On July 7, 2025, Strategy (previously Microstrategy) submitted to the US Securities and Exchange Commission (SEC) a report for the II quarter of 2025. According to him, the unrealized profit of the company amounted to $ 14.05 billion.

At the same time, Strategy did not buy bitcoins from June 30 to July 6, 2025. This is probably due to the presentation of papers. Similarly, the company did not increase the portfolio before publishing a report for the first quarter. Recall that then the company announced an unrealized loss of $ 5.91 billion.

The last recorded purchase of bitcoins by the company occurred in the period from June 23 to 29, 2025. As of July 7, 2025, Strategy controls 597 325 BTC with an average purchase price of $ 70,982.

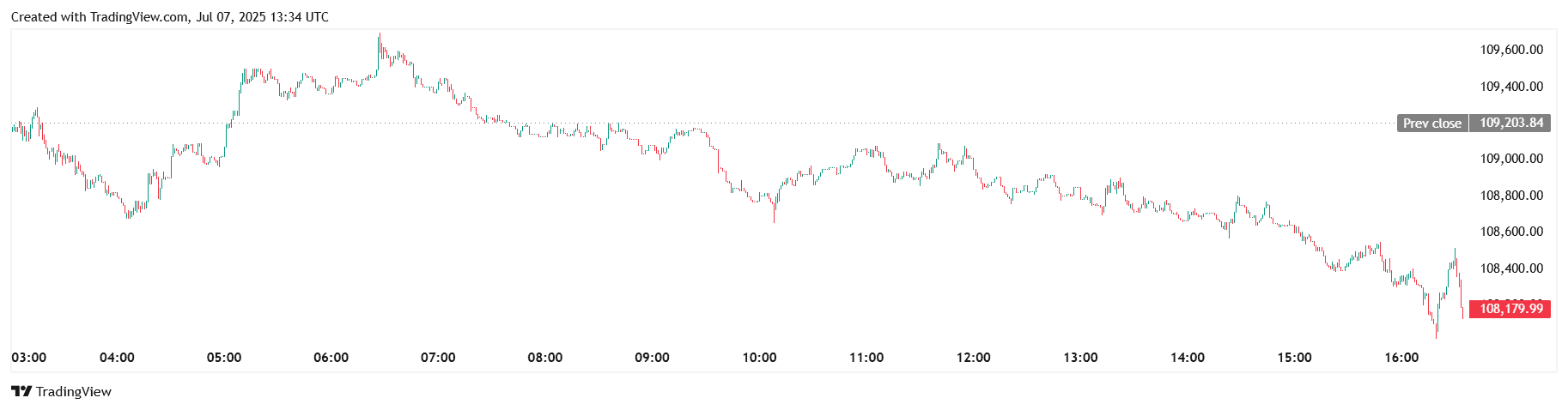

At the time of writing, bitcoin is traded at $ 108 180, which is due to such an indicator of unrealized profit.

At the same time, on July 7, Strategy announced plans to attract an additional $ 4.2 billion through StRD shares. This significantly exceeds the previously announced amount of emission.

According to the report submitted by Strategy to SEC, the sale of securities, not only the StRD, but also other shares and bonds, brought the company $ 6.8 billion in the II quarter.

Together with unrealized profit, the company indicated that it incurred expenses in the form of deferred tax deductions of $ 4.04 billion. The total amount of potential tightening is $ 6.31 billion.

The problem arose after the adoption of the law on reducing inflation in 2022, which introduced an alternative minimum tax for corporations (CAMT) in 15% on adjusted financial income (AFSI) for companies with an income of more than $ 1 billion.

In addition, in 2023, the Council for Standards of Financial Accounting (FASB) ordered American counterparties to display crypto assets on the balance sheet at a market price. This led to the fact that the corporations should pay for the tax from still unprofitable profit.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.