On New Year’s Eve and Christmas Eve, stock markets usually expect an upsurge, the so-called Santa Claus rally. And how are things going with this at the end of 2022 in the cryptocurrency market?

bitcoin

Investors of the first cryptocurrency are probably not in the most festive mood during the long crypto winter. The bitcoin rate does not show any dynamics at all, being in a lateral movement lately. The week from 23 to 30 December was no exception. The maximum value that BTC reached during these seven days was $16,961, and the minimum was $16,465. Thus, the price changed within 3% for the whole week.

A source: tradingview.com

The lack of movement in Bitcoin is confirmed by its historical volatility index, calculated by the BitMEX exchange. The value is near historical lows, and the lowest figure from December 2022 turned out to be a record one.

A source: tradingview.com

The lack of volatility is due to several factors.

First of all, not in favor of active trading played the bankruptcy of FTX. Investors began to fear for their savings, and as a result, withdraw cryptocurrency from centralized exchanges.

Secondly, the largest BTC miners sold off all the mined bitcoins, which led to a decrease in the price. And there are no new large investments in cryptocurrency yet. This, among other things, was evidenced by a statement by Messari analyst Tom Dunleavy.

Should you invest in bitcoin and other cryptocurrencies now? Opinions vary greatly. For example, CNBC host Jim Cramer believes that it is not worth it, and calls altcoins “money for morons.” Messari CEO Ryan Selkis takes a different view, noting that rapid growth is not to be expected. And MicroStrategy simply continues to increase the number of BTC. About it

informed founder of the company Michael Saylor (Michael Saylor).

From the point of view of technical analysis, the levels have not changed over the week. The nearest support is $16,293, the nearest resistance is $17,000, while it is only possible to talk about the start of upward movement in BTC after breaking the $18,400 mark.

A source: tradingview.com

The index of fear and greed among bitcoin holders has not changed significantly over the week: the value

has grown by 1 point from 27 to 28. Alas, so far investors are afraid of active actions.

Ethereum

As in Bitcoin, there are no special movements in Ethereum, and certainly there is no pre-New Year rally here. Over the week, the price of the second cryptocurrency by market capitalization changed from $1,235.33 to $1,181.90, that is, fluctuations were within 4.3%.

A source: tradingview.com

The lack of volatility is determined by the fact that now investors have no desire to take risks. This is also evidenced by statistics. Since January 2020, the influx of those who invested money has only been declining.

