Silvergate Bank

Silvergate Bank was the first to cease operations. This is the smallest of the banks considered in the article – its assets totaled only $11 billion. On the other hand, this did not prevent it, along with Signature, from being the largest bank involved in the crypto industry. Silvergate was founded in 1988 and is headquartered in San Diego, California.

The first 8 years – until 1996 – Silvergate was officially an association for savings and loans (S&L). For the first time, he plunged into the crypto industry in 2014, and later almost completely switched to working with cryptocurrencies. Since 2018, the bank has launched its own Silvergate Exchange Network (SEN) platform, with which it was possible to quickly replenish various exchanges with fiat.

The first news about the likely problems of Silvergate Bank appeared at the end of last year. The fourth quarter of 2022 turned out to be horrendous for the organization – a net loss for this period amounted to about $1 billion.

This was caused mainly by the collapse of the FTX, which led to decrease in deposits in crypto assets more than three times – from $11.87 billion to $3.8 billion. Silvergate had to sell the securities that it had on hand. Basically, these are bonds, the prices of which have fallen unprecedentedly due to Fed’s actions on interest rates and controversial policies to prevent inflation.

In January of this year, it became known about the reduction of the bank’s staff by 40%. All these events did not fail to affect the company’s shares, the price of which has fallen 23 times since November and 6 times in March alone.

Source: tradingview.com

In early spring, Silvergate Bank reported delays in reporting for 2022. This led to the termination of relationships with many leading companies, including Coinbase, Galaxy Digital and Paxos. On March 3, SEN ceased operations, and on March 8, the company said that the voluntary termination of operations and liquidation is the best solution under the current conditions.

So the sequence of events looked like this:

-

The Fed is raising rates to fight inflation as a disproportionate amount of money was printed during the pandemic. The decision turned out to be controversial, and some economists predicted a possible recession in the economy long before a series of problems with banks.

-

The collapse of one of the largest crypto exchanges at that time FTX causes panic in the market. The mass withdrawal of cryptocurrencies and their sale begins.

-

Against this background, many investors seek to withdraw funds from deposits.

-

At some point, the bank needs a lot of cash, which is not available, as a result of which it has to sell securities, in particular bonds.

-

The bonds are selling at a big loss as their price collapsed after the aforementioned rate hike.

-

There is a net loss of $1 billion.

-

In early January, 40% of the staff are laid off. This can be explained by the fact that the platform was trying to cut costs.

-

At the beginning of March, relations with a number of major players were severed after delays in reporting for 2022 were announced.

-

The bank is liquidated.

The collapse of Silvergate Bank was caused by a chain of successive events: the actions of the Fed, the collapse of FTX, the panic of investors. Could it have been predicted? Debatable. As an example, we can cite the fact that at the end of January the largest investment company Blackrock owned 7% of Silvergate shares. Even these professionals failed fully predict the course of events.

Silicon Valley Bank

The next to cease to exist was Silicon Valley Bank (SVB), the largest of the banks considered in the article. Under his leadership, there were assets worth over $200 billion. SVB was founded in 1983, and its headquarters were located in California, in the city of Santa Clara. At the time of liquidation, it was the 16th largest bank in America.

SVB worked primarily with fintech startups, including cryptocurrency ones. On March 8, nothing foreshadowed trouble – the company even released development strategy for the first quarter of 2023. However, over the next two days, a series of events led to the bankruptcy of SVB.

On the evening of March 8, the bank announced that it had a “hole” in the budget of $ 2.25 billion. Then panic began, one of the reasons for which was the situation with the aforementioned Silvergate. Many venture capitalists rushed to withdraw their funds. The Fed’s actions also “added fuel to the fire.”

Since SVB worked with startups that needed money to start a business, the only way out was to get a bank loan, which will turn out to be expensive due to the current monetary policy of the regulator. However, in the current conditions, paying wages, loans, etc. is quite difficult.

Like Silvergate, SVB started selling its bonds. Their Wednesday sell-off was a “success” with a loss of just under $2 billion. The next day, March 9, SVB CEO Greg Becker urged bank customers to “remain calm.” However, his appeal proved unconvincing. At the same time, SVB’s share price more than doubled.

Source: tradingview.com

By the evening of March 9, about $42 billion had been withdrawn from SVB deposits. This resulted in a negative cash flow of almost $1 billion per day, and to close this gap failed. It was the panic created around this situation that “buried” the SVB. A number of investment funds – Founders Fund, Union Square Ventures and Coatue Management – began sending messages to the startups they finance, calling for bank withdrawals. Fuel was added to the fire by the media with the corresponding news background.

“When you say, ‘Go take your deposits, this thing is going to fall apart,’ it’s like yelling ‘fire’ in a packed theater,” said Ryan Falvey, an investor at venture capital firm Restive Ventures.

