According to investment experts, while maintaining a positive correlation in the medium term, as well as taking into account the predicted gold growth, the script involving the growth of the course of the first cryptocurrency seems to be the most probable.

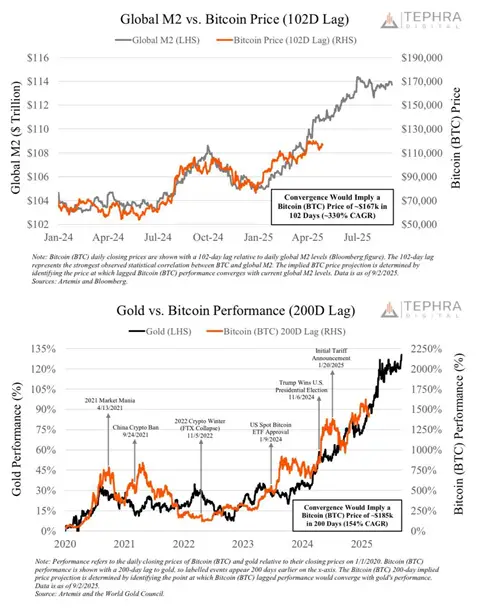

In addition, a possible reduction in the interest rate by the US Federal Reserve (Fed) can cause a global money supply increase, Tephra Digital believes. Analysts believe that the growth of the money supply will lead to the fact that in the global economy it will circulate more free liquidity.

Often, investors direct it to more risky assets, such as cryptocurrencies, in an effort to increase profitability, investment experts explained.

When increasing inflation and tightening the monetary policy of the largest economies, the first cryptocurrency has a chance to demonstrate a long bull trend in 2026, Tephra Digital experts say.

Previously, the founder of the Strike payment service, Twenty One Capital CEO Jack Mallers, suggested that over time, the market capitalization of bitcoin could reach $ 500 trillion.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.