- Donald Trump criticizes China for allegedly violating the trade agreement.

- MRVL collapses almost 8% while semiconductors face multiple obstacles.

- Germany proposes a new 10% tax on American Internet platforms.

- The data of the University of Michigan show an improvement in consumer perspectives in May.

American technological actions are losing ground on Friday after several negative news. The Nasdaq Composite has yielded up to 0.9%, while the Dow Jones Industrial Index (DJIA) remains slightly positive.

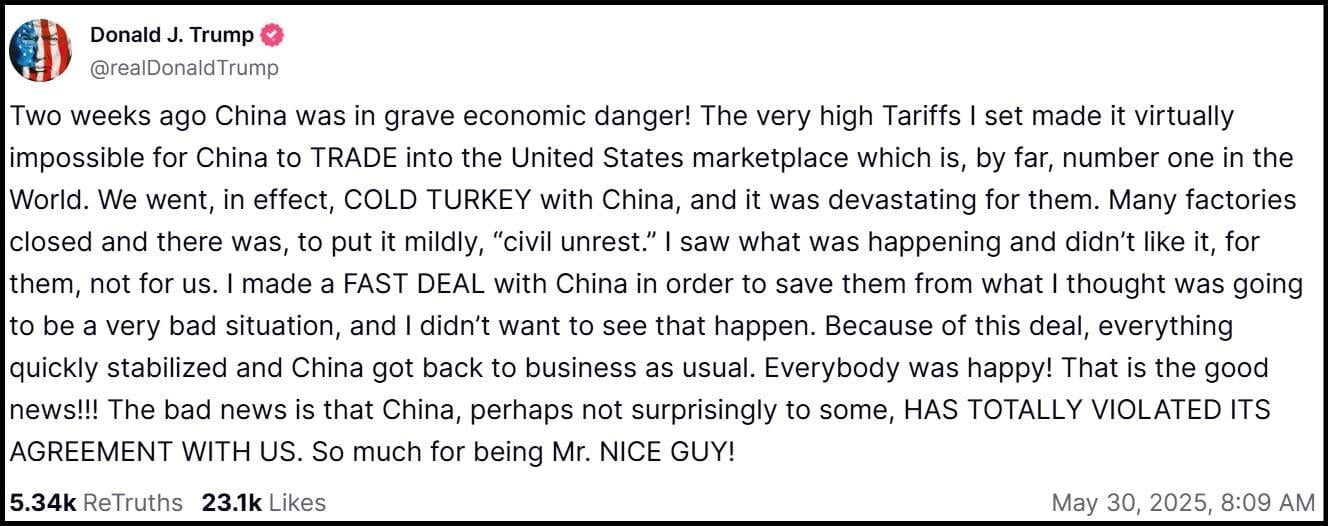

Investors are less excited after US President Trump issued a reprimand to China in relation to ongoing commercial conversations. The president did not present any evidence, but said: “The bad news is that China, perhaps not surprisingly for some, has totally violated its agreement with us. So it is too much of being Mr. Good boy!”

The Trump administration agreed to reduce its tariffs to China from more than 145% to 30% on May 12, since China returned the favor by cutting tariffs from 125% to 10%. However, on Thursday, Treasury secretary, Scott Besent, told Fox News that commercial conversations were “a bit stagnant” and that Chinese President Xi Jinping would need to speak directly with President Trump.

Trump publication in Truth Social on May 30, 2025

On the other hand, the United States Court of Appeals For the Federal Circuit, he issued a suspension of the decision of the US International Trade Court on Wednesday that arrested the broad tariffs at Trump’s country. The tariffs will remain in force until a superior court is pronounced on the issue of Trump’s powers to impose unilateral tariffs.

News about Marvel Technology’s profit report

Marvel Technology (MRVL) It quoted almost 8% down Friday after informing quarterly results. The company that designs specialized semiconductors exceeded the consensus of Wall Street for adjusted action (EPS) for a penny, and the revenues of 1.9 billion dollars in the first fiscal quarter arrived 16 million dollars above the consensus.

Daily MRVL Shares Chart

However, investors were unhappy because the income and profits of the second quarter, although they were in line with expectations, did not show much growth. The analysts commented that without new exciting news, the market tended towards multiple compression in the semiconductor industry.

Needham reduced its target price for MRVL shares from 100 $ to $ 85.

NVIDIA (NVDA)the main semiconductor designer, was the action of Dow Jones with the worst performance on Friday morning, falling 1.6%.

Mostly better economic indicators, but proposed in Germany

The inflation indicator preferred by the Federal Reserve (FED) arrived in line with consensus on Friday. Personal consumption expenses (PCE) in April reached 0.1% monthly and 2.5% year -on -year. However, March monthly reading was reviewed up at 10 basic points to 0.1% too.

Personal income also increased 0.8% in April compared to the 0.3% estimate.

Another positive point was the data of the University of Michigan that showed that consumer inflation expectations and the feeling of the consumer improved compared to April.

However, the Purchase Managers Index (PMI) of Chicago de Mayo fell surprisingly to 40.5 from 44.6 in April and compared to the consensus of 45.0. This shows a more marked downward trend in the manufacturing sector of the Chicago area.

Investors are also somewhat annoying for the announcement of the German government of their intention to impose a 10% tax on large Internet platform companies such as Alphabet (Googl) and Meta Platforms (Meta). The proposal is similar to an Austrian policy that taxes these companies with 5% of their income.

Nasdaq Composite daily graphics

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.