- Silver rises and trims some of its weekly losses, but not enough to finish the week higher; loses 3.37% in the week.

- The University of Michigan inflation expectations are tempered from around 3.1% to 2.8%; San Francisco Fed President Daly took notice.

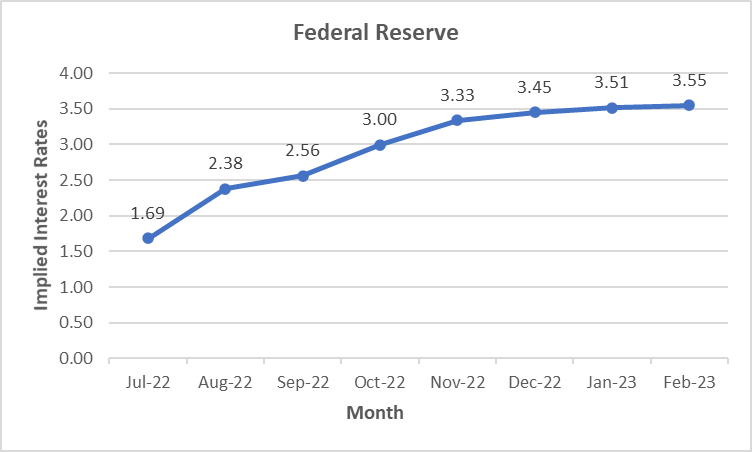

- Money market futures illustrate that traders expect a 75 basis point Fed rate hike in July and price in another 80 basis points by the end of the year.

Silver (XAGUSD) is paring some of Thursday’s losses late in the North American session, but still unable to recapture the $19.00 barrier on Friday, despite taking advantage of US dollar weakness, which is down 0.50%, according to the index. of the US dollar, which stands at 108,093, despite the positive US economic data.

XAGUSD is trading at $18.66, up 1.36% on Friday, in a quiet session that saw the white metal drop to $18.17, a new daily low, followed by a jump to $18.77 daily high.

Silver rises, but falters to conquer $19.00

Global equities are trading higher, despite the narrative of high inflation and recession fears holding. US retail sales advanced 1% year-on-year in June, beating forecasts. The May figures stood at -0.3%, showing the resistance of consumers. Later, the University of Michigan Consumer Sentiment for the month of July hit 51.1, topping estimates of 49.9 and topping June’s 50. The UoM survey highlighted that inflation expectations in a 5-year projection dropped from 3.1% to 2.8%.

XAGUSD has also been bolstered by falling US Treasury yields. The US 10-year Treasury bond yield is trading at 2.934%, down 3bps. Meanwhile, the US 2yr-10yr yield curve remains inverted for the ninth consecutive day, illustrating that investors remain bearish and are pricing in a US recession.

On the other hand, officials at the Federal Reserve crossed paths with the news. St. Louis Fed President James Bullard said raising 100 or 75 basis points would make no difference, adding that the pace could be adjusted for the rest of the year. Later, San Francisco Fed President Mary Daly said inflation is too high, the US economy is strong and the labor market remains strong. She added that the University of Michigan’s inflation expectations were “a good thing” and that recession is not her base case.

Fed Funds Rate Expectations

30 day fed funds rate futures

At the time of writing, market participants expect a 75 basis point rate hike, as 30-day fed funds rate futures show, and expect them to end around 3.45% in December 2022.

What must be considered

Next week, the Canadian docket will include data on housing starts, inflation and retail sales. In the US, the calendar will be packed with data on housing starts, building permits, existing home sales, initial jobless claims and global PMIs for July.

Silver (XAGUSD) Key Technical Levels

XAG/USD

| Panorama | |

|---|---|

| Last Price Today | 18.67 |

| Today’s Daily Change | 0.25 |

| Today’s Daily Change % | 1.36 |

| Today’s Daily Opening | 18.42 |

| Trends | |

|---|---|

| 20 Daily SMA | 20.2 |

| 50 Daily SMA | 21.13 |

| 100 Daily SMA | 22.93 |

| 200 Daily SMA | 23.13 |

| levels | |

|---|---|

| Previous Daily High | 19.24 |

| Previous Daily Minimum | 18.15 |

| Previous Maximum Weekly | 20.2 |

| Previous Weekly Minimum | 18.92 |

| Monthly Prior Maximum | 22.52 |

| Previous Monthly Minimum | 20.22 |

| Daily Fibonacci 38.2% | 18.57 |

| Daily Fibonacci 61.8% | 18.83 |

| Daily Pivot Point S1 | 17.96 |

| Daily Pivot Point S2 | 17.5 |

| Daily Pivot Point S3 | 16.86 |

| Daily Pivot Point R1 | 19.06 |

| Daily Pivot Point R2 | 19.7 |

| Daily Pivot Point R3 | 20.16 |

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.