- Silver prices are appreciating due to concerns over the escalating conflict in the Middle East.

- Israeli forces stepped up their offensive operations in northern and central Gaza on Wednesday.

- Fed Chair Powell said first-quarter data did not support increased confidence in the path of inflation.

Silver (XAG/USD) is gaining ground for the second consecutive session, trading around $31.00 per troy ounce during European hours on Tuesday. The rise in safe-haven silver is driven by concerns about a possible escalation of the conflict in the Middle East. Israeli forces continued their offensive in northern and central Gaza on Wednesday, following an airstrike on a tent camp, according to Reuters.

The militant group Hamas said the renewed Israeli campaign killed more than 60 Palestinians across the strip on Tuesday. This could derail efforts to secure a ceasefire in the Gaza war, with talks scheduled to resume in Doha on Wednesday.

Traders are looking ahead to Federal Reserve Chair Jerome Powell’s second semi-annual testimony and speeches by Fed Chair Michelle Bowman and Austan Goolsbee on Wednesday. In addition, attention will be on U.S. Consumer Price Index (CPI) data, due out on Thursday.

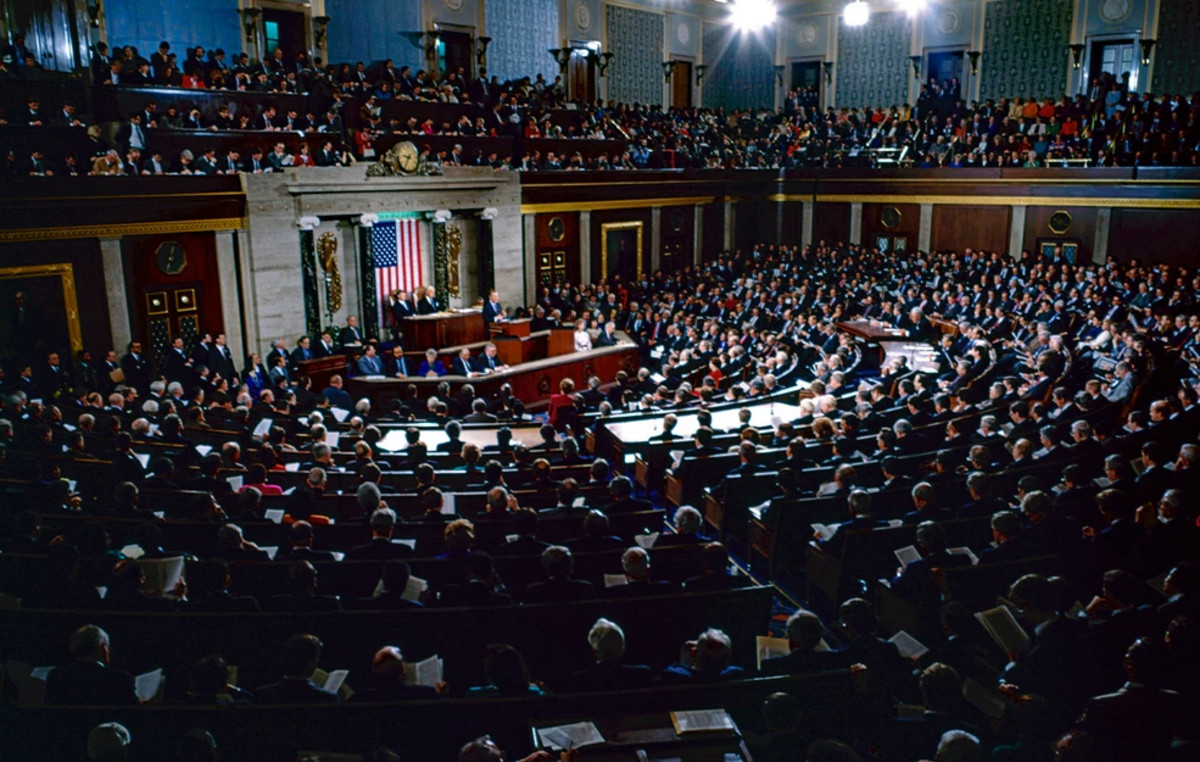

The price of non-yielding assets like Silver could face challenges as Fed Chair Jerome Powell reiterated the Fed’s cautious stance during testimony before the US Congress on Tuesday. Powell stated: “The first quarter data did not support the increased confidence in the path of inflation that the Fed needs to cut rates.”

Powell also stressed that a “policy rate cut is inappropriate until the Fed gains greater confidence that inflation is sustainably headed toward 2%.” The policymaker noted that “first quarter data did not support the increased confidence in the path of inflation that the Fed needs to cut rates.”

However, CME’s FedWatch tool indicates a 70.0% chance of a Fed rate cut in September, up from 68.4% a week earlier. The US Core Consumer Price Index (CPI) data, due on Thursday, is forecast to remain stable at 3.45% year-over-year in June. On a monthly basis, the core CPI is also expected to remain steady at 0.2%.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.