A source: tradingview.com

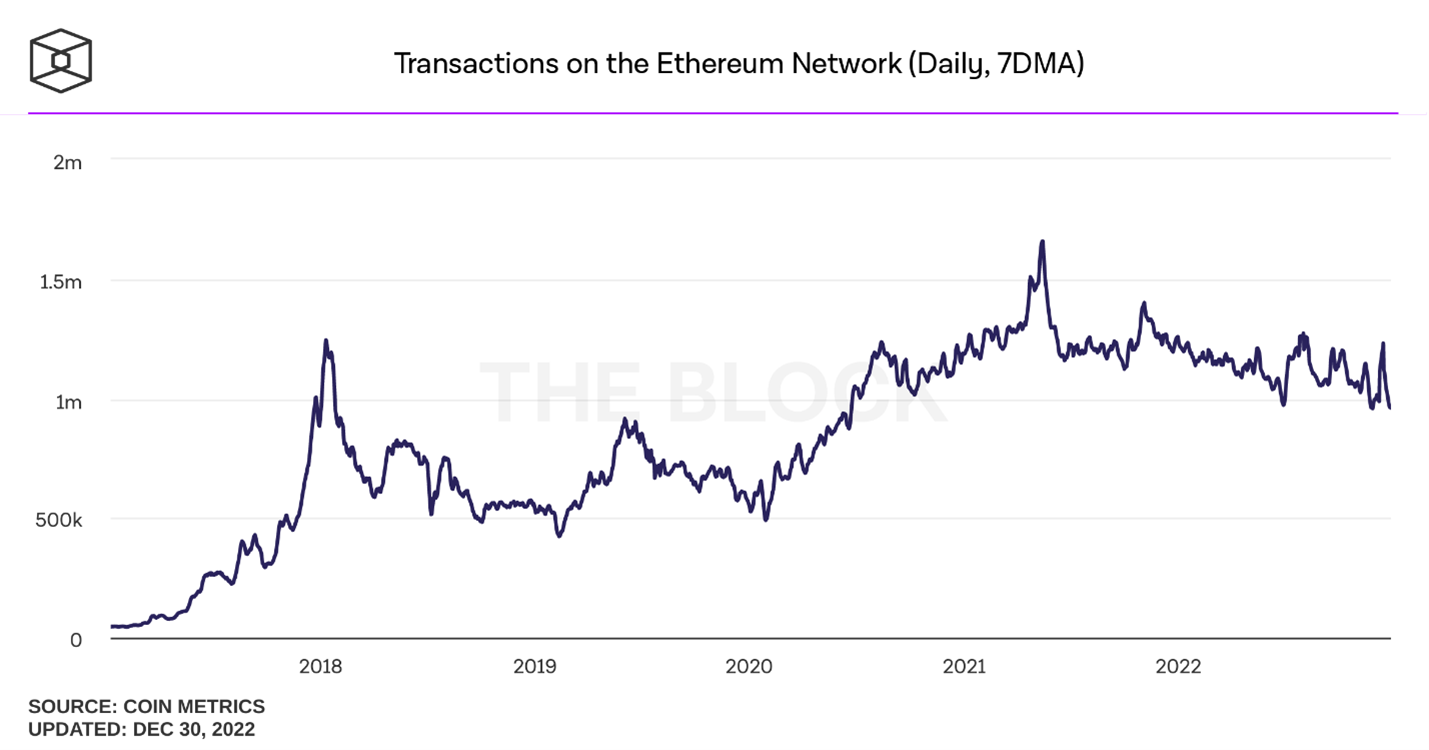

And in general, the number of transactions in the Ethereum network at the moment continues to decline. And December 27, 2022 was generally the worst day in this regard. Then there were only 963,070 transactions. At the peak – in August 2022 – there were 25% more transactions, about 1,270,000 per day.

A source: theblock.com

In terms of technical analysis, Ethereum is in a narrow corridor between $1,181.9 and $1,235.33. After the coin breaks down or up this flat trend, the main targets will already be $1,150.6 and $1,352.2.

A source: tradingview.com

Solana

New Year’s holidays did not add a good mood to Solana’s investors. The coin lost more than 30% in a week, dropping to the $8 region. Slightly corrected the picture post in the social network from Vitalik Buterin in support of the project developers. But even after this powerful stimulus, the coin lost almost 20% in relation to the value of last Friday.

