Cryptocurrency Solana

Since its inception, Solana has been positioned as an “Ethereum killer”. The main reason was the number

transactions per second (TPS), which can reach the platform from 65,000 (achieved as a result of tests) to 710,000 (theoretical value).

Such values can be achieved using a specific Proof-of-History (PoH) algorithm and some other solutions that increase network throughput. In short, we are talking about the blockchain synchronization algorithm and the internal clock that ensures the operation of the nodes “on schedule”, in conjunction with staking. Many other projects have been launched on the basis of this blockchain. However, with all the speed and high throughput, Solana had one big problem – very frequent system crashes. And only in 2023 was it possible to achieve some progress in this area.

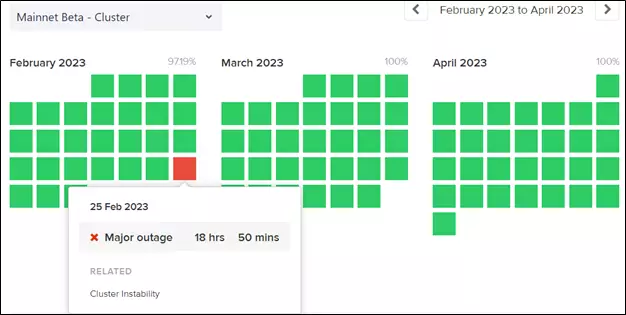

On July 20, Solana introduced work report your network. During the first half of the year, the platform had

just one crash, 25 February. At the same time, there were no failures at all in the second quarter. This speaks of the serious progress that the project has made in a year. In 2022, almost a third of January passed in failures.

Source: solana.com

The stability score wasn’t the only indicator of improvements in Solana. Growth was demonstrated by the ratio of voting transactions to non-voting ones. The first occurs when a block is confirmed by validators. The latter happen after the actions of network users, for example, when an NFT is released. Solana itself expects a decrease in the indicator due to the greater efficiency of the network.

Source: dune.com

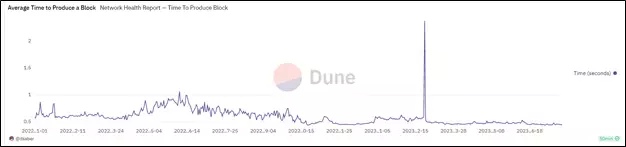

A positive effect was the reduction in the time required to produce the block. This means that the network works faster by conducting transactions. There was a sharp jump on February 25 – on that day, a failure was observed:

Source: dune.com

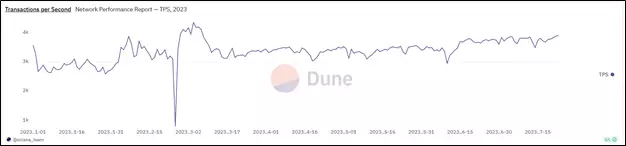

The number of transactions per second was almost unchanged and ranged from 3,200 to 4,300. The drawdown in TPS was observed only on February 25th. At that moment, the indicator did not even reach 800 transactions per second. Such numbers should not be surprising. In the test conditions, only simple transactions for sending tokens were taken into account. The data presented in the report is more complex and contains information about complex iterations. Buying an NFT, for example, requires more resources than a simple transfer.

Source: dune.com

And what happens to the price of Solana? Are the good performance of the platform reflected in the value of the cryptocurrency?

Solana technical analysis

Solana had a very successful stretch from June 10th to July 14th. In 34 days, the SOL token rose in price by more than 150%, showing a maximum in a year and a half – $ 32.27. Not surprisingly, after such a surge, investors and traders decided to take profits, and Solana began to correct. By July 24, the coin had lost just over 26% of its value.

Decrease Solana could contribute to the upcoming meeting of the Federal Reserve System (FRS) this week. There, a new increase in the interest rate may be announced, which usually has a rather negative effect on cryptocurrencies. In any case, after the speech of the representatives of the US Central Bank, we can expect an increase in volatility.

The decline is facilitated by the withdrawal of money from the exchanges by large players (the so-called whales). July 20

was bred 2 million SOL tokens (over $51 million) from the Binance exchange to an unknown wallet. The next day, however, on the same site

was instituted 409,823 SOL tokens (about $10.3 million). However, there is a general negative trend.

The main question that worries investors now is when will Solana stop falling? So far, there are no prerequisites for this. Perhaps they will appear if the cryptocurrency manages to stay above the support level in the $22.3 area. Resistance is in the $25-$27 range. If in the short term everything is rather negative, then in the long term there are positive signals. Even after losing more than a quarter of its value, Solana is still trading above the 50-day moving average (indicated in green):

Source: tradingview.com

It is worth adding: the coin is far from its historical maximum value, which in November 2021 exceeded $260. That is, the current rate is more than ten times lower than the record value. At the same time, Solana is currently in the top 10 cryptocurrencies by capitalization, ranking ninth (more than $9.55 billion) and significantly outperforming its competitor in the face of TRON ($7.25 billion), but behind Dogecoin ($10.78 billion).

Conclusion

Cryptocurrency Solana (SOL) in recent months has significantly improved indicators related to the stability of the network, providing an increase in the value of the coin in June-July. At the same time, the asset has not yet managed to move into a long-term and rapid growth with the support of bulls, and a correction of the course has formed since the second half of July. The coin is far from its record values. Pressure from US financial regulators may not be in its favor.

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.