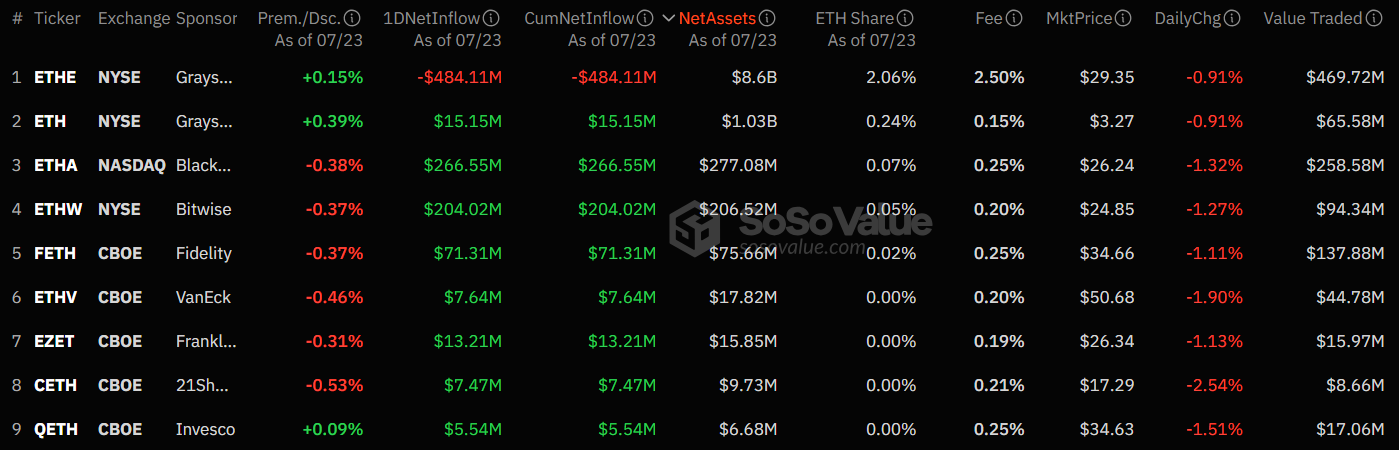

On July 23, 2024, spot Ethereum ETFs entered the US stock market. Trading volume in the sector was $1.11 billion by the end of the day, with net capital inflows of $106.78 million, according to SoSoValue.

As experts predicted, the Grayscale Ethereum Trust (ETHE) saw an outflow of $484.11 million. The remaining products are in the “green” zone:

Capital inflows/outflows in the US spot Ethereum ETF sector. Source: SoSoValue.

Capital inflows/outflows in the US spot Ethereum ETF sector. Source: SoSoValue.

According to the platform’s data, at least some ETHE investors have transferred funds to a new product from Grayscale Investments — Grayscale Ethereum Mini Trust ETF (ETH). It leads other funds in terms of assets under management (AUM).

Bloomberg Intelligence analyst Eric Balchunas commented on the situation with a significant outflow of funds from ETHE. According to him, this value is higher than expected. The expert is not sure that other funds will be able to compensate for it.

Damn. That’s a lot. Like 5% of the fund. Not sure The Eight newbies can offset w inflows at this magnitude. On flip side maybe its for best to just get it over with fast, like ripping a band aid off https://t.co/MCxGmRGAdr

— Eric Balchunas (@EricBalchunas) July 23, 2024

At the same time, he noted that the launch of the funds was generally successful. He compared spot Ethereum ETFs with products based on other assets in terms of trading volume on the first day.

Three Ethereum-based ETFs made it into the top 5: from BlackRock, Fidelity Investments, and Bitwise.

Ethereum (ETH) has shown little reaction to the situation. There are several jumps on the daily price chart, but the asset has not managed to break through the $3,500 level.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.