Since the Dencun update, which reduced fees on L2 solutions, Coinbase's Base protocol has dramatically increased the number of users, transactions and TVL. Meme coins account for most of the activity, with one coin out of six being a scam. This is stated in the report Cointelegraph Magazine.

Researchers collected “profiles” of 1,000 tokens launched between March 19 and March 25. In total, there are approximately 380,000 ERC-20 assets on Base.

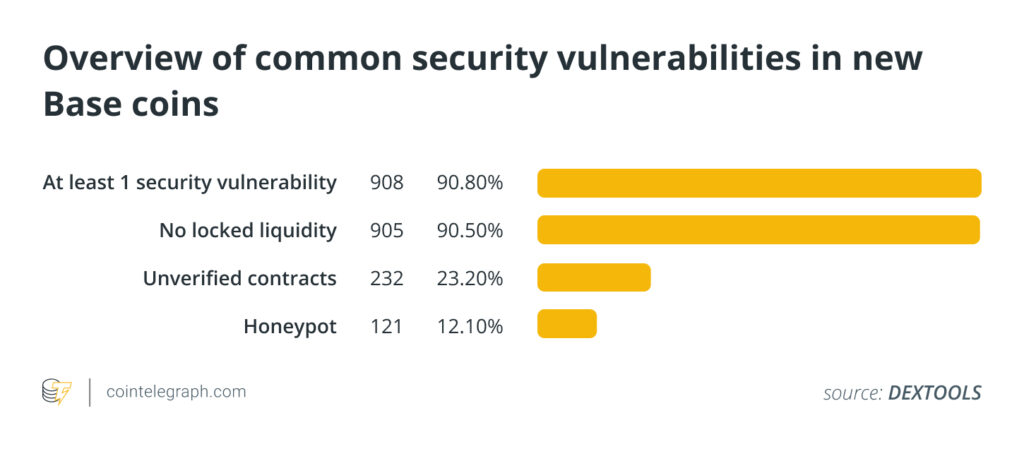

The coins were analyzed by auto auditors on the DEXTools analytics platform to determine their security. The tool looked at locked-in liquidity, verified contracts, and the absence of decoys.

90.8% of tokens had at least one security hole identified, and 90.5% did not have a locked liquidity pool (LP). Another 23.2% did not have a verified contract.

12.1% were “bait assets” that can be bought but cannot be sold due to smart contract restrictions.

While the data points to potential illegal activity, it also reflects a lack of knowledge among meme coin creators about security procedures, especially if they launched the token as a joke, the study said.

Outright fraud

According to the analysis, 16.9% of projects are suspected of criminal intent due to inflated sales fees or deliberately fraudulent smart contracts.

Possible “baits” were found in 121 assets; for 48 coins, commission fees reached 100%, which is practically no different from outright theft.

The most common vulnerability among the 1000 projects analyzed was found in their LP. 90.5% of projects have not recorded their liquidity, which makes them prone to failures and potentially susceptible to rug pull.

However, the absence of a liquidity lock does not always indicate fraudulent intentions. Among the 905 projects without blocking, 675 had verified contracts.

Real benefits

In the week leading up to March 25, nearly 1,300 new tokens appeared on Base, according to trading data provider Birdeye. Over the next seven days, their number grew to 4,000.

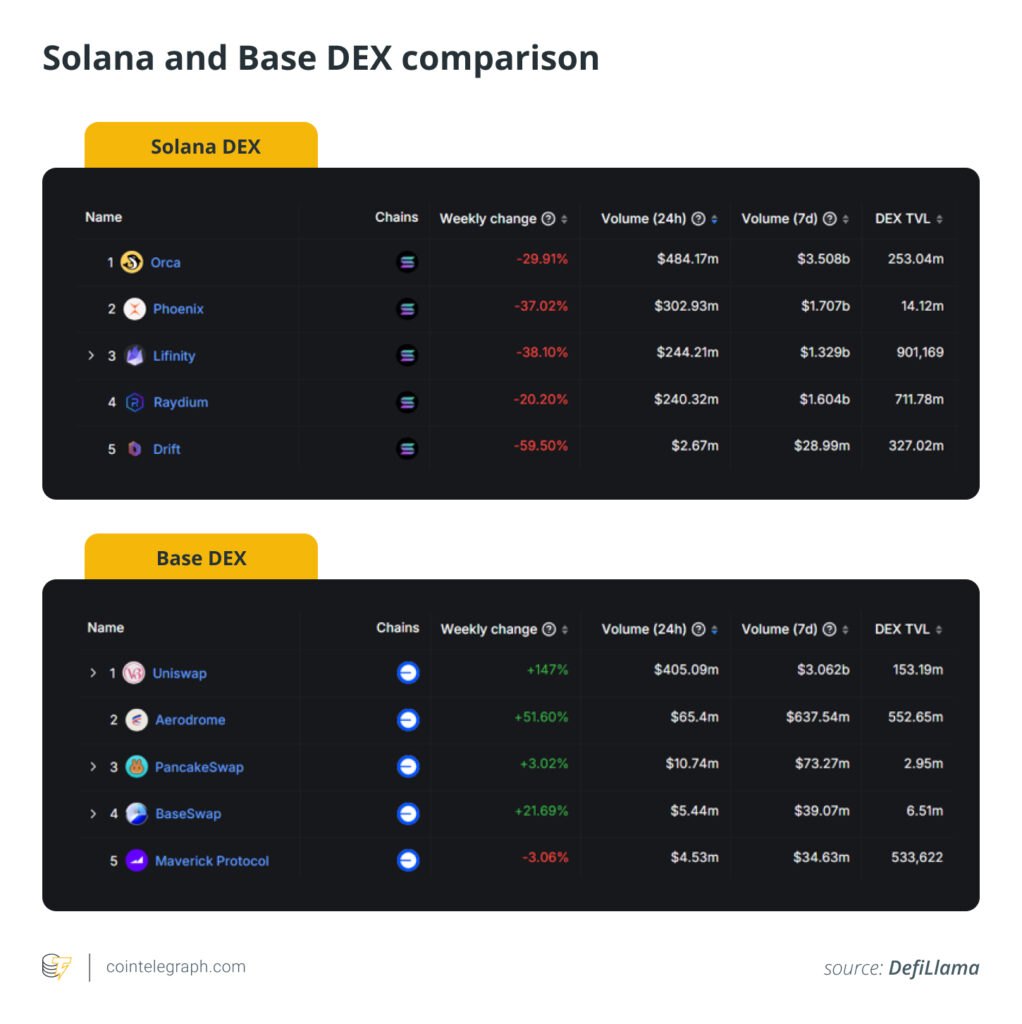

During this period, the weekly figure on the Solana network was about 19,000 coins. Based on the information received, the researchers noticed a transition of meme traders to decentralized exchanges (DEX) Base.

From March 25 to April 2, trading volumes on the Solana DEX dropped significantly, with the top five platforms in the ecosystem recording declines of 20-60%.

In parallel, four out of five decentralized exchanges on Base showed growth. Trading volume of the leading Uniswap increased 147%, to $405.09 million.

Previously, some industry experts criticized the meme coin boom, fearing a bubble burst. Founder and CEO of CryptoQuant Ki Yoon Joo said that such projects harm the crypto industry. He compared the situation to the ICO mania of 2018, as a result of which most investors lost their invested funds.

Messari head of research Maartje Bas, on the contrary, believed that meme tokens play an important role in attracting new users to cryptocurrencies. The benefits of assets for the industry were also discussed by ex-CEO of BitMEX Arthur Hayes and macro investor Raoul Pal.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.