October 18 Sui blockchain token (SUI) quotes reached minimum level at $0.36 – a drop from ATH amounted to 82.4%. The negative trend has persisted since the coin’s launch, but has intensified in recent days following news of the South Korean authorities’ interest in the Sui Foundation.

On the eve of the recession, the chairman FSS Lee Bok Hyun, during a speech before the House of Representatives, announced an upcoming investigation into some foreign cryptocurrencies and their issuers, in particular the Sui Foundation, reports a local publication Block Media.

The official used the term “burgercoins” to refer to Western digital assets, and “kimchicoins” to refer to local ones.

The head of the FSS responded to a warning from Democratic Party member Min Byung-deok that the Sui Foundation was manipulating the SUI proposal for personal gain.

According to him, the fund blocked staking tokens that should not be in circulation and made a profit from this. He also claims that the organization improperly increased the circulation of the asset through the sale of earned coins.

The speaker cited a report by Hansung University professor and DAXA consultant Cho Jae-woo, based on which “the obtained [Sui Foundation] interest income is $2.8 million.”

The expert’s analysis also found that the fund allegedly sold “multiple SUIs” on the over-the-counter market in the weeks leading up to the listing.

The FSS Chairman committed to reviewing evidence of bid manipulation and then contacting the Alliance for further information.

Representatives of the Sui Foundation hastened to refute the accusations of Korean officials and pointed out “some inaccuracies.”

All charts and data on the circulating supply of coins are always displayed on a publicly accessible website, the Sui Foundation recalled. The issuer identified three main provisions:

- the fund has never liquidated any SUI tokens, including staking rewards;

- every transfer of tokens by an organization is public and verifiable on the blockchain;

- the company acted consistently and transparently in publicly providing information about the issue.

However, some community members questioned the issuer’s “transparency and consistency.” One of the users indicatedthat the fund published the token release schedule only two months after the launch of the mainnet.

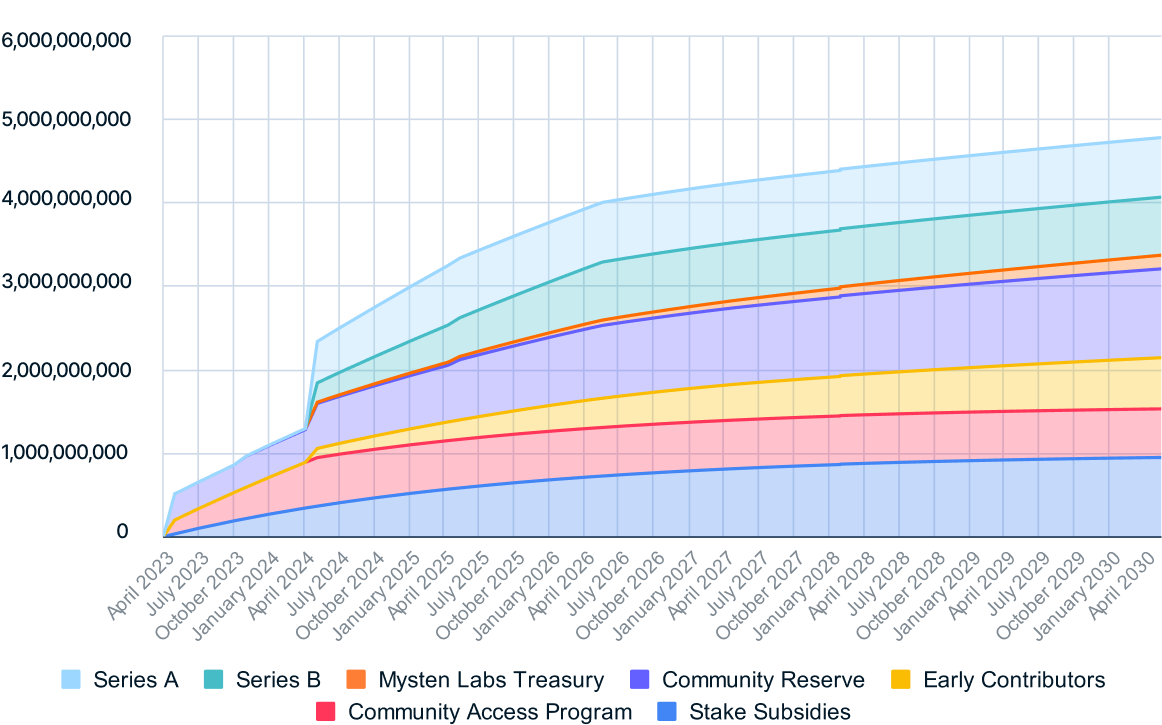

In addition, he noted that the Sui Foundation mentioned a public website, but did not leave a link to it. On the official page of the blockchain itself there is only a graph with an assessment of the circulating supply for the next seven years.

SUI distribution until 2030. Data: Sui.

SUI distribution until 2030. Data: Sui.

According to DeFi Llamaat the time of writing, the total value of funds blocked in Sui is $59.17 million. Unlike the coin rate, the indicator has recorded new highs almost every day over the past months.

Previously, a trader under the pseudonym DeFi^2 accused the Sui Foundation of selling staking rewards on Binance and violating the asset unlocking schedule. Then project representatives assured that adding SUI liquidity to the market was happening “according to plan.”

In August, the Mysten Labs team behind the Sui ecosystem implemented a liquid staking feature.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.