QCP Capital pointed to the higher stability of Ethereum compared to Bitcoin amid the transfer of 30,000 BTC to an unknown crypto wallet by US authorities.

“After Donald Trump’s speech, the ETH/BTC rate rose by 5%. We expect capital outflow from spot products to continue in the next two weeks. Then the outflow will slow down, and Ethereum will catch up with Bitcoin in terms of growth. We are targeting a breakout of the $4,000 level after mid-August, which will be the high of 2024,” — the experts’ forecast says.

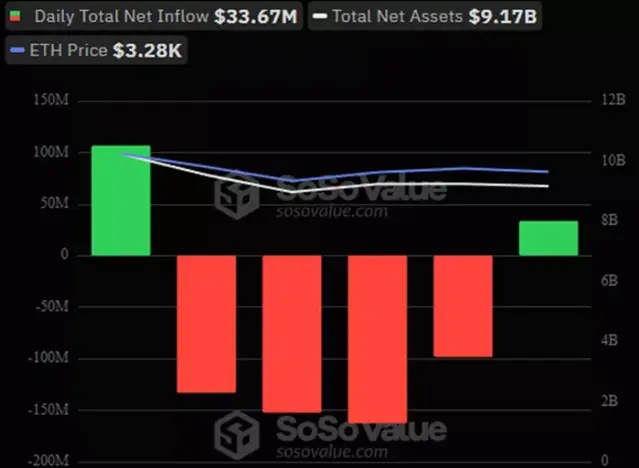

QCP analysts noted that the monthly premium for asset volatility in options increased from 4% to 8%. This should increase the attractiveness of Ethereum among investors. According to SoSoValue, a minor inflow of funds in the amount of $33.7 million was recorded on July 30, after four days of negative dynamics.

QCP Capital sees this as a positive sign, and the influx of capital has become a catalyst for the rise in the Ethereum price. According to experts, the cessation of outflows from Grayscale’s ETHE fund will increase the net inflow of funds and create the preconditions for a sharp increase in the price ETH.

Earlier, experts from the analytical company 10x Research stated that the outflow of capital from Ethereum after the launch of ETH-ETF repeats the picture that was observed after spot exchange-traded funds for bitcoin appeared on the US market.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.