Experts said that in the first quarter of the year, cryptocurrency rush was faced with a fall in the key parameters, which sharply contrasts with a rise at the end of 2024. The total capitalization of the crypto rush was reduced by $ 633.5 billion, to $ 2.8 trillion.

According to analysts, shortly before the inauguration of US President Donald Trump, the indicator reached a maximum at a mark of $ 3.8 trillion, after which it decreased during the quarter:

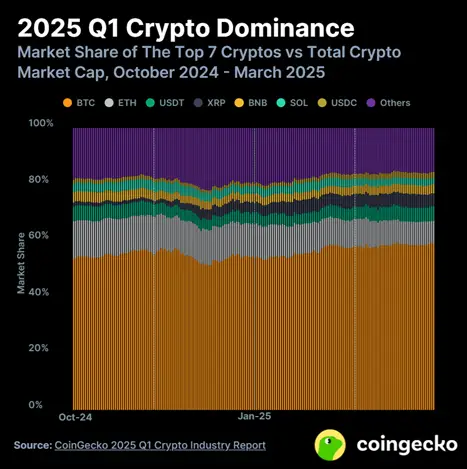

“The average daily bidding was reduced by 27.3% relative to the fourth quarter of 2024. The dominance of bitcoin among other cryptocurrencies has increased. By the end of the period, the indicator overcame the mark of 59.1%. Nevertheless, the asset closed the quarter with a drawdown of 11.8%, losing to both the US Treasury bonds and gold. ”

Another class of assets that benefited from the general decline in the market is stablecoins, the report said. The share of the USDT market increased to 5.2%, USDC – to 2.18%.

The dominance of the broadcast has decreased to 7.9%, which is a new minimum since 2019. Among the largest coins, only XRP and BNB were able to maintain positions, Soingecco experts said.

Earlier, the head of the research department of the Bitcoin New York Digital Investment (Nydig) Greg Cipolaro platform said that the Bitcoin market remains quite sustainable against the backdrop of panic moods among investors caused by US trade policy.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.