bitcoin

In the week of March 3-10, 2023, Bitcoin lost over 10.5% of its value, falling below $20,000 for the first time since January 14. The whole week passed with negative sentiments, only on Sunday, March 5, BTC slightly increased in price: 0.36%.

Source: tradingview.com

What caused such negativity?

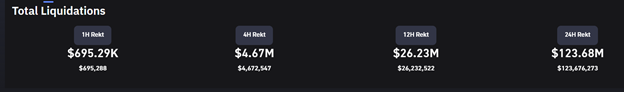

Firstly, a history of Silvergate’s problems. The parent company liquidated its banking division, Silvergate Bank. This situation initially, on March 3, led to a record for more than six months.

liquidation long positions in BTC futures. The trend continued after. As of Friday evening, March 10, nearly $124 million worth of bitcoin positions have been liquidated.

Source: coinglass.com

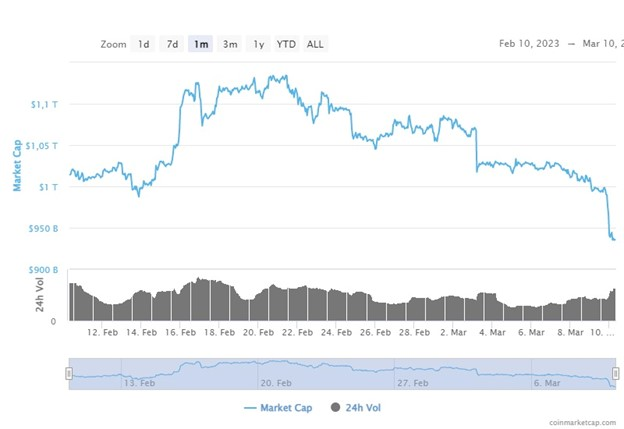

The capitalization of the crypto market also fell: by more than 10% over the week. And now again it is less than $1 trillion.

Source: coinmarketcap.com

Secondly, there was news from the company PeckShiekd about the confiscation by the US authorities of 49,000 BTC from criminals. Expectation

possible sale a given amount of cryptocurrency could also cause excitement among speculators.

Thirdfuel was added to the fire by the statement of the head of the Fed, Jerome Powell, about the future

raising rates. Above the level that was expected due to high inflation. Such information clearly did not inspire investors and did not add to their enthusiasm for risky investments in volatile assets, which is Bitcoin.

Fourth, The US Treasury published proposals to change tax laws. It is proposed to introduce an excise tax on mining. The size will depend on the amount of electricity consumed. In 2024, it is proposed to set the rate at 10%, and in the next two years

raise up to 20% and 30% respectively.

BTC, according to technical analysis, broke through the support level indicated last week as $21,376. Then it did the same with a mark around $20,300. Now these two levels should become resistance. The support level is shifting to the $18,200 area.

Source: tradingview.com

The index of fear and greed has shifted from the neutral zone to the negative amid the negative on the crypto market. Its current value

is 34, down 16 from a week ago.

Ethereum

Over the past week, Ethereum has lost slightly less than Bitcoin – 9.84%. The price dropped from $1,569.8 at the close on Friday March 3 to $1,415.8. As with BTC, the largest decline occurred on March 9, when Ethereum fell by 6.17%.

Source: tradingview.com

The fall of the world’s second-largest cryptocurrency in terms of capitalization is due to the same reasons as the fall of the first. But there are also their own catalysts. One of them was the accusation by the New York State Attorney’s Office of the KuCoin exchange of an unlicensed offer of cryptocurrencies. One of them was ether, which in the case with the stock exchange appears as, according to the prosecutor’s wording, a security. This recognition was the first official from the authorities. Prior to this, the head of the SEC, Gary Gensler (Gary Gensler) only handed out hints. Ethereum decentralization has raised questions before, and official

statements government agencies have only strengthened them.

Well, on the platform itself, they continue to prepare for the delayed Shanghai update. On March 8, the Ethereum blog reported that The Shapella network will be activated on March 14. In fact, it will be an improved update of The Goerli network. It is stated that with this

innovation validators will be able to withdraw their stakes.

From a technical standpoint, Ethereum has finally come out of the wide range between $1,680 and $1,500, but unfortunately down. Already, the price is in the $1,400 area and is likely to drop to $1,350, where the current support level is located. The nearest resistance level is in the February 2023 lows at $1,463.

Source: tradingview.com

Shiba Inu

Memcoin SHIB is down 10.9% over the week, hitting a new low since January 14th. Over the past nine days, Shiba Inu has declined in eight of them. The only exception was a slight increase on March 6, by 0.63%.

Source: tradingview.com

The general dynamics in Shiba Inu was due to the reasons that are common to all cryptocurrencies, described above. Also, the fact that Vitalik Buterin sold off a number of meme cryptoassets, including SHIB, could serve as a negative moment.

There was also good news. On Twitter Shibarium Network announced the launch of a beta version of the second-level blockchain based on Ethereum – Shibarium. However, no official date was given. The text of the message states that for further information it is necessary to follow

Shiba Inu social networks.

The technical picture for SHIB is still bearish. The coin must find a bottom before moving on to a new growth. The nearest support level is $0.00000945 and the resistance level is $0.00001165.

Source: tradingview.com

Total, in the week from March 3 to March 10, the crypto market remained in the red zone. The decisions of the US authorities related to inflation and possible taxation of mining companies, as well as the liquidation of the Silvergate bank, predetermined the decline in the value of almost all cryptocurrencies.

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.