Bitcoin

Bitcoin from April 11 to April 18, 2025 added 1.75 %. All week, the BTC was traded in a fairly narrow range between $ 82,784 and $ 86,450. The largest intra -day change in price over all seven days did not exceed 2.27 %.

Source: TradingView.com

In the United States, data on the number of unemployment benefits were published. The indicator was 215,000, which is 10,000 less consensus prognosis. This shows that the American economy is still working stably, despite Donald Trump’s trading duties. For bitcoin, these data are not very positive, since strong indicators in the labor market are unlikely

Call Reducing the interest rate on loans in the near future. And if so, then the appetite to risky assets, which belongs to cryptocurrency, will be quite restrained.

The Glassnode analytical platform presented the information according to which the implemented capitalization of bitcoin (calculated as the amount of prices at which transactions were made for the last time) reached its historical maximum of $ 872 billion. At the same time, as the site notes, the total monthly growth of the indicator has slowed up to 0.9 %. This

speaks The fact that although most of investors still believe in the growth of bitcoin, the appetite for risk gradually runs out.

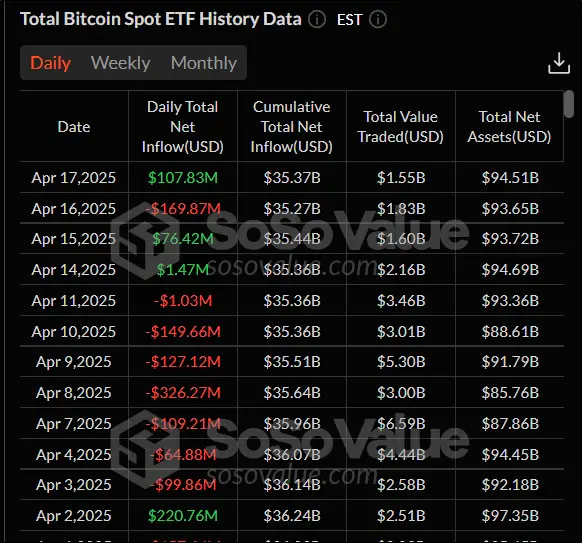

In the spotal ETF on the BTC, the situation last week has somewhat straightened out. The seven -day outflow of funds from exchange funds is interrupted. From April 14 to April 17, 2025, three trading sessions with a tributary of money were recorded at once. The largest fell on the last day and amounted to $ 107.83 million.

Source: sosovalue.com

From the point of view of technical analysis, Bitcoin began to give some hopes for growth last week. The price of BTC again overcame the 50-day sliding average (indicated in blue), which is a bull signal. Nevertheless, the ADX indicator continues to reduce. This suggests that the ascending trend in the market, if there is, is quite weak. Support and resistance levels: $ 82,764 and $ 89 164, respectively.

Source: TradingView.com

Index

Fear and greed Compared to last week, he climbed eight points. The current value is 33. This indicates that fear prevails over greed in the moods of crypto -investors.

Ethereum

The cost of the broadcast from April 11 to April 18 has changed by less than 1%. The second in capitalization of cryptocurrency continues to bargain in the range of $ 1,500 – $ 1700. In the week, three growth sessions and four falls were recorded.

Source: TradingView.com

According to representatives of the analytical platform

Santimentone of the main reasons for the ongoing fall of ETH is low activity in the Ethereum network. The average transaction commissions fell to $ 0.168 – the minimum value in five years. Interestingly, in Santiment they also find pluses in such a situation. Analysts

They believeThat now is the best time for developers to launch and test new applications. But the zeal of investors during economic uncertainty is not worth it yet.

ETH dominance is approaching the historical minimum. In April 2025, it reached 7.18%. Below it was only in September 2019 (7.08%). Then, standing around this mark, five months, the indicator moved to growth. As a result, in December 2021, the domination of the ether was 22.38%. Some analysts, for example, in Rekt Capital,

They believethat the situation may well be repeated, and the current moment of time is quite suitable for purchases of the second cryptocurrency capitalization.

