Analysts, referring to the reports submitted to the US Securities and Exchange Commission (SEC), emphasized that the positions in the spotal ETF on Bitcoin turned out to be “disappointing”, while the growth of investments in the Strategy campaign “encouraging”.

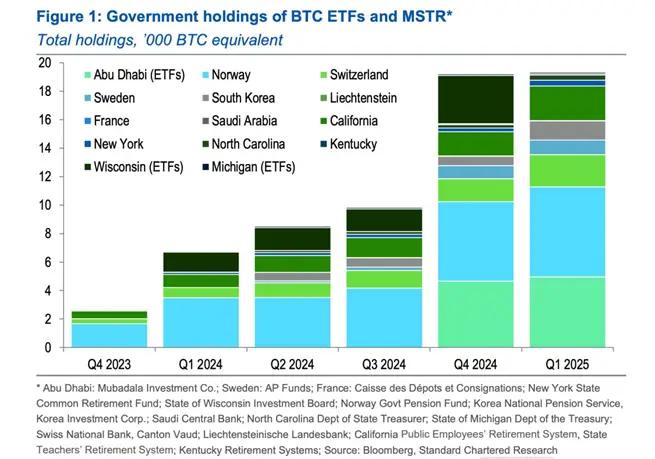

In the first quarter of the share in Strategy, the Norwegian State Fund, the Swiss National Bank, South Korean State Funds, as well as the pension funds of California, New York, North Carolina and Kentucky-in total at 1700 BTCs increased. France and Saudi Arabia for the first time bought Strategy shares, which Standard Chartered is considered a sign of expanding sovereign interest in the first cryptocurrency.

According to analysts, Strategy shares are considered by states as “proxy investments” in Bitcoin. In some jurisdictions, this is a way to circumvent a ban on a direct ownership of an asset.

The Standard Chartered believe that the bitcoin exchange rate will be able to reach $ 500,000 before the end of 2028, since the market has formed a steady trend for sovereign and institutional interest in the first cryptocurrency.

Earlier, Fidelity Global Macro Strategia, Jurrien Timmer, said Bitcoin could become the main means of maintaining value and protection against inflation, along with gold.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.