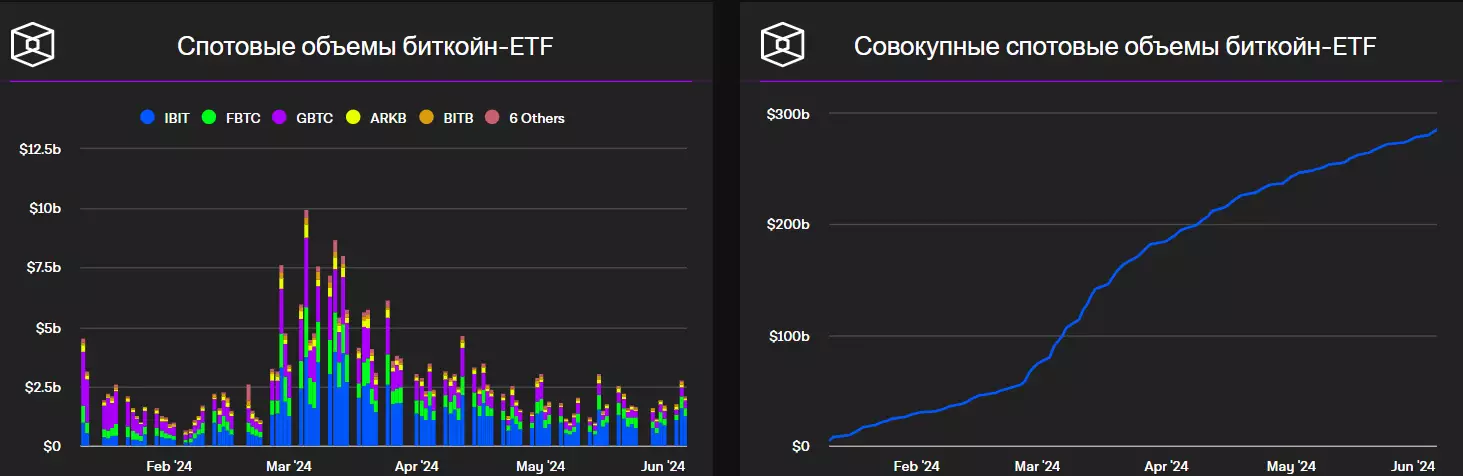

All of the 11 spot Bitcoin exchange-traded funds reported 17 consecutive days of no losses and a net inflow of liquidity. This is the longest streak of positive growth dynamics since the month of BTC-ETF launch, SosoValue figures say.

Among all Bitcoin ETFs, FBTC Fidelity leads the way with a net daily liquidity inflow of $221 million. The second position is occupied by IBIT BlackRock with $155 million. The Ark Invest and ARKB funds from 21Shares received an average of $71 million, and BITB from Bitwise $19 million daily.

After a short “zero break”, GBTC Grayscale recorded net inflows of $15 million. VanEck, Invesco and Galaxy Digital reported roughly equal daily liquidity inflows of $4 million.

On Wednesday, June 5, the total trading volume of shares of all 11 funds was more than $2 billion.

SosoValue believes that, despite market volatility, a prolonged positive influx of liquidity into Bitcoin ETFs can demonstrate long-term investor interest and optimism regarding the prospects for growth in the market value of the first cryptocurrency.

Earlier, the State of Wisconsin Investment Board (SWIB), which manages the assets of the local pension system, announced an investment of more than $160 million in shares of spot Bitcoin ETFs from BlackRock and Grayscale Bitcoin Trust.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.