- USD/CLP is trading higher for the second consecutive session.

- Copper prices rise to new highs since June 21.

- Investors are gearing up for Chile’s Trade Balance and Consumer Price Index data due out on July 8.

The USD/CLP marked a daily low during the European session at 946.07, rebounding to reach a daily high at 953.52. At the time of writing, the US Dollar against the Chilean Peso is trading at 952.38 gaining 0.19% on the day.

Investors will focus on data from Chile’s Trade Balance and Consumer Price Index

Next Monday, Chile’s Trade Balance for June will be released, with the latest reading showing a deficit of 1.598 billion dollars in May. At the same time, Chile’s Consumer Price Index will be published, with the most recent monthly reading standing at 0.3%.

Copper, on the other hand, has rebounded after hitting a 10-week low of 4.31. The metal is posting its third consecutive session of gains, trading at 4.40 and gaining 0.09% today.

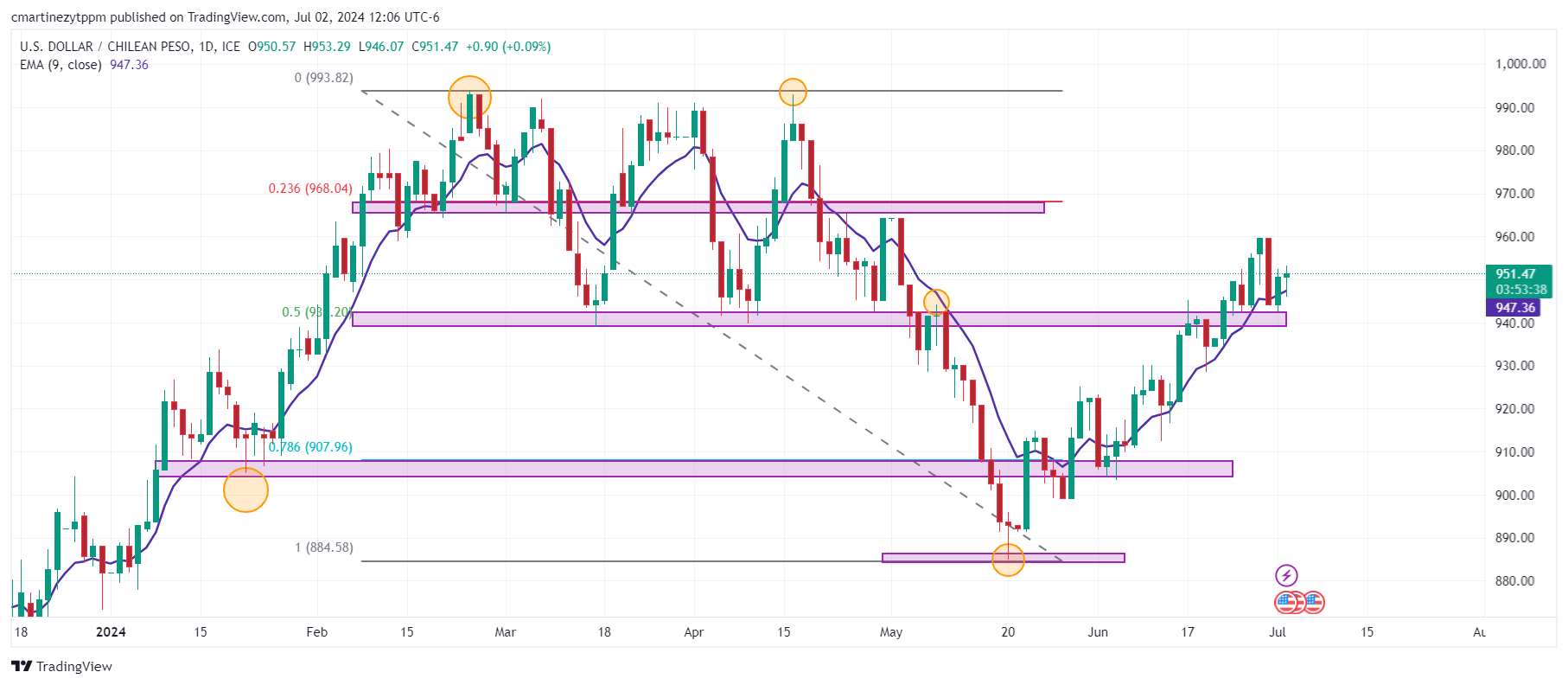

Technical levels in the USD/CLP

The USD/CLP remains above the 9-period Exponential Moving Average at 947.18, indicating strength in buying. The first support is found at 940.00, the low of June 24. The first resistance is found at 968.00, in convergence with the 23.6% Fibonacci retracement. The next resistance is at 993.05, the high of the session of April 16.

Chilean Peso Daily Chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.