He also conducted his own analysis of SVB, which found that the bank was well capitalized.

What will happen to the bank now? The Federal Deposit Insurance Corporation (FDIC) has ruled that all SVB deposits and assets will go to the new Bridge Bank, which will be managed by the FDIC itself. Starting March 13, customers will be able to withdraw their money. Losses associated with Silicon Valley, will not passed on to taxpayers.

Thus, the collapse of SVB was the result of the same reasons as the bankruptcy of Silvergate: the actions of the Fed and the panic of the people. The second factor became even more significant, as it was “accelerated” by venture investors and the media. The Silvergate bankruptcy itself, which preceded the SVB bankruptcy, was its catalyst.

Signature Bank

New York Signature Bank is the youngest of those presented in the article. It was founded in 2021. Signature occupies an intermediate position in terms of assets between Silvergate and SVB – in total it had more than $110 billion. The bank’s activities were multi-directional and cryptocurrencies were not the main priority, like Silvergate. The bank began to deal with them only at the end of 2018. They accounted for about 23% of all deposits, while Signature was going to reduce their share to 15%.

The history of Signature is somewhat different from what happened with the previous two banks. After the SVB closure was announced, many customers began calling Signature offices to ask about the safety of their funds. The commotion was due to the fact that many customers had accounts of more than $250,000, and the FDIC guaranteed refunds for only that amount.

On the same day, withdrawals became more frequent. However, by March 12 the situation had stabilized. The news that Signature is going out of business came as a surprise even to the company’s managers. How was this explained? $79 billion — nearly 90% of Signature’s total deposits at the end of 2022 — was unsecured, according to the documents. In addition, $16.52 billion was in digital assets.

The reason for the closure of Signature was, in essence, the decisions of the authorities, explained “systemic risks”. US Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell, and Federal Deposit Insurance Corporation (FDIC) Chairman said:

“The decisions made should protect the US economy by boosting people’s confidence in our banking system.”

What will happen now? Like SVB, Signature will be taken over by the FDIC. She, in turn, will transfer all deposits and assets of the company to Bridge Bank. All clients will be given access to their money.

Thus, the case with Signature is somewhat different from the two previous ones: its closure took place forcibly, and not on its own initiative. It is worth noting that throughout this time, Signature shares have been falling. So, since March 8, the price has decreased by almost 33%.

Source: tradingview.com

And what impact will the fall of the three major crypto-related banks have on global markets and economies?

Impact on markets

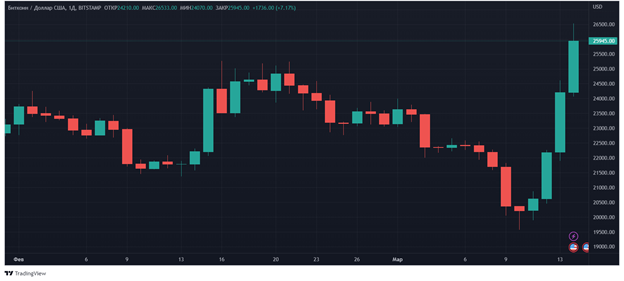

Let’s start with the impact on digital assets. For example, consider the daily chart of bitcoin.

Source: tradingview.com

On March 8, when Silvergate was declared bankrupt, BTC fell 2.23%. Assume that the effect was delayed. On March 9, the decline was 6.16%. The reaction to the collapse of the SVB on March 10 was extremely muted – only 0.72%. At the same time, the news about the termination of Signature Bank’s activities was met with almost 10% growth. What does it say? At least that there is no direct dependence, since the reactions in three cases are different: negative, neutral and positive. In addition, investors are becoming more relaxed each time these banking failures.

Much worse things are in the banking sector as a whole. So, as of the evening of March 13, Wells Fargo shares were down 6.37%, Bank Of America – by 3.3%, and Citigroup – by 6.51%. It follows from this that the problem is rather not in the crypto industry, but in the banking segment. And the reason for it is precisely the inflation caused by the launch of the printing press.

It can be assumed that the growth of BTC is associated precisely with banking troubles. Investors in fear of a recession and banks seek to withdraw money. But keeping them just on hand is not the right way just because of inflation. Before people there is a question – where to invest them? And here the option with BTC turns out to be relatively good and reduces the risks of depreciation of savings.

There may also be some temporary difficulties with liquidity in the crypto markets. Solutions such as Silvergate’s SEN and Signature Bank’s Signet were convenient for institutional investors because they didn’t need to to pay commissions to third parties.

What will happen next with the crypto world and the banking system? They will exist as before. Cryptocurrencies survived the collapses of MtGox, Terra and FTX, and banks survived the loss of Lehman Brothers Holdings. So new bankruptcies are a natural process that can cause short-term declines, but sooner or later growth will begin.

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.