Clients of the American division Standard Chartered are more interested in “stable coins” than in bitcoin. This was stated by the head of the bank’s digital assets research department Jeffrey Kendrick, writes The Block.

According to the bank, 90% of the discussions last week were dedicated to stablecoins. The meetings were held in Washington, New York and Boston with clients and officials.

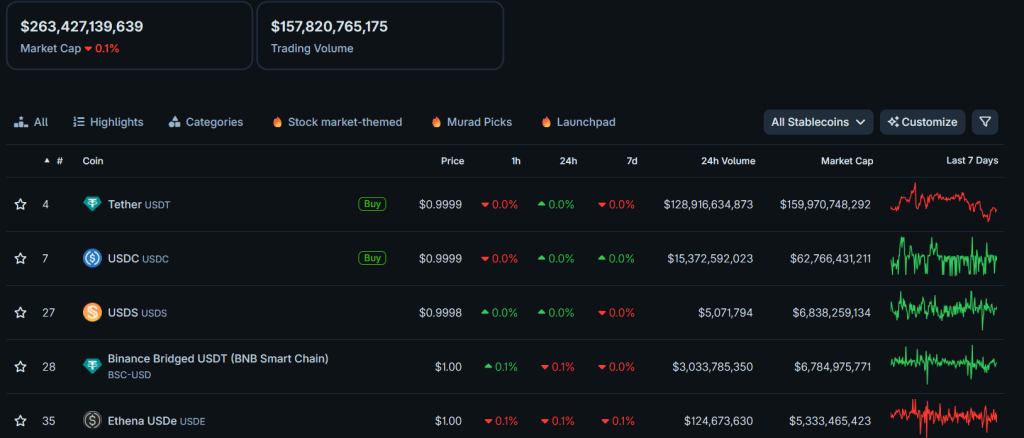

The participants discussed the influence of such assets on the economy after the growth of the “stable coins” market to $ 750 billion. At the time of writing, the capitalization of the segment is about $ 263 billion, according to Coingecko.

Kendrick believes that the predictable indicator will be achieved by the end of 2026. Then the stablecoins will begin to influence traditional financial assets and politics. In particular, to ensure “stable coins” in the United States, more treasury bills will be required. This can change the structure of public debt and demand for dollars, the expert emphasized.

Regulation

The discussions coincided with the consideration of the bills on the regulation of the industry, in particular stablecoins (Genius Act).

On July 15, the House of US representatives rejected three documents regarding cryptocurrencies. However, after the publication of the President of the country Donald Trump, a new schedule of meetings was proposed about a meeting in an oval cabinet with congressmen. Consideration of the projects will begin on July 16.

According to Kendrick, after the adoption of Genius ACT in developed countries, stablecoins will most likely be used for payments. Corporations will receive faster and more cheap transfers. Banks and municipalities will be able to produce their own assets.

The expert noted that in developing countries people buy “stable coins” for savings in dollars. This helps to protect assets from the devaluation of local currencies.

A large outflow of funds through stablecoins can create problems for some countries, Kendrick believes. It will become more difficult for them to control foreign exchange rates and support banking systems.

The specialist also mentioned Clarity Act. In his opinion, the law can become a regulatory framework for digital assets and goods, which will have a “special” effect on RWA market. The project will create a framework for the tokenization of assets – from real estate to shares. This will expand the sphere of Defi protocols like AAVE, Kendrick concluded.

Fintech and the market “Stable coins”

The largest US Bank JPMorgan is already studying public stabilcoins tied to the dollar, writes CNBC. At the same time, the head of the conglomerate James Diamond doubted their necessity, but admitted:

According to him, the reason is the pressure of fintech competitors.

The bank is already testing the JPMD on the BASE blockchain, supported by the American Coinbase crypto -rope. The coin is designed to simplify the calculations between the institutional customers of JPMorgan.

Recall that experts warned of a bubble in the market of stabelcoins. They believe that a successful Circle listing will launch an IPO wave from feeding companies.

Later, Bis said that “stable coins” do not undergo a test according to three key criteria: “unity”, “elasticity” and “integrity”.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.