GBP/USD is posting its worst monthly losses since March 2020, shedding 5.43%. The US economy contracted 1.4% and fell short of the 1% expansion forecast by economists. GBP/USD Price Forecast: Remains under pressure unless bulls retake 1.2700 The GBP continues to fall, extending its April monthly drop to 5.43%, and approaches 1.2400 on Thursday amid […]

Tag: Technical analysis

Still waiting for a technical fix

The DXY index hits highs at levels last seen 19 years ago. Further gains in the dollar could lead to a test of the 104.00 level. There is no change in the dollar’s bullish stance as the DXY index rally faltered just below the 104.00 level on Thursday, an area last seen in January 2002. […]

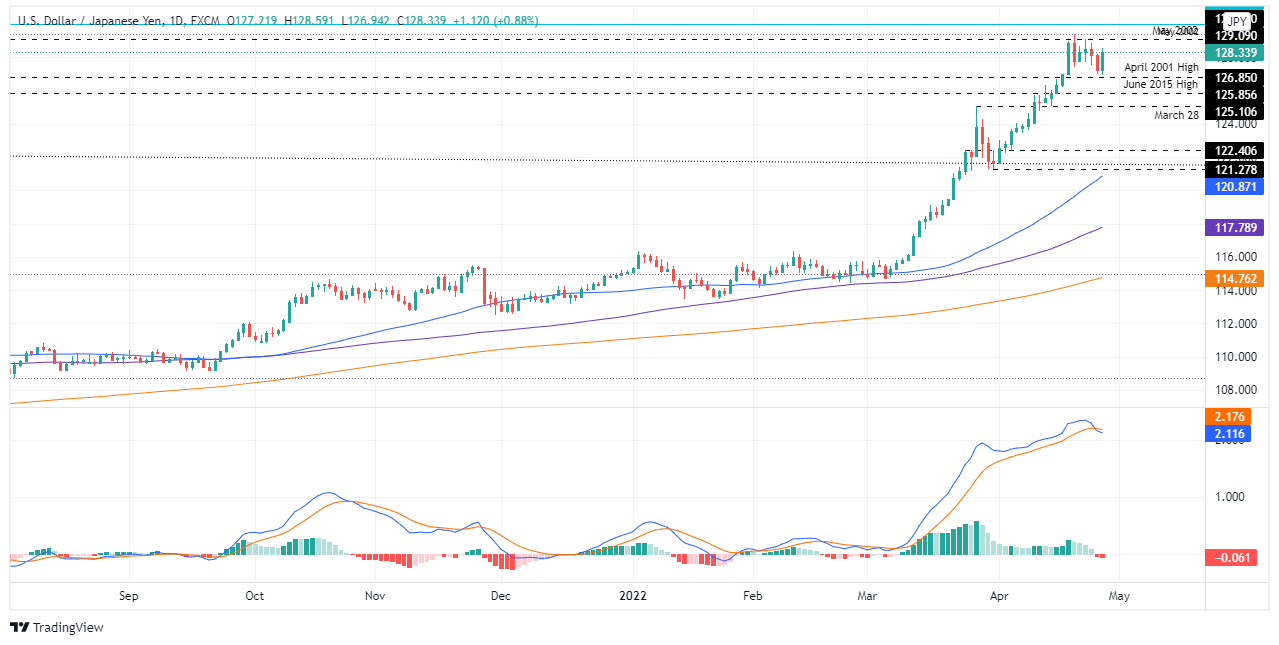

Slowly approaching towards 130.00 as a bullish engulfing pattern looms

USD/JPY remains positive as the end of the month approaches, up 5.50%. News from China that Shanghai is about to ease lockdowns lifted investors’ spirits. USD/JPY Price Forecast: A Bullish Engulfing Pattern on the daily chart opens the door to a yearly high. The USD/JPY bounces from Tuesday’s lows and rises above 128.00, attributed to […]

EUR/USD hits five-year lows but trims some losses and hovers around 1.0565

The EUR/USD accumulates weekly losses close to 2.12%, the biggest loss since June 2021. Market E lifted the euro outlook after hitting a yearly low at 1.0514. EUR/USD Price Forecast: Ready to test Jan 2017 swing lows around 1.0340. The EUR/USD extended its decline, which accelerated on April 22 after closing around 1.0831. Since then, […]

Struggle around 0.9700 after hitting a new 20-month high

USD/CHF is up 1.25% on the week so far. USD/CHF Price Forecast: RSI in Overbought Conditions and a Sharper Uptrend Could Open the Door for a USD/CHF Consolidation. On Wednesday, the USD/CHF it rose about 80 pips and gained 0.75%. At 0.9684, USD/CHF pulled back from 0.9701 where it hit a fresh almost two-year high […]

US Dollar Index Rises Past 103.00, New 5-Year Highs

The DXY gathers extra strength and breaks 103.00. Preliminary results showed a trade deficit of 125.32 billion dollars in March. US yields remain in positive territory so far on Wednesday. The dollar, measured by the US dollar index (DXY), is trading at levels last seen over five years ago, breaking above the 103.00 level on […]

Records new four-week highs near 0.8460

EUR/GBP hits a four-week high just shy of 0.8460, up 0.62% on Tuesday. British pound continues to be battered as GBP/USD breaks below 1.2600. EUR/GBP Price Forecast: Has a neutral bias, but a daily close above the 200 DMA would further strengthen the case for a change in trend. The EUR/GBP rose to fresh four-week […]

Update weekly highs, around 1.2800

USD/CAD attracted heavy buying on the dips on Tuesday and rose to a fresh multi-week high. Aggressive Fed rate hike expectations continued to lift the USD and continued to support the move. An intraday bounce in crude oil prices failed to support the loonie or dampen momentum. The pair USD/CAD rose more than 100 pips […]

A technical correction should not be ruled out

The DXY index makes new highs just above 102.00 on Tuesday. Additional gains could lead to a test of the 2020 high near 103.00. The dollar’s bullish bias remains intact pushing the US Dollar Index (DXY) to new highs since March 2020 above the 102.00 barrier on Tuesday. The current sharp rally has just entered […]

It is holding near the one-week low, around the 200 SMA/23.6% Fibonacci level.

USD/JPY fell for the second day in a row and fell to a one-week low on Tuesday. The risk-off mood benefited the safe-haven JPY and put pressure on amid falling US bond yields. The technical set-up favors bearish traders, although the policy divergence between the Fed and the BoJ should limit losses. The pair USD/JPY […]

-637865762719668164.png)

-637865726090487142.png)