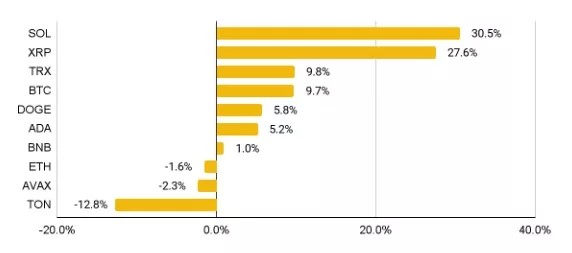

Solana (SOL) has seen its price increase by 30.5% in July, while Ripple’s XRP has gained 27.6%, significantly outperforming other leading coins. This follows from report Binance Research.

Dynamics of top 10 coins by capitalization in July. Data: Binance.

Dynamics of top 10 coins by capitalization in July. Data: Binance.

The total market capitalization increased by 6.1% over the month. According to experts, this was facilitated by a number of positive events. Among them:

- German authorities have completed the sale of 50,000 BTC;

- The SEC has approved S-1 filings for nine spot Ethereum ETFs, which began trading on July 23;

- Donald Trump promised to create a strategic reserve in bitcoins if he is elected US President at the Bitcoin 2024 conference.

However, concerns remained in the market about Mt. Gox beginning to pay out more than $9 billion to victims of the 2014 hack and the transfer of 29,800 BTC by the United States government, analysts noted.

They believe that Solana’s performance was largely driven by a 42.2% month-over-month increase in decentralized exchange (DEX) trading volumes, reaching $54.6 billion, largely driven by meme coin trading. The network’s average daily active addresses reached a record 1.7 million, while daily transactions increased 18.2% to 1.3 million.

The rally in XRP began after CME and CF Benchmarks launched indices and reference rates for the asset, the report said. Investor confidence was boosted by Ripple Labs CEO Brad Garlinghouse’s announcement that a lawsuit with the SEC could be resolved.

Tron (TRX) maintained its positive dynamics in July, adding 9.8% and entering the top 10 coins by capitalization, experts emphasized. The cryptocurrency’s prospects were boosted by the statement of its founder Justin Sun about the development of a gas-free stablecoin.

The month was not positive for all major digital assets, with the price of Ethereum falling by 1.6% over the period. After trading began, ETH exchange-traded funds initially recorded a net outflow of $484 million, analysts said.

DeFi and NFT Segments Confirm Mixed Dynamics

Total value locked (TVL) in the DeFi segment increased by 3.5%. This is roughly in line with the upward trend of the crypto market as a whole, Binance experts noted.

Among the protocols, Polymarket demonstrated significant growth in TVL: the figure in July exceeded $387 million, which is 614% more than the January value.

TVL on the Symbiotic platform increased by 283% in July, driven by market interest in restaking and partnerships with well-known projects such as Mellow Protocol, Lido, Ether.fi, Ethena, and Pendle. By the end of the month, the protocol had exhausted all pool limits, raising $1.2 billion since its launch in May.

Mellow Protocol also saw a 69.6% increase thanks to the Modular Liquid Restaking Primitive initiative, which allows for double farming of reward points for future airdrops of both its own token and Symbiotic.

Among other protocols that demonstrated significant growth, experts noted CORE (121.2%), Scroll (66.0%) and Mantle (30.9%).

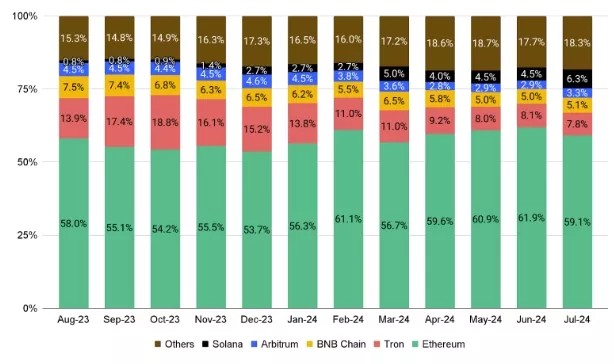

TVL segment by blockchain. Data: Binance.

TVL segment by blockchain. Data: Binance.

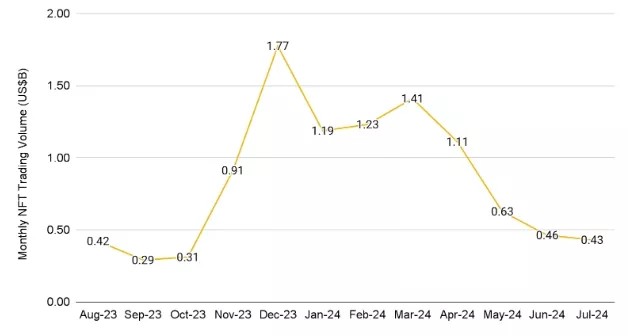

Non-fungible token sales volume fell by 7.14% in July, reaching $430 million. The leaders in this indicator were DMarket ($16.2 million) and DogeZuki ($13.9 million).

Collections on Solana like Monkey Business and Retardio Cousins have seen significant growth in volume, while sales of NFTs on Bitcoin and Ethereum have dropped significantly, analysts noted.

They also noted Immutable, which grew by 75.68% thanks to the growth of blockchain games, including the launch of Illuvium.

Monthly NFT trading volumes. Data: Binance.

Monthly NFT trading volumes. Data: Binance.

Binance Loses 21% of Trading Volume as Chasers Close in

According to Colin Woo’s team, Binance retained its leadership among centralized exchanges (CEX) in July by trading volume with $336.8 billion, although it fell by 21% over the month.

Cex Data for July: The spot trading volume on major exchanges decreased by 9% MOM, with Cryptocom (+59%), Upbit (+26%), Gate (+21%) and Binance (-21%), Bitget (- 18%), and OKX (-16%). Read more https://t.co/l2SCt6dwnh pic.twitter.com/gpSlN3AOp8

— Wu Blockchain (@WuBlockchain) August 12, 2024

This allowed Bybit ($110.2 billion and -7%) and Gate ($90.5 billion and +20.9%) to significantly reduce the gap.

The most notable growth among the leading platforms was demonstrated by Crypto.com (59%) and Upbit (26%).

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.