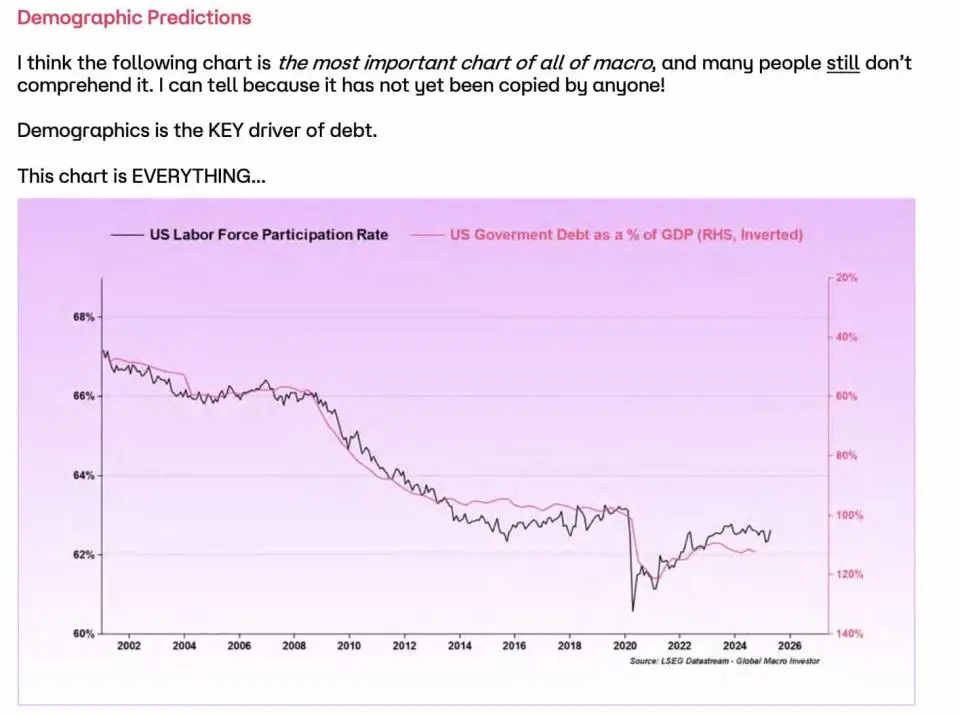

Raul fell shared two macroeconomic charts, which, in his opinion, are ignored by the government. Pal claims that it is demographic data, and not a budget policy contribute to the growth of US public debt. Since 2002, the level of labor participation in the US economy has declined, while the debt has increased. This trend accelerated sharply after the financial crisis in 2008 and 2020. An aging labor force means less economy and greater dependence on government spending, the macro economist explained.

The second diagram demonstrates a close correlation between the US public debt and the net liquidity of the US Federal Reserve (Fed). As soon as the debt exceeds 100% of GDP, organic economic growth is not enough to pay interest. This gap is covered by a monetary issue, reducing the value of the currency, Pal said.

“Against this background, bitcoin becomes the main asset that can absorb a blow. Cryptocurrency, mainly bitcoin, is a rescue raft for the economy, since it becomes more valuable due to its adoption in society, ”Pal said.

Earlier, the expert calculated that Dogecoin surpassed bitcoin on the growth rate of market capitalization, so DOGE has a chance to become “firm money” and overtake the first cryptocurrency in terms of investment income.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.