Electric car manufacturer Tesla transferred $765 million of its bitcoins to unknown wallets. In total, the corporation conducted 26 transactions, including test transfers, during which all 11,500 BTC were moved.

The crypto community is afraid that Tesla’s actions indicate that the company is preparing to sell bitcoins. Such a move could cause great damage to the crypto market.

Where did Tesla’s bitcoins go?

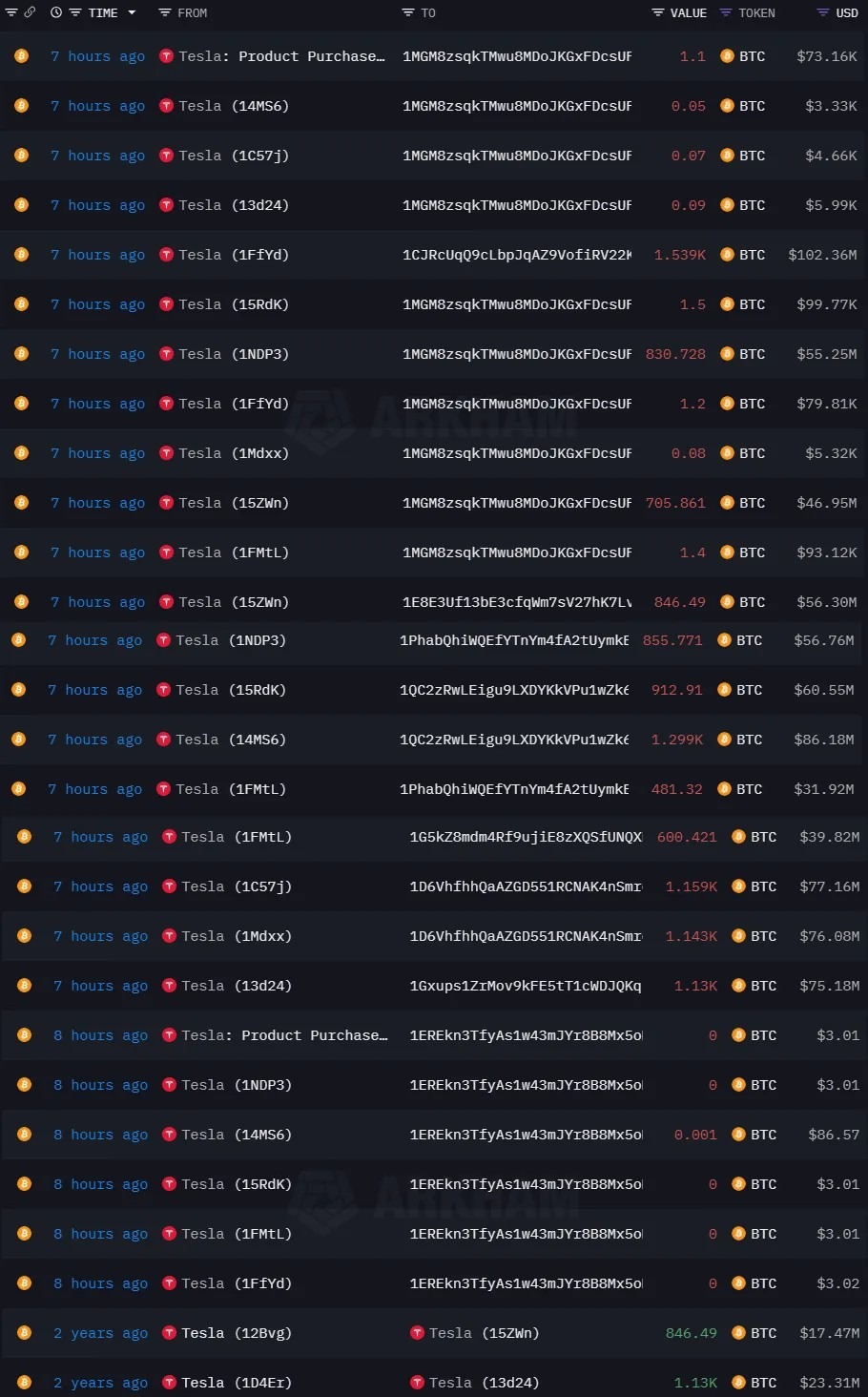

Arkham Research was the first to notice the movements of Tesla bitcoins. According to the platform, the test transfer was recorded on October 15, 2024 at 20:41 UTC. A series of translations followed. As of the time of writing this review, 0 BTC in Tesla wallet.