Source: TradingView.com

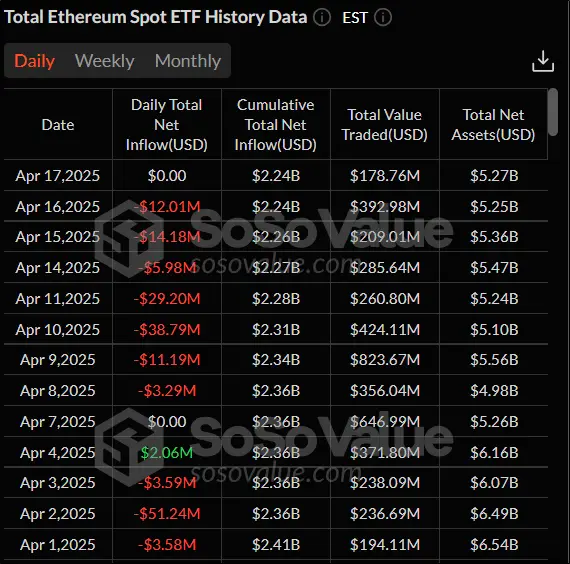

Institutional investors are also not yet eager to invest on the air. Last week, all trading sessions, with the exception of April 17, when the activity was zero, were marked by an outflow of funds from spotes ETH-ETF. In total, for nine days in a row there is no flow of money to exchange funds, and since the beginning of April it has been recorded only once, a fourth, in the amount of $ 2.06 million.

Source: sosovalue.com

From the point of view of technical analysis, the ether remains in the descending trend. Indicators are also discussed about the initiative of the bears: the price is located below a 50-day sliding average (indicated in blue), and RSI-below the level of 50. Support and resistance levels from last week have not changed and amount to $ 1,385.7 and $ 1754.2, respectively.

Source: TradingView.com

SOLANA

Solana added more than 10 % from April 11 to 18. This cryptocurrency was again able to overcome the line of $ 130, which failed to more than two weeks in a row. Almost all the growth came on Saturday, April 12, when Solana added 8.99%at once.

Source: TradingView.com

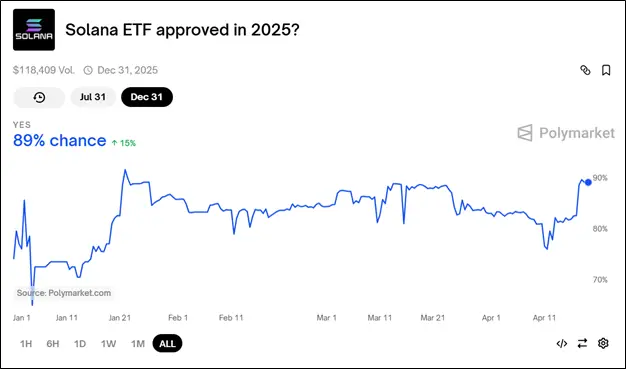

The main catalysts of positive dynamics were the statement of Paul Atkins (Paul Atkins) to the post of new head of the securities and exchanges commission (SEC), as well as a surge of interest in SOL on social networks. Against this background, investors believed that by the end of 2025, the SOLANA STF SOLANA will be approved in the United States. The probability of this event on April 18 on the Polymarket portal

Assessed at 89%, and the time on April 12 was only 76%.

Source: Polymarket.com

If in the United States, sp – spoon ETF are expected, then in neighboring Canada they have already been approved. Since April 16, exchange funds of such management companies as Purpose, Evolve, CI and 3IQ have become available to investors. Launch of spotes ETF

will allow To facilitate access to cryptocurrency for investors-legal entities.

It is worth noting that the increase in the cost of SOLANA led to an increase in the number of large transactions. For example, on April 14, two translations were made from some unknown wallets to others. According to the Whale Alet portal, one of them

exceeded $ 101 million, a

second $ 105 million.

From the point of view of technical analysis, Solana is in an upward trend. This is confirmed by the fact that the price has surpassed a 50-day sliding average (indicated in blue). The volatility of the cryptocurrency is weak, which is confirmed by a decrease in the ATR indicator. The current levels of support and resistance are in marks $ 121.82 and $ 147.5, respectively.

Source: TradingView.com

Conclusion

The week turned out to be quite positive for cryptocurrencies. SOLANA has grown stronger than bitcoin and ether, which is associated with the excitement around the spotal ETF for this cryptocurrency. The ether looks worse than the market due to low activity on the network.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.