A source: tradingview.com

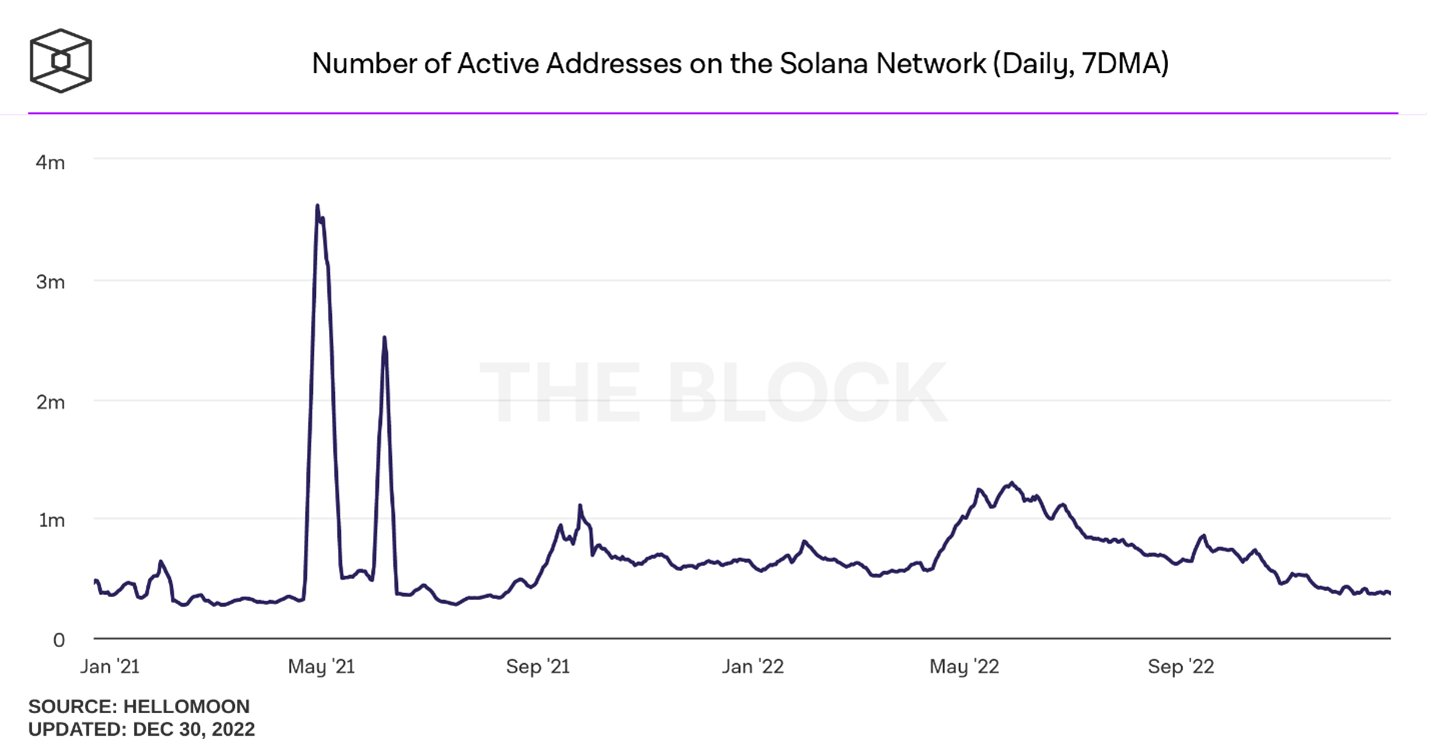

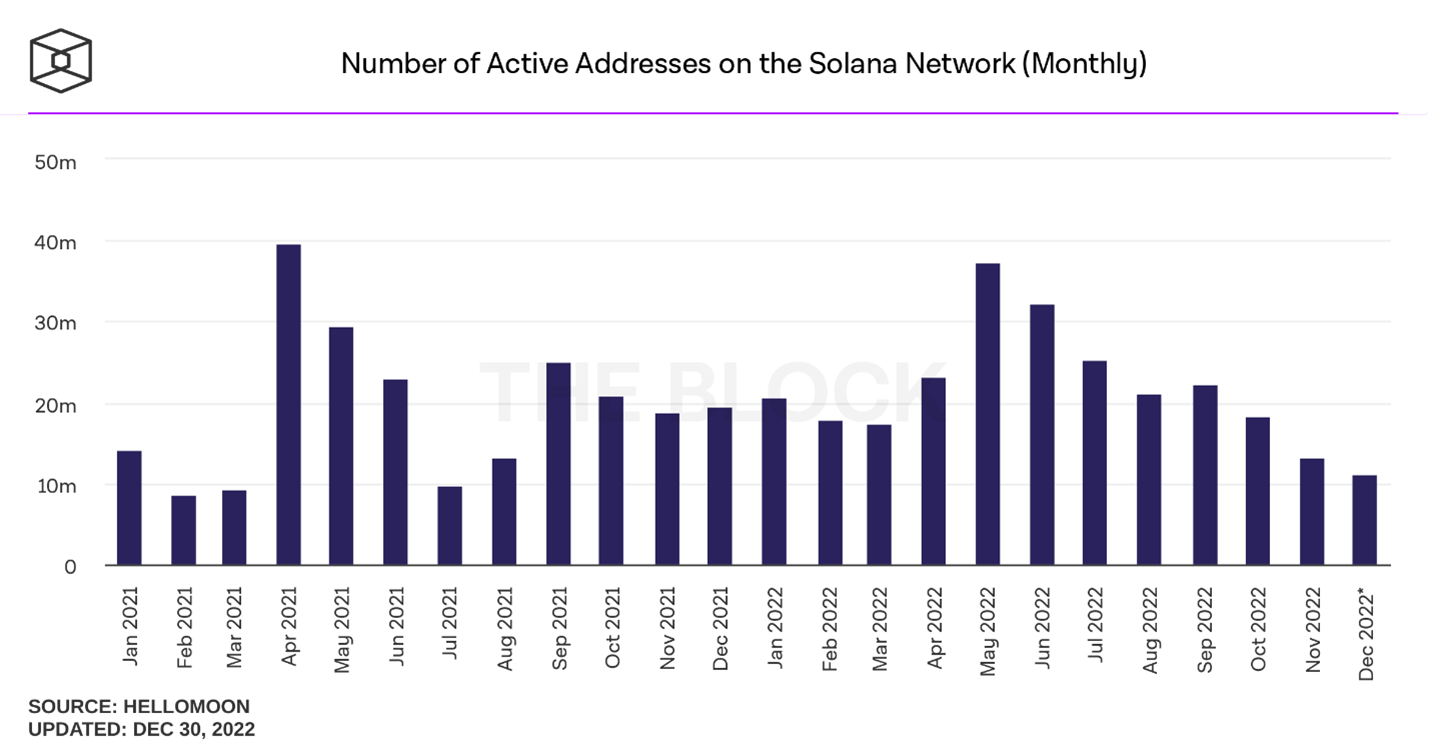

If we talk about the fundamental components, then at the moment there are very few prerequisites for a change in the Solana trend. For example, the number of active addresses in the network has only been getting smaller since the end of May.

A source: theblock.co

A similar conclusion can be reached by looking at the statistics for new addresses on the network. What does it say? The fact that those who have money are not eager to invest in Solana. And if so, why would it grow in value?

A source: theblock.co

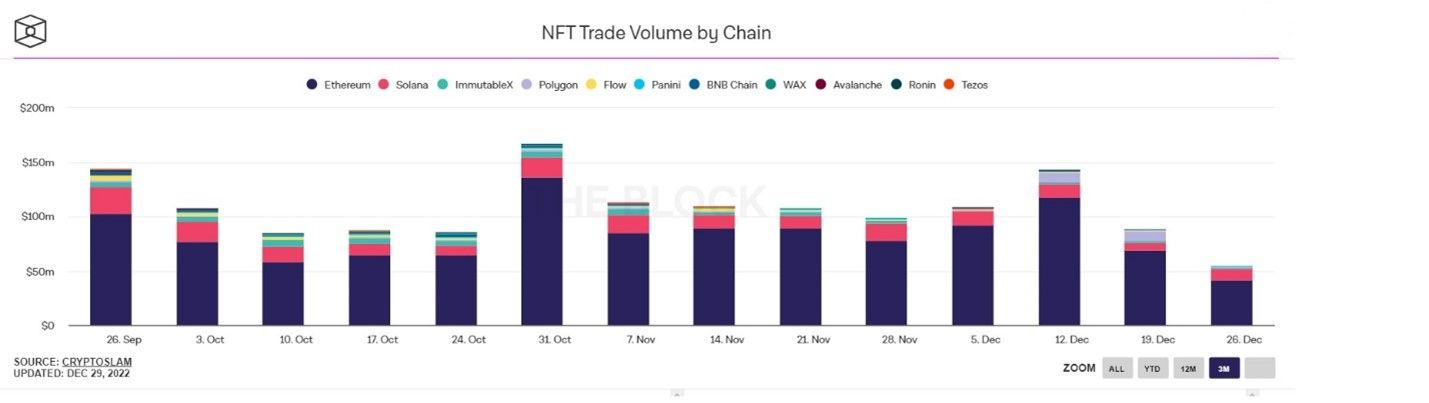

The only positive information for Solana is the fact that the network maintains the second place in NFT sales – behind Ethereum. But this does not help the price of tokens to rise, as NFTs themselves are in crisis.

A source: theblock.com

From the point of view of technical analysis, Solana is also quite bleak. The level that was still support last week – around $10.9 – has now become resistance. Support is the low of December 29 at $8, which also became a historical low.

A source: tradingview.com

Generallywhile the cryptocurrency market is at best in a lull stage. No pre-New Year growth is observed, although it is in light of the belated Santa Claus rally that the fall has probably slowed down somewhat. Significant capital in the crypto market is now rather absent, and most investors prefer not to take risks.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.