TrueCoin and TrustToken Reach Settlement with SEC on charges of fraudulent and unregistered sales of investment contracts in the form of the TrueUSD (TUSD) stablecoin.

According to the lawsuit, TrueCoin acted as the issuer of the coin, TrustToken was the operator of the TrueFi lending protocol.

From November 2020 to April 2023, the companies offered investors the opportunity to buy TUSD and profit from the asset on a lending platform. TrueCoin and TrustToken claimed to back the stablecoin 100% with US dollars, and promoted the products as risk-free and reliable.

In fact, most of the assets from the stablecoin reserves were invested in a “speculative offshore fund.”

By the fall of 2022, the defendants learned that the structure was having problems repaying its obligations, but continued to advertise investments in TUSD as safe, the SEC claims. As of September 2024, the fund was the holder of 99% of the stablecoin’s collateral.

Without admitting or denying the allegations, the companies agreed to a settlement subject to final judgment. The terms include:

- prohibition on violation of securities laws;

- payment of a civil penalty of $163,766 to each of the firms;

- TrueCoin was awarded $340,930 in ill-gotten gains and $31,538 in settlement fees.

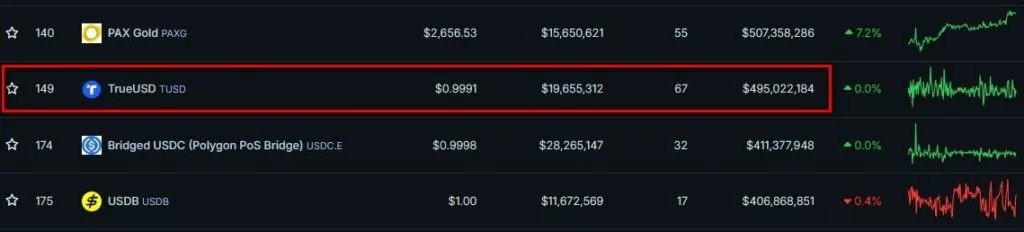

According to data CoinGeckothe capitalization of TUSD is $495 million. The coin ranks 11th in the stablecoin segment, the total value of which exceeds $173.3 billion. USDT from Tether and USDC from Circle dominate the market – $119.2 billion and $35.9 billion, respectively.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.