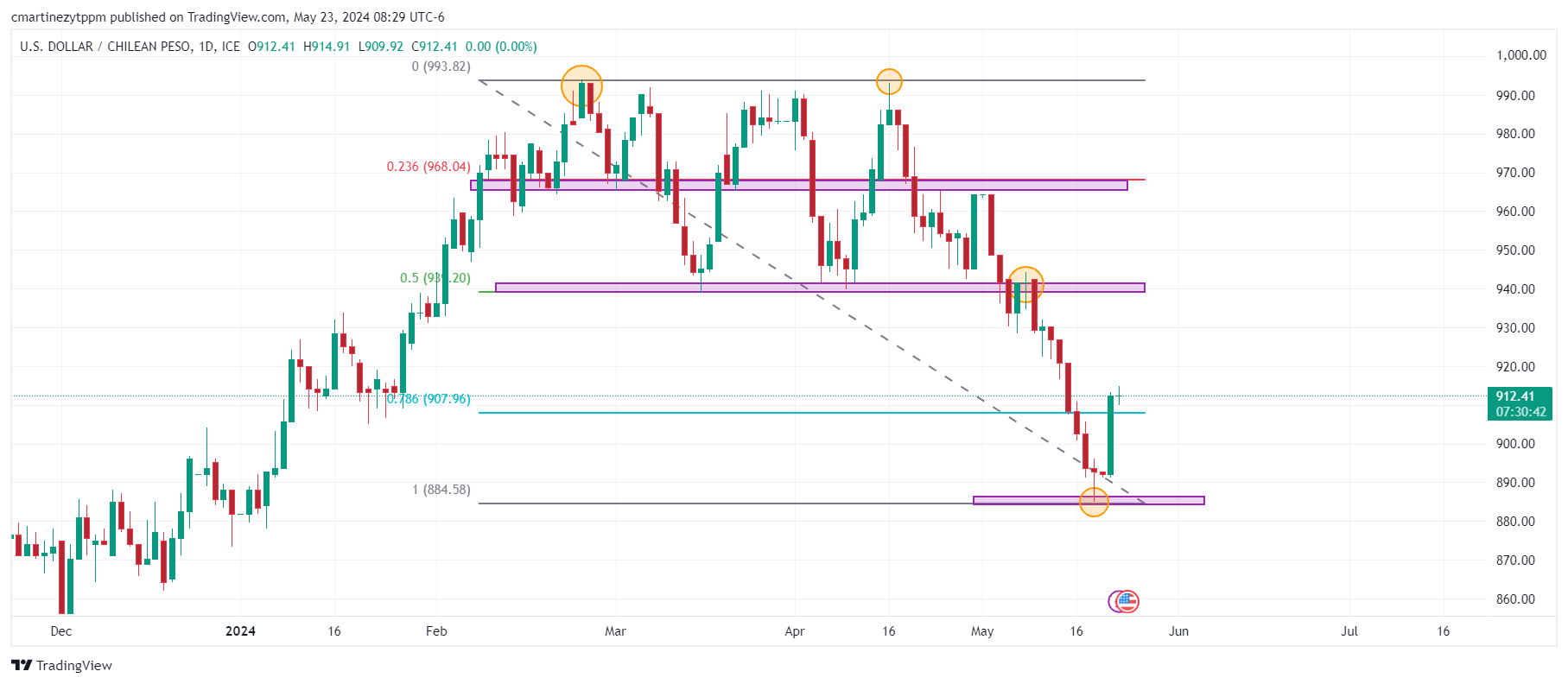

Technical levels in the Chilean Peso

The closest support in the short term is found at 884.85, the minimum of the session on May 20. The first resistance is at 944.29, the May 8 high, confluence with the 50% Fibonacci retracement. The second resistance is located at 964.32, May 1 high, in convergence with the 50% Fibonacci retracement.

Chilean Peso daily chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.