There is a possibility of a negative scenario developing, as QCP Capital reasoned. The price may fall below the psychologically important level of $3,000. Especially if there are problems with the launch of ETH-ETF.

In any case, experts at QCP Capital believe that an increase in the volatility of the second largest cryptocurrency by capitalization is inevitable. Regardless of the SEC's decision.

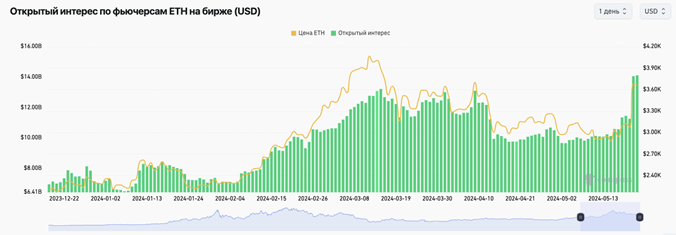

Cumulative open interest in Ether futures reached a record high of $14 billion. Year to date, the figure has increased by 40%, indicating increased interest in trading digital silver.

The SEC asked the NASDAQ and CBOE stock exchanges to make adjustments to their Ether-based spot ETF applications, and asset manager Fidelity removed the staking clause from its updated spot ETF application.

Earlier, analysts at the largest American cryptocurrency exchange Coinbase announced that Ethereum will remain in the leading position among DeFi projects in the next few months.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.