According to experts, this influx of funds into ETFs demonstrates that traders are optimistic about the future dynamics of the market value of Bitcoin and believe that by the end of the year BTC will break through the previously reached all-time high. The last time such a significant influx of funds into the first cryptocurrency was recorded on June 4 – then it exceeded $886 million.

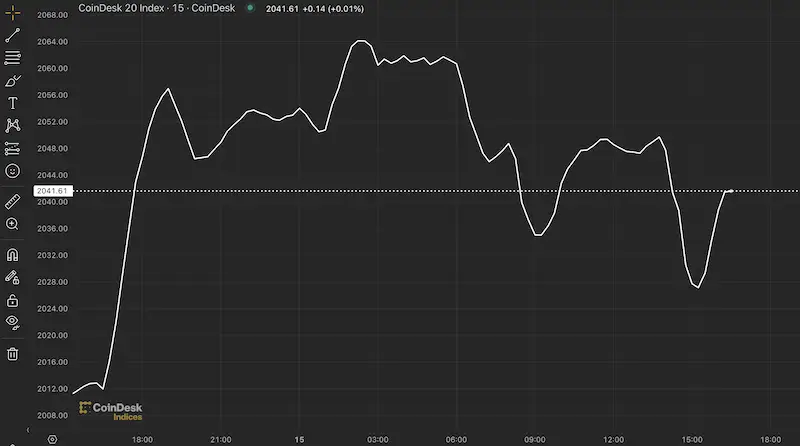

SoSoValue noted that, according to technical analysis, Bitcoin could break $73,000, signaling a return to an uptrend after months of volatile price fluctuations. By data CoinDesk Indices, BTC increased by 1.78% over 24 hours, which is in line with the dynamics of the CoinDesk 20 index, an index that tracks the movement of the total value of the largest digital assets.

Earlier, Bitwise analysts said that the resumption of the influx of funds into spot Bitcoin ETFs will allow the first cryptocurrency to demonstrate new historical highs and trigger the growth of other crypto assets.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.