The yen gains momentum in the market before the American session. USD / JPY with its sights on the 115.50 support zone. The USD / JPY climbed hours ago to 115.84, the day’s high, and then reversed direction, dropping to 115.57, erasing the day’s gains.. The pair remains near 115.55, unchanged from Friday and trading […]

Tag: Main Pairs

US dollar DXY index bounces off lows and nears 96.00

The DXY Index regains some composure and is approaching the 96.00 level. Higher US yields support the dollar’s recovery so far. November wholesale inventory data in the US will be released today. The US dollar DXY index, which measures the strength of the dollar against a basket of major currencies, returns to positive territory and […]

Markets watch returns in the absence of high-level data releases

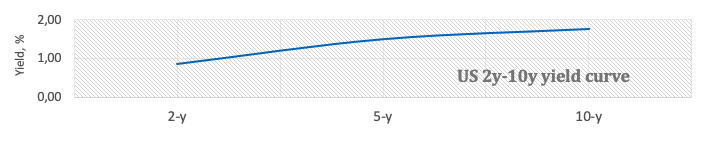

This is what you need to know to trade today Monday, January 10: Benchmark 10-Year U.S. Treasury Yield rose to its highest level in nearly two years on Friday and it helped the US dollar remain resilient against its rivals despite the disappointing December figure in the NFP non-farm payroll report. The US Dollar DXY […]

EUR / USD remains stable around 1.1350 after a mixed US non-farm payroll report.

US nonfarm payrolls disappointed, but the unemployment rate improved. Inflation in the euro area reaches 5%, exceeds estimates. EUR / USD Technical Outlook: The 1 hour chart shows a bullish bias, although a break above 1.1400 increases the chance of an attempt to hit the 100 DMA at 1.1500. After a mixed-than-expected US employment report […]

USD / JPY struggles at 116.00 after a US NFP mixed report amid rising US Treasury yields.

The dollar ignores the rise in US Treasury yields, with the 10-year yield hitting 1,785%. The US Non-Farm Payroll report hit 199,000, disappointing estimates, the unemployment rate falls below 4%. USD / JPY Technical Outlook: Biased lower, unless it recovers to 116.00. The USD/JPY fails to gain traction after a mixed US nonfarm payroll report, […]

USD / CAD breaks below 1.2700 after Canadian and US employment data.

The Canadian economy added twice as many jobs as expected by economists, while the unemployment rate fell below 6%. US nonfarm payrolls disappointed, but the unemployment rate fell below 4%. USD / CAD Technical Outlook: A break below 1.2700 opens the door for a decline towards 1.2642. The USD / CAD is extending its slide […]

US Dollar Index unchanged above 96.00 after NFP report

The index maintains the bearish note above 96.00. US nonfarm payrolls increased by 199,000 jobs in December. The unemployment rate fell to 3.9%. Selling interest around the dollar remains good and solid at the end of the week and keeps the US dollar index in the area above the 96.00 barrier on nonfarm payrolls. The […]

Additional winnings probably above 96.50

DXY fades Thursday’s modest advance and retests 96.00. If the bulls wake up, the next target is nearing 96.50. The DXY (US Dollar Index) alternate losing earnings at / above 96.00 ahead of key US non-farm payrolls on Friday. If buying interest gathers momentum, the index should initially target the area of cumulative yearly highs […]

Upside pressure mitigated below 115.30 – UOB

Currency strategists at UOB Group noted that upward pressure on the USD/JPY it could be eased in case the pair breaks below the 115.30 level. 24-hour perspective: “Yesterday we highlighted that despite the rebound, the bullish momentum had not improved much. We added, that the USD could edge higher, but any advance was unlikely to […]

EUR / USD remains consolidated between 1.1240 and 1.1395 – UOB

FX strategists at UOB Group suggested that the EUR/USD trade within the 1.1240-1.1395 range in the coming weeks. 24-hour perspective: “The euro was trading between 1.1283 and 1.1331 yesterday, a narrower channel than our expected lateral trading range between 1.1280 and 1.1340. The quiet price action offers no new clues and further lateralization would not […]