GBP/USD has been consolidating in a range of 1.3200-1.3240 since the US session started, on track for a 0.8% daily drop. Risk aversion related to the Ukraine crisis and rising commodity prices, coupled with strong US employment data, weighed on the pair. The GBP/USD has been swinging sideways since the start of US trade, for […]

Tag: Fed

EUR/USD bounces back above 1.1050 from 22-month lows, ahead of NFP report

EUR/USD hit a new 22-month low on Thursday at 1.1030 amid continued euro weakness amid the Russian-Ukrainian conflict. Since then, the pair rallied above 1.1050 but was down 0.5% on the day. Dovish comments from Fed Chairman Powell also seemed to support the dollar as attention turns to Friday’s US jobs report. A continued surge […]

What matters for inflation is how long the rise in oil prices lasts

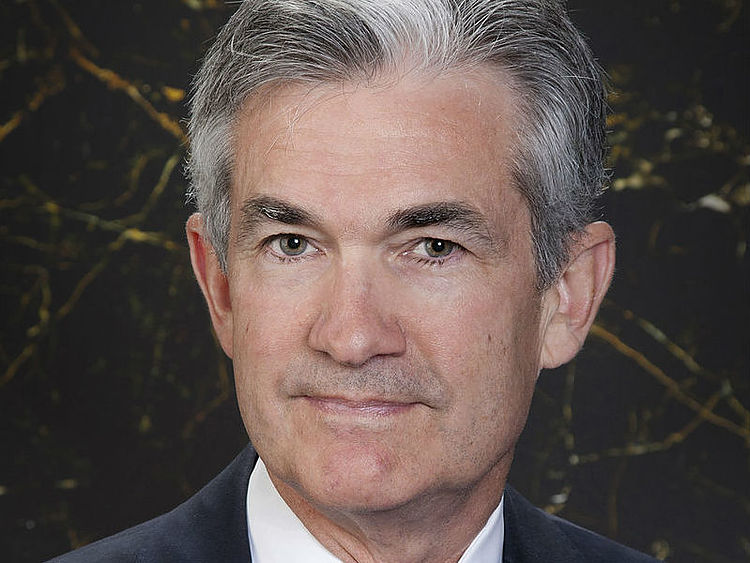

Fed Chairman Jerome Powell he said on Thursday that what matters for inflation is how long the oil price rise lasts, Reuters reported. Featured Statements “Right now we have substantial excess demand.” “The labor market is overheated.” “There’s a lot we can do to reduce demand without risking harm.” “I hope to bring the economy […]

Hindsight says we should have moved sooner to view inflation as more durable

Federal Reserve Chairman Jerome Powell on the second day of his semi-annual testimony before the US Congress, he said that, in hindsight, we should have acted sooner to recognize that inflation is more durable. Featured Statements “We are short of workers right now.” “For the most part, real wages are declining.” “That’s why we need […]

There will be upward pressure on inflation for a while

Federal Reserve Chairman Jerome Powell, on the second day of his semi-annual testimony before the US Congress, said rising energy prices will spill over into the US economy, and subsequently there will be upward pressure on the inflation for a while. Reuters reported. Additional statements: “We could see people holding back spending in the United […]

We think we should participate in a series of rate hikes and let our balance sheet shrink

Fed Chairman Jerome Powell speaking before Congress on the first day of his semi-annual testimony, he said we believe we should engage in a series of rate hikes and let our balance sheet shrink, reported Reuters. Featured Statements “Supply-side constraints are much longer lasting than expected.” “Throughout this year, markets have reacted appropriately to our […]

We need to move away from highly stimulating monetary policy environments

Fed Chairman Jerome Powell speaking to Congress on the first day of his semi-annual testimony, he said it is time to move away from highly stimulative monetary policy environments, Reuters reported. Monetary policy cannot address supply-side challenges and constraints, he added. Powell. Featured Statements: “The US economy is very strong, the labor market is extremely […]

I expect a 25 bps rate hike in March, more hikes “in succession” than previously thought — Charles Evans

Chicago Fed President and FOMC member Charles Evans said on Wednesday that it expects a 25bp rate hike in March followed by more “successive” rate hikes than previously thought, reported Reuters. Featured Statements “Four rate hikes were expected in December in 2022; since then inflation has been more intense than expected.” “Later this year, we […]

Inflation is extremely high, monetary policy must be adjusted

The Chicago Fed President Charles Evanssaid on Wednesday that US inflation is extremely high and that must be addressed by monetary policy for sure, Reuters reported. “We will continue to see strong labor markets,” Evans continued, “and we will have to adjust monetary policy to deal with high pricesas inflation currently represents a major risk […]

March Rate Hike Is Appropriate

The chairman of the Fed, Jerome Powellin previewing his opening remarks in Wednesday’s testimony before the US Congress, said that expects it to be appropriate to raise interest rates at the next meeting in March. Powell noted that the Fed is monitoring the situation in Ukrainewhose impact on the US economy is “highly uncertain”. The […]