Development dynamics, tourism dynamics, political stability and the European Central Bank’s new tool, TPI, significantly help Greece’s creditworthiness and strengthen its prospects, the German rating agency Scope estimates in its analysis.

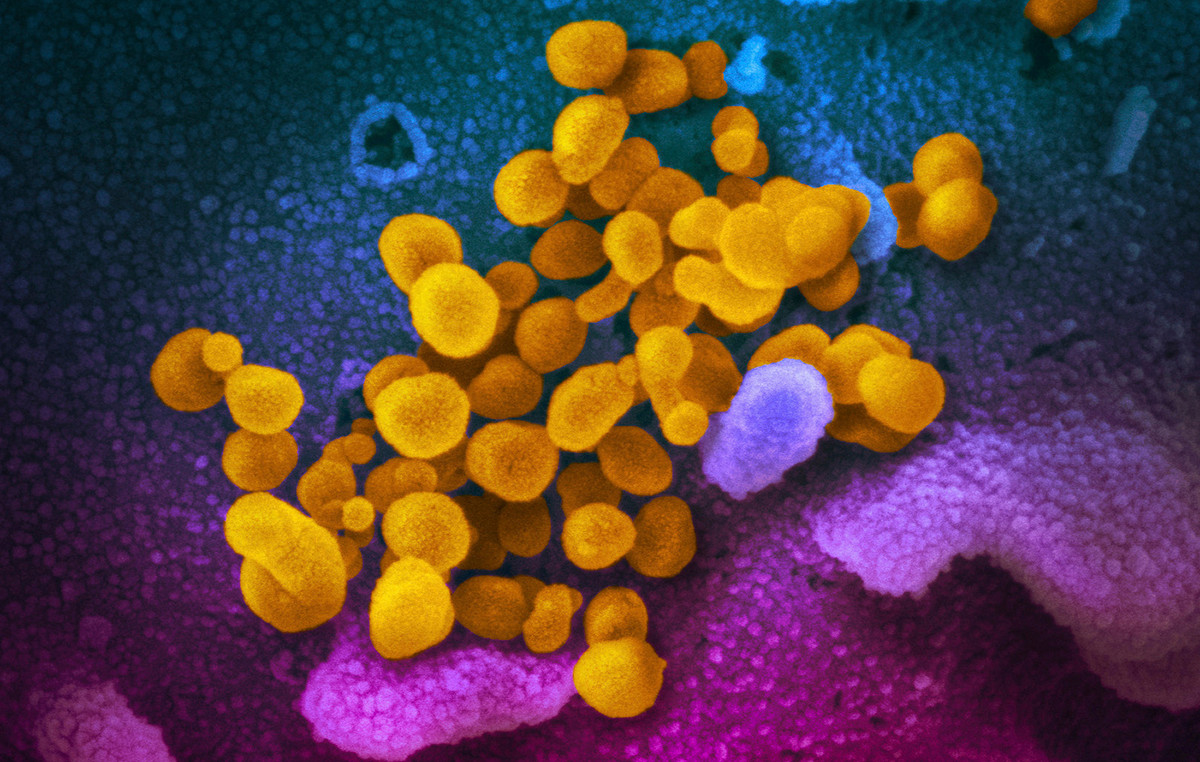

In an analysis signed by the director of the house’s sovereign debt assessment department, Dennis Shen, it is noted that “Greece (BB+/Stable – the level of credit rating attributed by Scope to Greece) has progressed in a strong recovery from the Covid-19 crisis. Last month, Scope Ratings revised its growth forecast for 2022 to 4.9% from an estimate of 4.6% at the start of the year – the economy grew by 8.3% last year – although it revised downwards its forecast for 2023 to 2.1% from 2.5%.

A strong recovery in tourism in Europe this summer, which led to better-than-expected second-quarter growth in Spain and Italy, may also ensure Greece’s second-quarter GDP is higher than a quarterly increase of 0 .25% expected by the German house. Conversely, any correction of recent significant stock accumulation would pose a downside risk. Greece is due to announce Q2 GDP data on September 7.

Political stability under the New Democracy of Prime Minister Kyriakos Mitsotakis and strong monetary and fiscal support are additional supports for the economy, Scope adds.

Lack of investment grade no longer precludes Eurosystem support

ECB support has stabilized Greek debt markets. Along with the first line of defense of the central bank’s Pandemic Emergency Purchase Program (PEPP) reinvestments, monetary policy’s new Transmission Protection Instrument (TPI) helps Greece’s creditworthiness in three important ways.

First, there is the very inclusion of Greece in the TPI despite its non-investment grade credit ratings. Second, there is a program option for unlimited purchases of Greek bonds, even when purchases are restricted, thus avoiding any conflict or contradiction with future directions for tighter monetary policy. Third, the ECB will buy bonds taking into account the specific circumstances of the euro area countries rather than being bound by each country’s percentage of capital participation in the central bank’s capital.

In addition, eligibility criteria requiring fiscal and macroeconomic sustainability will logically, to some extent, provide incentives for responsible policymaking – particularly critical with the end of the Greek Enhanced Surveillance Program this month and associated policy uncertainty post-programme.

However, the vague trigger criteria for the TPI – which leave considerable discretion to the ECB’s Governing Council over which bonds to buy and when – leave it unclear how the ECB would define what constitutes an “unwarranted” rise in yields, which would could limit the use and effectiveness of the new mechanism. Additionally, the lack of definition leaves the program vulnerable to future legal challenges.

TPI is a potentially durable monetary backstop for Greek bonds

In the house’s September 2021 assessment of Greece, Scope referred to the strengthening of Eurosystem support for Greece after the Covid-19 crisis as critical to any further credit rating upgrade from BB+. Recent Eurosystem announcements such as i) the strengthening of PEPP reinvestment ii) the extension of Greece’s waiver under the ECB’s repo framework until around the end of 2024; and, importantly, iii) the TPI announcement are steps in the right direction .

More broadly, the central bank’s action since 2020 has marked a sharp shift from the pre-pandemic exclusion of Greece from the ECB’s monetary operations due to speculative credit ratings. In particular, TPI presents the potential to provide a permanent support program for the Greek markets, which we stated as critical to the future rating trajectory at the September 2021 rating upgrade.

The TPI provides a permanent ECB purchase facility for Greece that does not include increased barriers to triggering Definitive Monetary Transactions. Such a sustained Eurosystem backstop for regional markets is particularly important as there remains a significant risk of a regional debt crisis as the ECB raises interest rates with the possibility of a winter energy crisis.

Debt to GDP could be reduced below 150% by 2027

Yields on Greece’s 10-year government bonds rose to 4.7% in mid-June, before falling sharply to 3% – although they are still double the estimated 1.5% weighted average cost of debt for 2022.

The house expects a nominal fiscal deficit of just 3.5% of GDP and a primary deficit of 0.75% this year, better than the government’s targets of 4.4% and 2% respectively, before achieving a balanced primary account in 2023-27, with a nominal a deficit of about 2.7% of GDP in those years.

The overall debt ratio appears to be falling much faster than previously expected, supported by inflation rising to 12.1% year-on-year in June, real GDP growing above forecasts and fiscal consolidation. The debt-to-GDP ratio will fall from a peak of 206.3% in 2020 to 171.3% by the end of 2022, falling below the 180.7% recorded before the crisis in 2019, while potentially to moderate further to 146.5% by 2027, the German house concludes.

Source: Capital

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.