The Securities and Exchange Commission (SEC) has dropped its investigation into Paxos, the New York-based stablecoin issuer responsible for issuing the Binance USD (BUSD) token. The regulator’s decision may signal that stablecoins are not securities in most cases.

The crypto industry has long been in need of clear rules for regulation and determination of the status of digital assets.

What’s happened

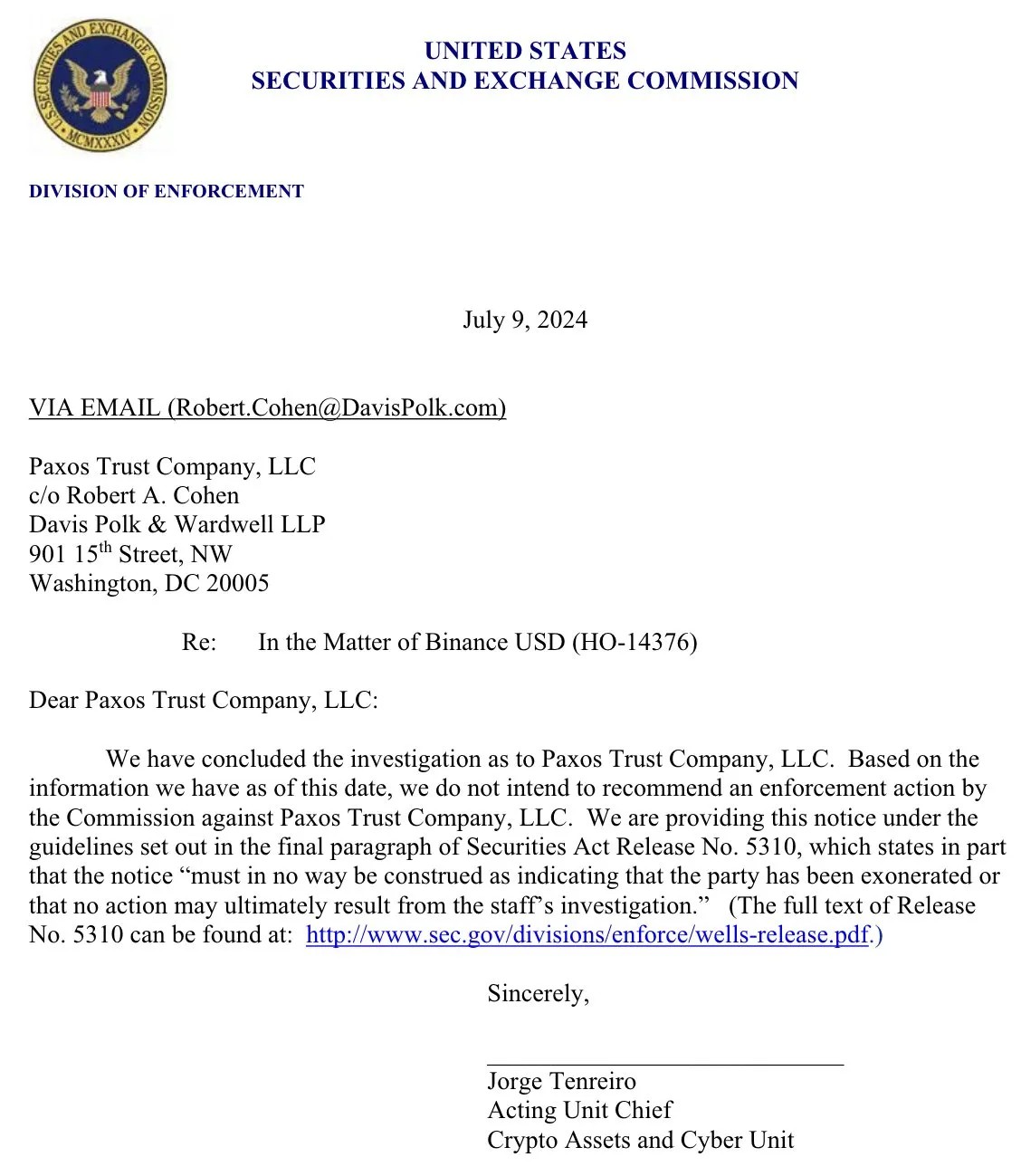

On July 9, SEC officials reported team of the stablecoin issuer about the completion of the investigation into the company. The letter states that based on the information available, the Commission does not intend to recommend enforcement action against Paxos Trust Company, LLC. At the same time, the SEC noted that the notice should not be interpreted as a complete exoneration of the company, as other actions may be taken in the future based on the ongoing investigation.

Chronology of events

The company came under scrutiny from the SEC in February 2023 over the Binance USD (BUSD) stablecoin of the popular crypto exchange Binance, which was issued by Paxos. The SEC team argued that BUSD was a security because the cryptocurrency failed the Howey Test. The regulator still uses an outdated framework to determine the status of digital assets.

The issuer did not agree with the accusations. Despite being confident in its rightness, Paxos had to distance itself from Binance and stop issuing the stablecoin. Soon, the crypto exchange announced that it would stop supporting BUSD, and the coin’s market capitalization began to fall rapidly.

What Paxos’s Victory Means for the Market

The SEC’s ruling could bolster the U.S. stablecoin sector, which has faced regulatory uncertainty.

Paxos launched BUSD in partnership with Binance in September 2019. While BUSD hasn’t been able to outpace its competitors Tether’s USDT and Circle’s USDC, it has become a significant player thanks to its integration with the Binance ecosystem.

Earlier, Ethereum software developer Consensys also reported a victory over the SEC. The regulator was unable to prove that ETH had the characteristics of an illegally issued security.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.