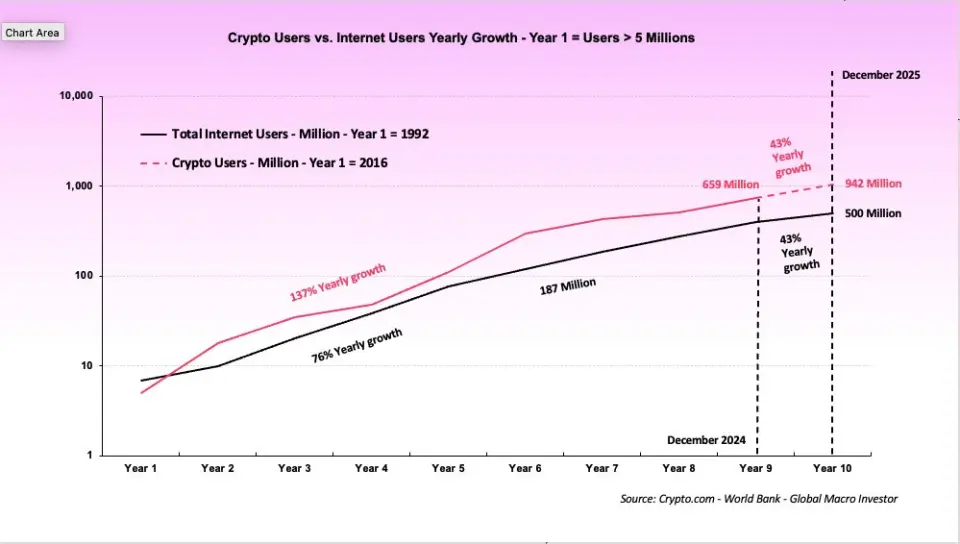

Pal said that according to the Triple-a analytical company, the result of five million cryptocurrencies was achieved twice as fast as five IP addresses at the initial stage of the development of the Internet.

According to the head of Real Vision, the main drivers of the growth of the number of digital assets holders were mass acceptance and depreciation of fiat currencies.

“The depreciation explains 90% of the price of digital assets, while mass acceptance provides the full superiority of cryptocurrencies over traditional currencies,” Pal said.

Against the backdrop of the rapid growth of the number of digital assets, it suggests PAL, the market capitalization of the cryptorrhist can exceed $ 100 trillion by 2032–2034, which will make the industry comparable to the largest financial markets.

The day before, Raul said that in the near future four large altcoin – Solana, Sui, Doge and XRP – can demonstrate rapid growth.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.