Specialists of the Satoshi Action Education organization presented the results of a large -scale study devoted to the dynamics of proposal, demand and pricing bitcoin.

The authors of the work – Dr. Murray A. Radd and Dennis Porter – built a model of price formation based on fundamental economic principles, without reliance on historical trends or assumptions about the future popularity of cryptocurrency.

The model takes into account the fixed emission limit of 21 million coins and five key factors:

- changes in market demand;

- interrequatic investment preferences;

- sensitivity to withdrawal of funds;

- the volume of the initial liquid proposal;

- Daily volumes of exemptions from a liquid proposal.

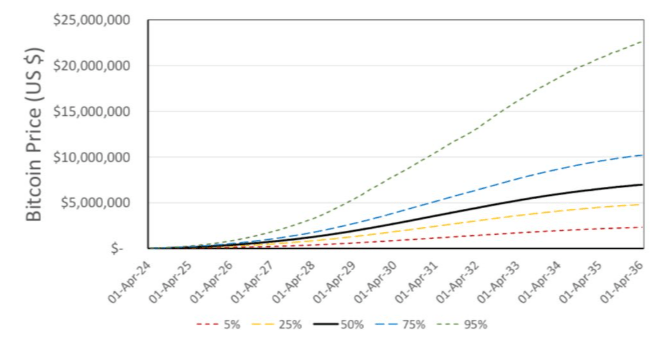

Using the *Monte Carlo method, the researchers conducted a series of simulations, randomly varying these parameters. As a result, it turned out that there was a 75% probability that by April 2036 the price of bitcoin would exceed $ 4.81 million. In a number of scenarios, under certain conditions, by 2036 the cost of a coin can reach tens of millions of dollars.

*A way to solve problems using multiple random modeling.

The model is predicts the most sharp increase in price if the liquid proposal falls below 2 million BTC, and the sensitivity to withdrawal of funds will remain low. Such a deficit would contribute to a parabolic jump in value.

The schedule in the study indicates that the spread of forecasts expands significantly after 2026. This is due to the fact that the initial volume of liquid proposal has the greatest impact on the uncertainty of long -term forecasts.

The authors paid special attention to the scenario in which it is possible to reduce the liquid supply below 2 million BTC by the beginning of 2026 and below 1 million by December 2027. Such a scenario is able to provoke a sharp deficiency of cryptocurrency in the market and extreme price increase. At the same time, the researchers noted that its implementation is possible only under relatively rare starting conditions.

Researchers note that their model coincides according to key conclusions with forecasts of leading investment institutions, and metrics that they have developed can help investors better evaluate the risks and potential points of accelerated price growth.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.