- Silver price falls from intraday high of $28.44 following resilient US retail sales data for July.

- The consecutive decline in US jobless claims suggests that labor market conditions are not as bad as previously anticipated.

- Strong US retail sales have fueled a strong recovery in the US dollar and bond yields.

Silver (XAG/USD) is giving back some of its intraday gains in the New York session on Thursday following the release of resilient US retail sales data for July and a lower-than-expected number of people filing for first-time unemployment benefits in the week ending August 9.

The white metal struggles to hold the crucial $28.00 support as upbeat US data has boosted the US Dollar (USD) and bond yields. The US Dollar Index (DXY), which tracks the value of the USD against six major currencies, rebounds above 103.00. The 10-year US Treasury bond yields soar near 3.96%. Higher yields on interest-bearing assets weigh on non-yielding assets such as Silver by increasing the opportunity cost of holding an investment in them.

Retail sales, a key measure of consumer spending, returned to expansion and rose at a robust 1% pace from estimates of 0.3%. Meanwhile, initial jobless claims were lower, coming in at 227,000 versus estimates of 235,000 and the previous release of 234,000, revised up from 233,000. This is the second time in a row that the number of jobless claims has been lower than expected, suggesting that labor market conditions are not as bad as the July nonfarm payrolls (NFP) data indicated.

Meanwhile, the short-term outlook for the silver price remains firm as investors are confident that the Federal Reserve (Fed) will start cutting interest rates from the September meeting. However, the upbeat data has dampened hopes that the Fed will take an aggressive policy easing stance.

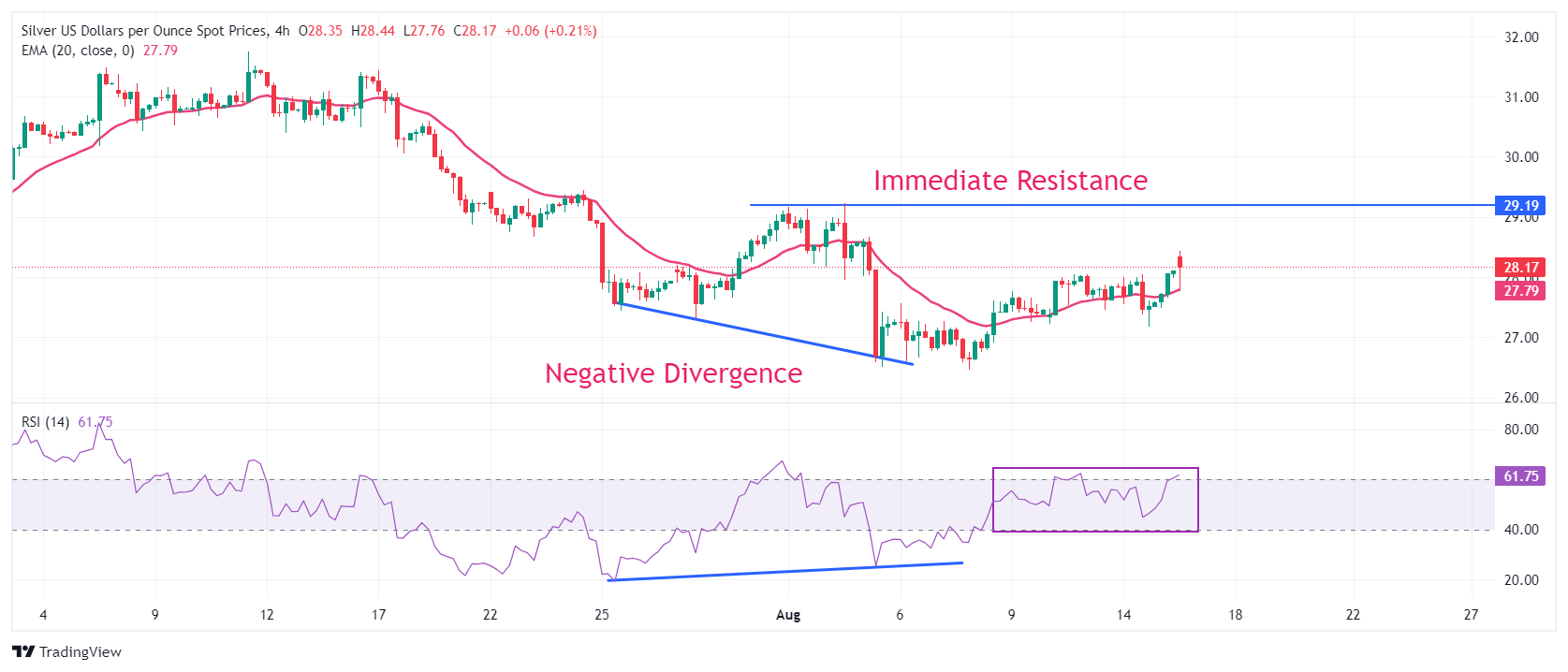

Technical analysis of Silver

Silver price bounced off a negative divergence formation on the four-hour time frame, which forms when the momentum oscillator refuses to make lower lows, while the asset continues that formation. The 14-period Relative Strength Index (RSI) bounced off 24.00 without breaking below the previous low of 20.00.

However, the mentioned formation would be triggered if the white metal breaks above the immediate swing high drawn from the August 2 high of $29.23.

The asset is holding above the 20-period exponential moving average (EMA) near $27.80, suggesting that the short-term trend has turned upwards.

The 14-period RSI has bounced near 60.00 and a decisive break above it will trigger the bullish momentum.

Silver four-hour chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.