A combination of factors dragged USD/CAD lower for the third day in a row on Thursday. A rebound in oil prices, a stronger Canadian CPI supported the Canadian dollar and put pressure. Ukraine diplomacy hopes, falling US bond yields weighed on safe haven USD. The pair USD/CAD It continued to move lower during the middle […]

Tag: Fed

Aggressive Fed will support the dollar, USD/JPY will rise towards 125 – ING

Risky money flows dominated financial markets in the second half of the day on Wednesday despite the dovish outlook from the US Federal Reserve. Still, ING economists are in favor of dollar strength continues against low-yielding assets, while commodity-related currencies outperform. DXY index will move towards the 100.00 level in the short term “A risk […]

XAU/USD Extends Recovery From Monthly Low, Upside Potential Seems Limited

Gold gains traction for the second day in a row and recovers further from the monthly low. A pullback in US bond yields weighs on the USD and benefits the yielding yellow metal. Risk appetite and bullish Fed outlook should limit further XAU/USD gains. The price of gold (XAU/USD) has built on the previous day’s […]

EUR/USD returns above 1.1000

Despite a more aggressive than expected Fed, EUR/USD rallied and is at session highs of 1.1035. The Fed signaled rate hikes at each remaining meeting this year and four more in 2023, pushing US yields higher. But it was risky after pressure from Powell and a rally in stocks weighed on USD demand. Although most […]

Forex Today – Asian Session: Fed, War and Inflation Not Enough to Bring Down Wall Street

What you should know on Thursday, March 17: The US dollar ended the day lower following the US Federal Reserve’s monetary policy decision. The US central bank raised rates by 25 bps, as expected, with Bullard the only dissenter to vote for an increase of 50 bp. However, the dot plot now indicates six rate […]

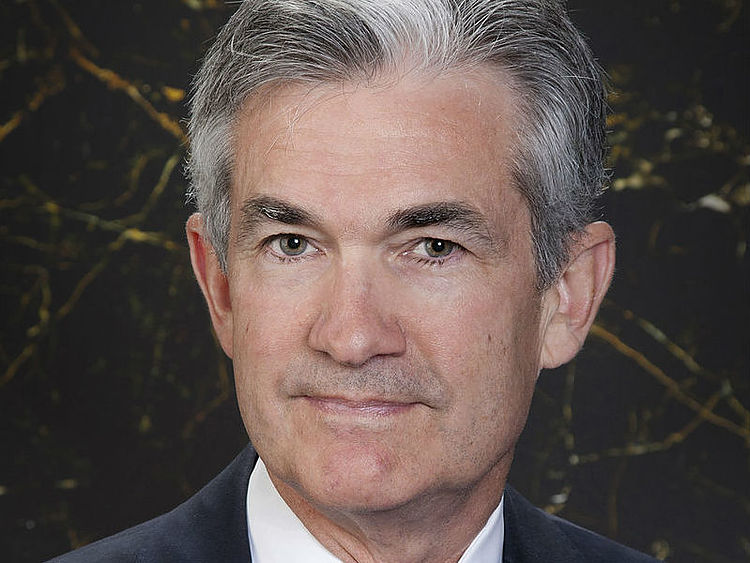

We will raise interest rates as quickly as possible, go beyond neutral if necessary

Fed Chairman Jerome Powell said at his press conference after the meeting of the FOMC on Wednesday that the Fed will raise interest rates as fast as possible and move them beyond neutral if necessary. We will not allow high inflation to take hold, he said. Featured Statements “Nothing in our framework has made us […]

USD/JPY Appreciates to New Highs Beyond 119.00 After Fed Rate Hike

Dollar hits new 7-year highs beyond 119.00 after Fed hike. The Federal Reserve raises rates to 0.5% and points to six more hikes. USD/JPY seen rallying towards 122.90/123.00 – Credit Suisse. The U.S. dollar has risen 0.5% against the Japanese yen to hit fresh long-term highs above 119.00 after the Federal Reserve announced its decision […]

We made excellent progress on our balance reduction plan, could be finalized at the next meeting

Fed Chairman Jerome Powell he said in his post-FOMC meeting press conference on Wednesday that the US economy is very strong and therefore the Fed expects to reduce the size of its balance sheet. Omicron’s slowdown was mild and brief, Powell added, noting that labor markets are extremely tight and improvements in labor markets have […]

EUR/USD falls to daily lows after Fed

EUR/USD falls against a strong US dollar after a Fed hawkish line statement. Traders await Powell’s comments at the press conference. The EUR/USD has fallen to 1.0947 after the Federal Reserve raised the benchmark interest rate by 25 basis points, meeting expectations. This was the first rate hike since 2018, with the aim of curbing […]

The FOMC increases rate hike projections for 2022, 2023 and 2024

projections The Fed outlook on end-2022 fed funds rate raised to 1.9% from 0.9% in December. For 2023, the estimate rose to 2.8% from 1.6% previously. 11 of 16 Fed policymakers expect interest rates to move above the neutral rate of 2.4% by the end of 2023, the new dot plot showed. The outlook for […]

-637831023664301773.png)