Strategy (previously Microstrategy) bought 4980 BTC for $ 531.9 million in the period from June 23 to 29, 2025. The company controls a total of 2.8% of the asset of the asset.

The average cost of 1 BTC amounted to $ 106 801, according to the statement of the former CEO of Michael Seilor. Which is below the current market course.

In total, the company controls 597 325 BTC for a total of $ 42.4 billion. For the portfolio as a whole, the average purchase price of 1 BTC is $ 70 982.

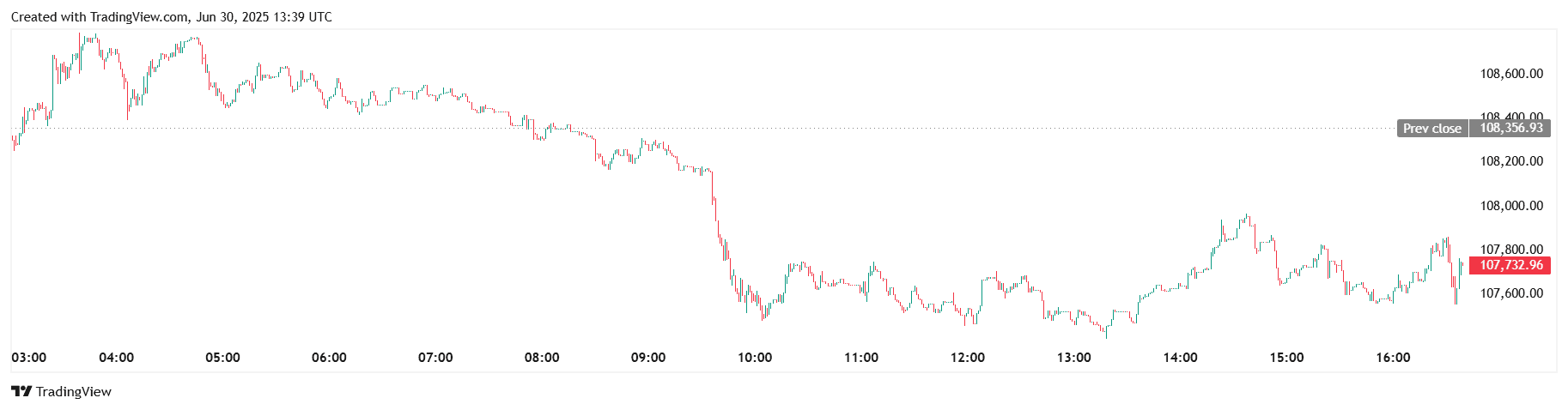

At the time of writing, bitcoin is traded at $ 107,732. In this case, the Strategy bitcoin portfel is estimated at $ 64.35 billion. The unrealized profit of the company is $ 21.9 billion.

According to documents submitted to the US Securities and Exchange Commission (SEC), Strategy funded investments in the first cryptocurrency by selling securities, in particular:

- ordinary shares of class A MSTR – 1.35 million;

- StRK – 276 071;

- STRF – 284 225.

The annual profitability of the company’s infusion in Bitcoin reached 19.7%, Saylor pointed out in the publication.

In early June 2025, Strategy announced the issue of another class of shares – StRD. Thus, the company plans to attract about $ 980 million.

This is part of the 42/42 plan, the purpose of which is to invest $ 84 billion in Bitcoin by long and share capital until the end of 2027. At the same time, the company already controls 2.84% of the Bitcoin revolutionary supply of 20 million BTC.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.