Tesla crypto wallet transactions. Source: arkhamintelligence

Tesla crypto wallet transactions. Source: arkhamintelligence

There are no signs indicating the transfer of cryptocurrency to exchanges, which means it cannot be definitively stated that the company plans to sell cryptocurrency. Tesla representatives did not warn about the transfers. Their goal is unknown, which adds to the tension. It is also unclear whether the company still controls its bitcoins.

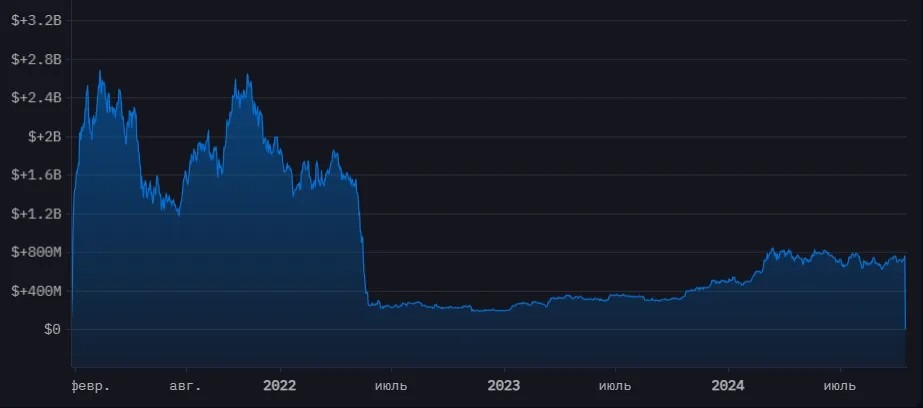

How Tesla’s Bitcoin balance changed. Source: arkhamintelligence

How Tesla’s Bitcoin balance changed. Source: arkhamintelligence

Tesla’s third quarter financial report will be released on October 23. The publication may provide answers to questions about the fate of the company’s bitcoins. As of the time of writing, BTC has not responded in any way to information about Tesla transfers.

Tesla’s path to crypto

In February 2021, it became known that Tesla was investing $1.5 billion in Bitcoin. In March of the same year, sales of the company’s electric cars for BTC started. However, already in May, Tesla abandoned the initiative and canceled accepting payments in bitcoins for cars. The founder of the company, Elon Musk, explained the decision by his reluctance to support the destructive impact of BTC mining on nature. According to the businessman, Teslas will again be sold for bitcoins if 50% of miners switch to green sources of electricity. Members of the crypto community complied with Musk’s demand, but he did not keep his promise.

On July 21, 2022, it became known about the sale of 75% of Tesla’s bitcoins. Participants in the crypto community suggested that in this way the company tried to improve quarterly reporting.

Despite the decision to sell 75% of Bitcoin, the electric car manufacturer remained one of the largest BTC investors among public companies. Musk said at the time that Tesla had no plans to completely abandon Bitcoin. Later in 2023, the company hinted at a loss of faith in the long-term investment potential of BTC.

Notably, SpaceX, Musk’s other company, continues to hold 8,285 BTC.

Why Tesla is so important for the crypto industry

Bitcoin reacts strongly to Tesla’s actions, since Musk is one of the most active participants in the crypto industry. The businessman has repeatedly supported the crypto community.

About 40% of American investors make decisions with an eye on Musk’s actions. Therefore, his “slap in the face” of Bitcoin could hit the crypto industry hard, as it did during the period of Tesla’s refusal to sell cars for crypto and against the backdrop of news about the sale of 75% of BTC reserves.

Are there any risks?

The sale of 75% of Tesla’s Bitcoin in 2022 preceded the publication of the second quarter report. The situation may repeat itself. If Tesla’s report for the third quarter of 2024 contains information about the sale of BTC, the rate of the most capitalized cryptocurrency risks falling.

Members of the crypto community suggestthat the transfer of bitcoins to an unknown address may indicate that the company is preparing to sell coins on the over-the-counter market. Cryptoquant founder Ki Young Joo believesthat fears are exaggerated. According to his calculations, the impact of Tesla’s BTC sales will not match the scale of the consequences of the sale of Bitcoin by the German authorities, which the crypto market experienced in the summer of 2024.

Stay informed! Subscribe to World Stock Market in Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.