Negotiations of a possible agreement between Russia and Ukraine dominate the attention of the markets on Thursday morning (3).

On the return to the financial market after Carnival, asset prices were adjusted under three assumptions: commodities in the sky, stronger and prolonged inflation in the spot and high interest rates in response to the Central Bank (BC).

Corn, wheat and natural gas prices are rising at a rate not seen in many years.

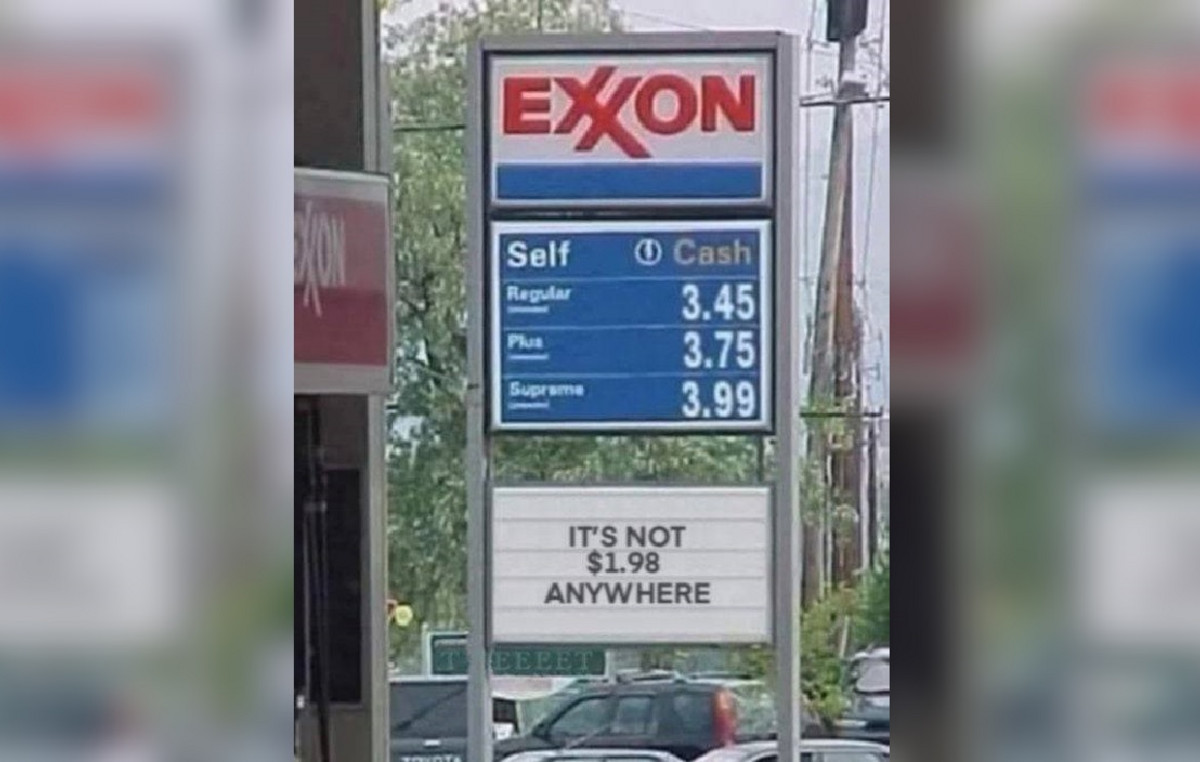

Oil starts the fourth round of highs, with less intensity in recent days, but WTI and Brent prices are above $115.

In Asia, the day was positive, fueled by the speech of Jerome Powell, from the American central bank, who debuted a new communication strategy. For the first time, the chairman of the Fed – the US central bank – announced what he will propose at the meeting of the Fomc (the US monetary policy committee) – a 0.25 point hike in US interest rates.

European stock exchanges tried to board at the same pace, but switched signals, triggering caution about the eighth day of the war in Ukraine.

The biggest expectation for today is at the negotiating table that should take place with Russia and Ukraine on either side. Sergey Lavrov, the Russian foreign minister, said this morning that they are ready to talk but will continue with attacks.

The Ukrainian government has already admitted that it has lost control of Kherson, a major port city in the country.

Sanctions against Russia continue to be announced by governments and companies, closing the gaps for accessing, liquidating, selling and operating with Russian or Russian assets in the international market.

The highlights of this Thursday, in addition to the war, are data on economic activity and inflation from countries in Europe and the United States. In the Eurozone, producer inflation was above 30% in January.

The OECD (Organization for Economic Co-operation and Development) released its January price indicator, which rose to 7.2%, the highest rate since 1991.

Brazil

With inflation in the vein of the international economy, Brazil is no different. In an interview with CNN, Agriculture Minister Tereza Cristina admitted that food prices should rise with the rise in commodities and said that she is looking for alternatives to prevent agriculture from running out of fertilizers for the crop that begins to be planted in September.

To Reuters, the president of Petrobras, Joaquim Silva e Luna, said that the company has not yet made a decision on raising fuel prices – but it seems to be inevitable. According to the experts, the price gap exceeds 25%, in the case of diesel, the difference reaches R$ 1.

In Brazil, the price shock has more perverse and more lasting dynamics than in other countries, which keeps expectations for the Selic – the basic interest rate – closer to 13% than to 12% this year.

Indexes

The futures Ibovespa has a slight drop of 0.06%. The dollar falls, quoted at R$5.09, and the S&P futures are down 0.06%.

Agenda of the Day

Here in Brazil, the market is once again paying attention to the National Congress, which should fuel the debate on fuel price controls.

Overseas, US employment, services and industrial orders data. US Treasury Secretary Janet Yellen speaks at a virtual noon event.

Source: CNN Brasil