- The actions fall, the prices of the bonds go up and the gold triggers before the reciprocal tariffs of Trump.

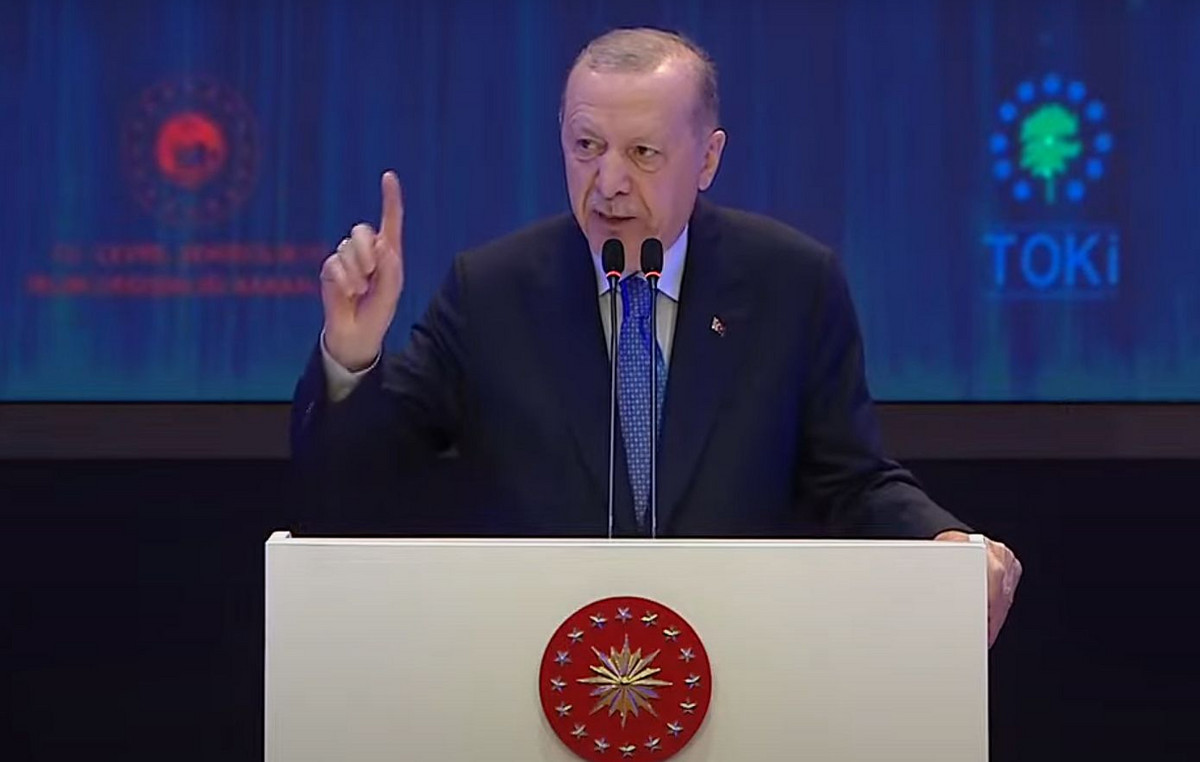

- The US president Trump confirmed that all countries will be subject to measures.

- The American dollar index is stable about 104.10, although there are no safe refuge flows in the dollar.

The US dollar index (DXY), which tracks the performance of the US dollar (USD) compared to six main currencies, lacks direction and lies almost flat on Monday. The DXY stays completely in the dark while the shares are sold, the prices of the bonds shoot and the gold has reached a new historical maximum above the 3,100 $ early in the day. This movement occurs after the president of the United States (USA), Donald Trump, reiterated Sunday at the Airforce One that all countries will be subject to reciprocal tariffs on the ‘Day of Liberation’ on Wednesday, Bloomberg reports.

One thing that was clear last week is that the US dollar (USD) moves depending on the US economic data, and the fears of stagflation or recession are weakening the dollar. Thus, Monday’s approach will be transferred to the Chicago Shopping Managers Index and the Manufacturing Business Index of the Dallas Fed. Contractions and decelerations in these economic data points could trigger another fall in the DXY.

What moves the market today: the data becomes important for confirmation

- At 13:45 GMT, the Chicago Purchase Manager (PMI) index will be published. The expectations are 45.4, only one point less than the previous 45.5.

- At 14:30 GMT, the Federal Reserve of Dallas (FED) will publish the March Manufacturing Business Index. There is no forecast available, with the previous reading at -8.3.

- The shares are falling with losses between 1.0% and 2.0% crossing Asia to Europe and the US futures.

- According to the CME Fedwatch tool, the probability that interest rates will be maintained in the current range of 4.25%-4.50%at the May meeting is 82.1%. For the June meeting, the chances of the costs of indebtedness being lower are at 81.2%.

- The 10 -year performance of the United States is traded around 4.20%, a substantial fall and the reason why the Fedwatch tool sees high possibilities of a rate cut in June.

Technical analysis of the US dollar index: one thing is clear

The American dollar index (DXY) provided an answer last week and this Monday to a question that was in the minds of the operators. Tariffs clearly do not impact the US dollar. On the other hand, US economic data seem to be impacting the dollar, as seen on Friday with the feeling of the consumer of the University of Michigan and the high inflation expectations, which pushed the US dollar downward. The fear of recession or stagflation no longer supports a stronger US dollar, and more evidence of stagflation could push DXY down here.

A return to the round level of 105.00 could still occur in the next few days, with the simple mobile average (SMA) of 200 days converging at that point and reinforcing this area as a strong resistance in 104.94. Once that area is broken, a series of key levels, such as 105.53 and 105.89, could limit the bullish impulse.

In the lower part, the round level of 104.00 is the first close support, although it looks gloomy after being tested on Friday and again this Monday. If that level is not maintained, the DXY runs the risk of falling again in that range of March between 104.00 and 103.00. Once the lower end at 103.00 yields, you have to be attentive to 101.90 in the lower part.

US dollar index: daily graphics

Commercial War between the US and China Faqs

In general terms, “Trade War” is a commercial war, an economic conflict between two or more countries due to the extreme protectionism of one of the parties. It implies the creation of commercial barriers, such as tariffs, which are in counterbarreras, increasing import costs and, therefore, the cost of life.

An economic conflict between the United States (USA) and China began in early 2018, when President Donald Trump established commercial barriers against China, claiming unfair commercial practices and theft of intellectual property by the Asian giant. China took retaliation measures, imposing tariffs on multiple American products, such as cars and soybeans. The tensions climbed until the two countries signed the Phase one trade agreement between the US and China in January 2020. The agreement required structural reforms and other changes in China’s economic and commercial regime and intended to restore stability and confidence between the two nations. Coronavirus pandemia diverted the attention of the conflict. However, it is worth mentioning that President Joe Biden, who took office after Trump, kept the tariffs and even added some additional encumbrances.

Donald Trump’s return to the White House as the 47th US president has unleashed a new wave of tensions between the two countries. During the 2024 election campaign, Trump promised to impose 60% tariff particularly in investment, and directly feeding the inflation of the consumer price index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.