- The S&P 500 is trading at 5,320, in a day with few participants.

- Economic data reflects a strengthening in the US economy.

- The Federal Reserve is expected to keep monetary policy unchanged in June and July

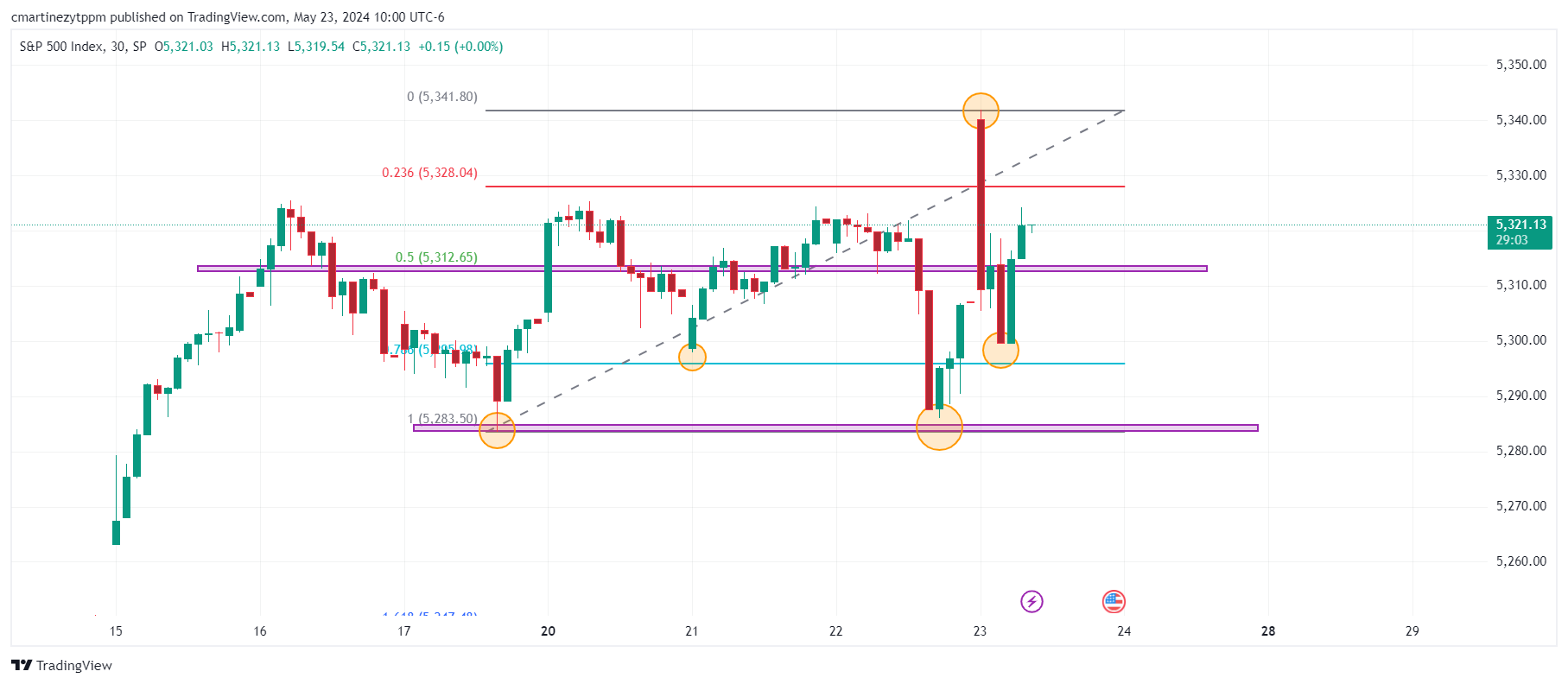

The S&P 500 opened the American session at 5,339, finding aggressive sellers and taking the market to a daily low of 5,299. The index is currently trading at 5.320 gaining 0.25% daily.

US PMI surprises and unemployment claims increase less than expected

The US manufacturing PMI improved to 54.4 in the flash estimate for May, up from 51.3, showing growth at a faster pace than in April. Initial claims for unemployment benefits increased by 215,000 compared to the previous weekly increase of 223,000. These data contribute to a strengthening in the Dollar (DXY), which at the time of writing is trading at 104.934, gaining 0.02% daily.

Federal Reserve Chair Jerome Powell said another rate hike was unlikely to be the next move, but explained that it might be appropriate to postpone interest rate cuts if inflation proves more persistent and the labor market tightens. keeps strong.

Technical levels in the S&P 500

The first technical support in the short term is found at 5,300, given by the pivot points in convergence with the 78.6% Fibonacci retracement. The second support is at 5,385, the low of the May 22 session. The closest resistance is located at 5,340, the maximum reached during today's session.

S&P 500 30-minute chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.